Challenging the throne: Lido's decreasing dominance

Ethereum's transition from Proof of Work (PoW) to Proof of Stake (PoS) through Ethereum 2.0 has ushered in a new era in blockchain technology, displaying tremendous cooperation across all of the stakeholders within the Ethereum ecosystem.

At the same time, this adjustment in Ethereum’s consensus mechanism took considerable time to conclude whilst individuals could already stake since the beginning of this transition without the ability to withdraw their deposit. This shift led to an increase in staked Ether (ETH), creating liquidity issues for holders.

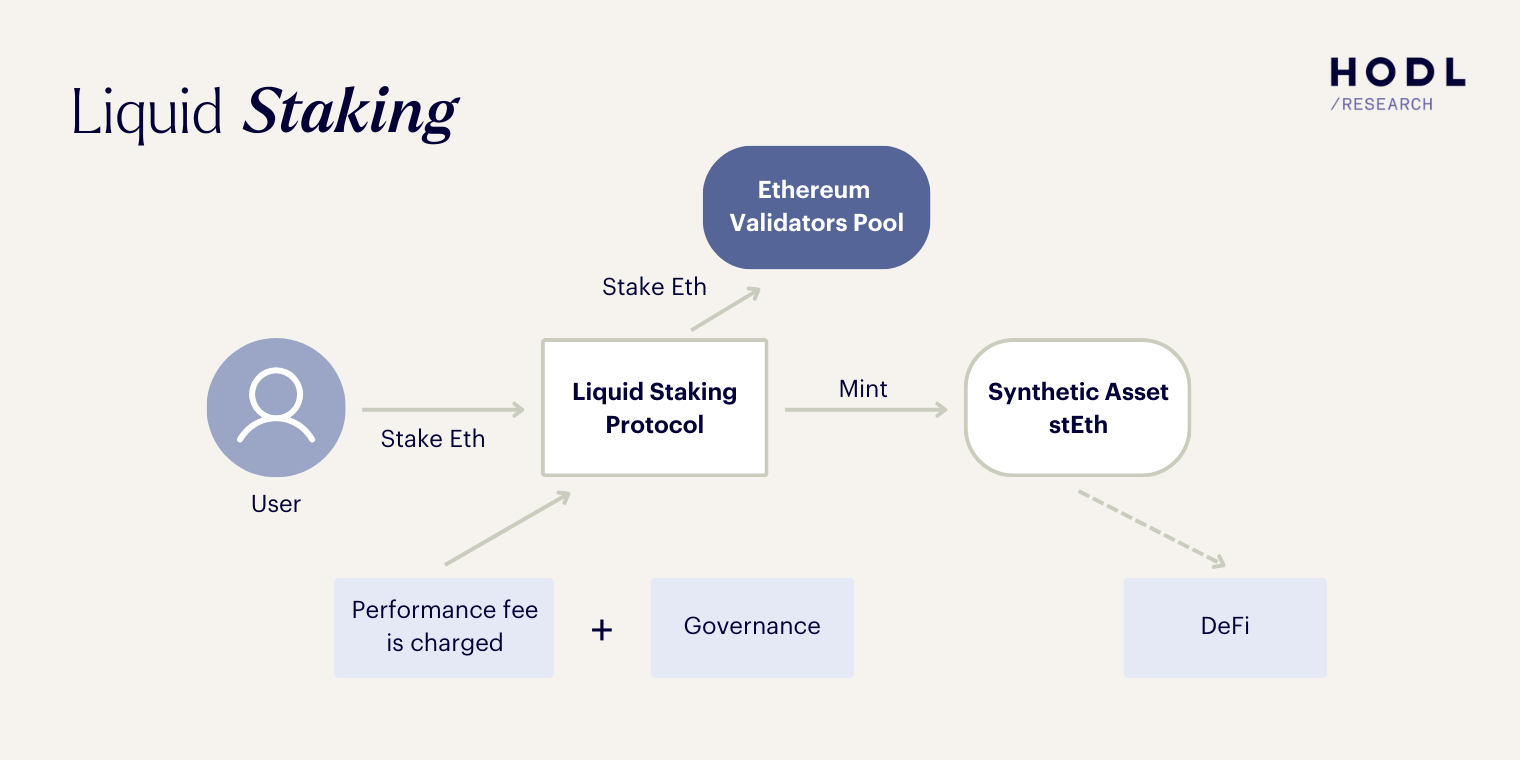

To solve this gap in user experience, a solution has come in the form of Liquid Staking Derivatives (LSDs). Liquid Staking Services addresses the liquidity problem by offering users the benefits of staking while maintaining their positions liquid.

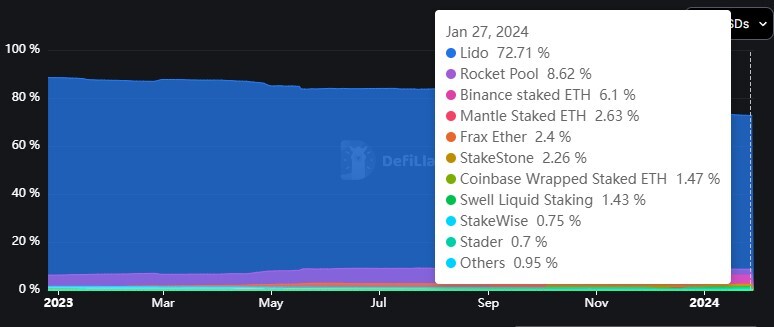

The first platform to offer this service was Lido Finance which due to its first-mover advantage, attracted an enormous amount of Ether and has dominated the industry. At its peak, Lido had over 90% of the Total Value Locked (TVL) within the Ether liquid staking industry. Please note, that the figure presented only considers liquid-staked Ether, which disregards staking pools, single home stakers and of course, the ETH that is not currently staked.

