A Critical Look at DAOs

DAOs have become an important industry component, allowing projects and networks to follow the decentralized ethos of blockchain and digital assets. This is achieved through a community voting round in which token holders can vote on important issues and decide the long-term trajectory of the project. Throughout the years, these DAOs have become significantly bigger in terms of users and treasury, with various DAOs having more than $1 billion in assets. However, are these protocols governed effectively and is the treasury well spent?

Distribution of voters

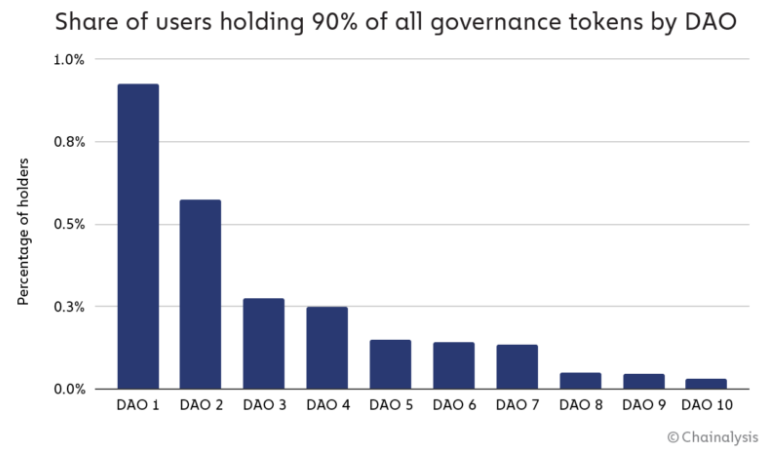

One crucial aspect of DAOs is that token holders can vote on important issues, ensuring no centralized party controls the decision-making process. However, most DAOs are not as decentralized as they appear. A 2022 Chain Analysis report found that the distribution of governance tokens in ten major DAOs was imbalanced, with less than 1% of holders having 90% of the voting power. Yes, technically it’s decentralized but the decision-making relies on a few whales, it’s more a plutocracy than a democracy. How does it look 2 years later? Well, it hasn’t changed.

When observing the top ten DAOs in the DeepDAO app, a data and analytics platform regarding DAOs, we observe that the majority of the voting power is still concentrated in view wallets. What makes things even less favorable, most token holders don’t vote. For instance, Gnosis DAO has around 20,000 token holders, but in the latest voting round for GIP-93, only 280 addresses voted, with one wallet representing 57% of the total votes. This trend is common among DAOs.

Treasury distribution and spending

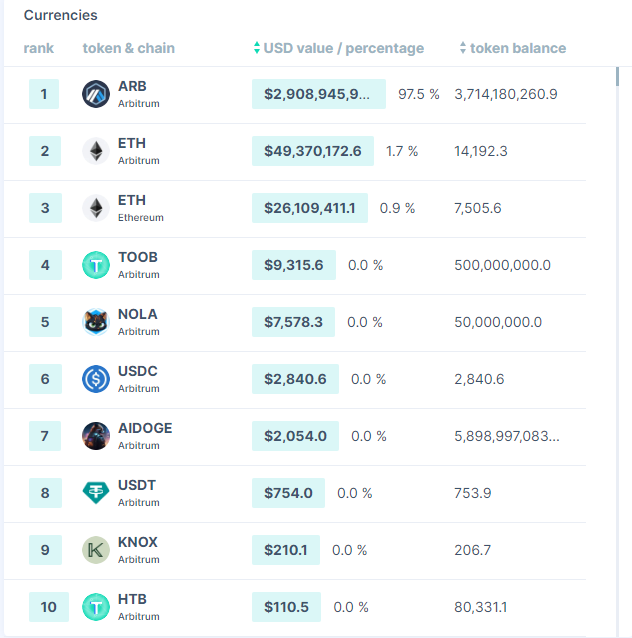

As aforementioned, these DAOs have significant amounts of capital in their treasuries which can be used for a variety of purposes such as marketing or ecosystem development. But what kind of assets can we find in a common DAO treasury? The most commonly seen asset in DAO treasuries is their own governance token, usually this represents almost all of the capital. For example, in the illustration below, 97.5% of the Arbitrum DAO’s treasury consists of Arbitrum tokens. One of the reasons behind this is that it shows faith in their token, however, this has several drawbacks.

The first issue is that most of these tokens remain idle until the community or a few whales decide how to use them to support the protocol. While idle, these tokens are at risk of losing value over time due to inflationary tokenomics, market downturns, exploits, and other factors. This can decrease the purchasing power of the funds and fail to extend a project's runway.