This development raised concerns among market participants that Lido may become too big and pose a risk to Ethereum itself, as a single point of failure that owns too much ETH.

Source: https://defillama.com/

However, since the beginning of 2023, it has been observed that Lido’s dominance is slowly decreasing, where it is currently at approximately 72%. As Lido’s dominance faded, various platforms gained traction, such as Binance staked ETH, which had accumulated over 6% of the TVL while having less than 1% in June.

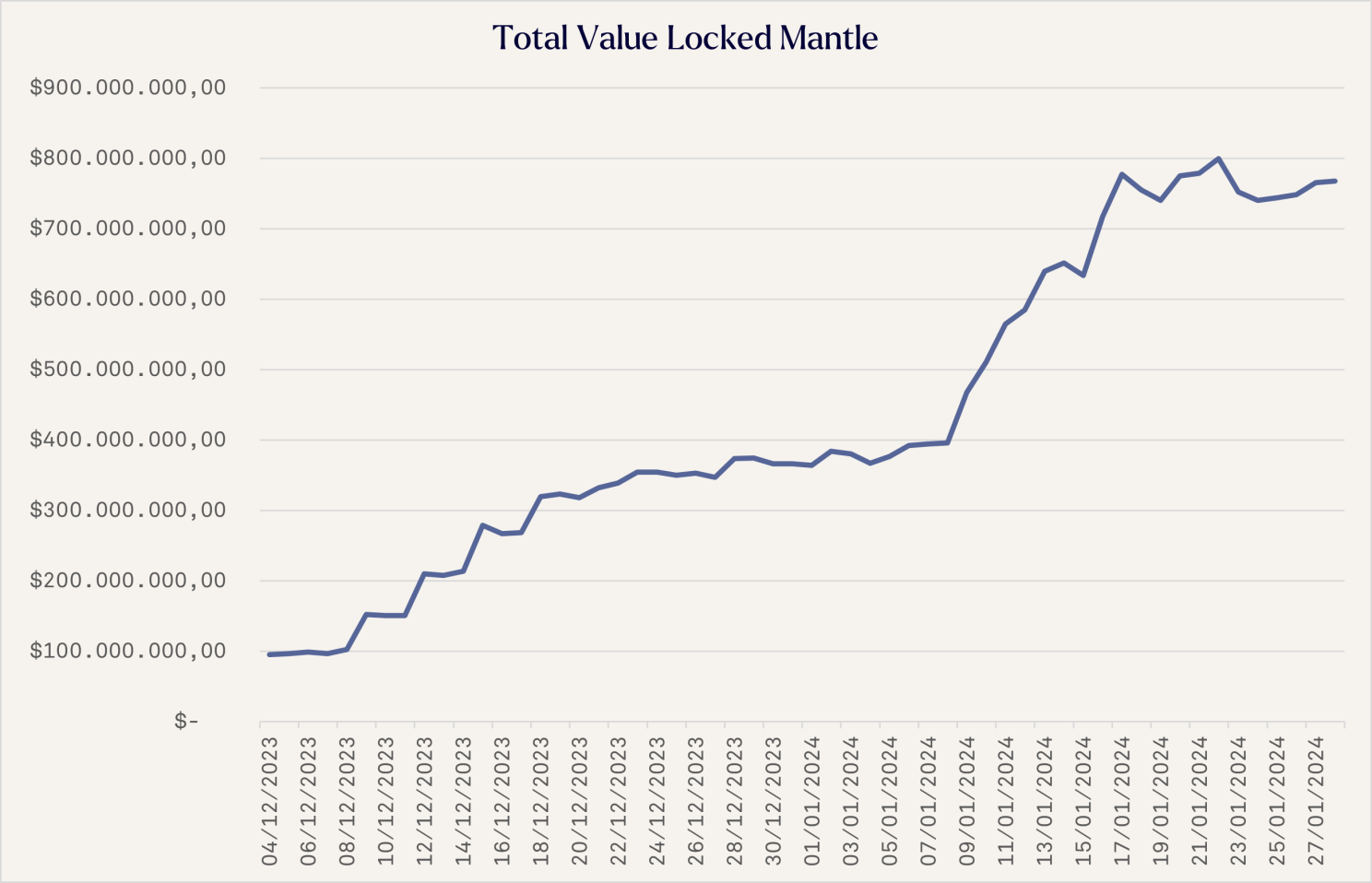

Another notable gainer is Mantle Network staked ETH which has attracted $600M worth of Ether in little less than two months, representing 2.5% of the total TVL and being the fourth largest liquid staking protocol for Ether. We witness a similar trend with the upcoming platform StakeStone, in December it had a TVL of $4M and it currently stands at over $650M.

Source: https://defillama.com/

While Lido remains the dominant player in the sector, it’s worth noting the considerable efforts that the project has made to reduce attack vectors as well as displaying strong Ethereum alignment. It's exciting to observe that emerging protocols have the potential to capture TVL within the Ether LSD sector. For the overall health of the sector, it would be beneficial for TVL to be more evenly distributed among platforms.