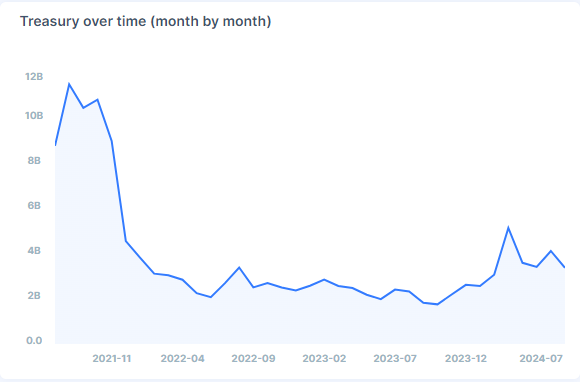

The second drawback is that governance tokens are heavily correlated with overall market growth. As a result, the DAO treasury and its runway depend significantly on market performance. Unfortunately, selling the governance token to secure the runway is often considered a divine sin, as token holders may think you are selling out or believe the DAO is in trouble, and selling the token decreases the price even further. Thus, as the market declines, the DAO's spending possibilities decrease. This issue affects even the largest DAOs, such as Uniswap, whose treasury peaked at ~$12 billion in 2021 before falling to ~$1.8 billion in 2023, as seen in the illustration above. Unfortunately, most DAOs do not hedge their treasuries to prevent such losses.

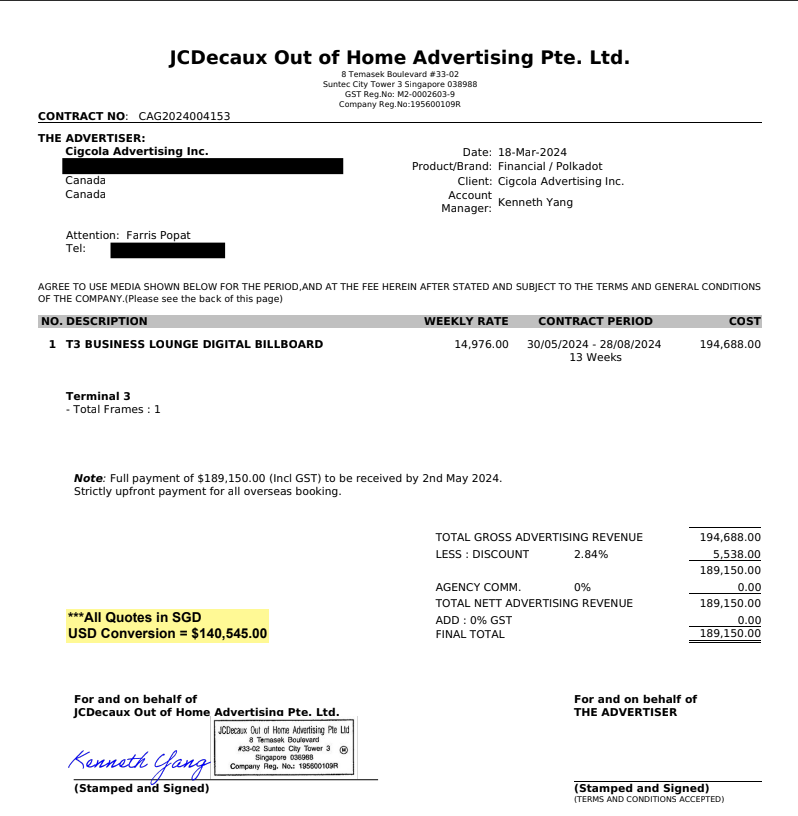

Lastly, there have been various instances where DAOs have spent significant amounts of money without achieving real results. The beauty of a DAO is that every token holder can vote, but this does not mean that they have any expertise on the topics at hand. A recent controversy involved Polkadot, which revealed that it had spent over $87 million, with $37 million allocated to marketing initiatives. While spending money to make money is necessary, the community raised concerns about some questionable payments. For example, Polkadot paid $53,000 for a six-month animated logo on Coingecko, $180,000 for six months of advertising on private jets, and $140,545 for 13 weeks of digital billboard advertising at Singapore Airport. There are many more invoices with significant amounts, these can be accessed through this link: Marketing Bounty Invoices [Public]. Many believed that this was misguided, arguing that the advertising should have focused on attracting developers and projects to grow the network. Furthermore, at the current rate of spending, Polkadot's runway is only two years.

The future of DAOs

Although DAOs face challenges, they remain a crucial component of the digital assets industry. The first DAO was introduced in 2016, marking this technology as still in its infancy. Since then, DAOs have progressed significantly. The industry has seen a continuous stream of tools being developed to aid DAOs in governance and finance. As the industry evolves, we expect DAOs to become more efficient and streamlined. For example, Decentralized Finance instruments were also initially imperfect, but the open-source nature and innovation within digital assets have allowed for rapid growth. While DAOs are not perfect, the future looks promising, and their potential is immense.