Dissecting the Bitcoin ETFs

It has been over two months since the approval and trading of the eleven Bitcoin spot exchange-traded funds (ETFs) and they exceeded many expectations. The new investment products have drawn in billions of capital, but there are strong differences between them. In this article, we dive deeper into the first two months of Bitcoin spot ETFs and the clear winners and losers.

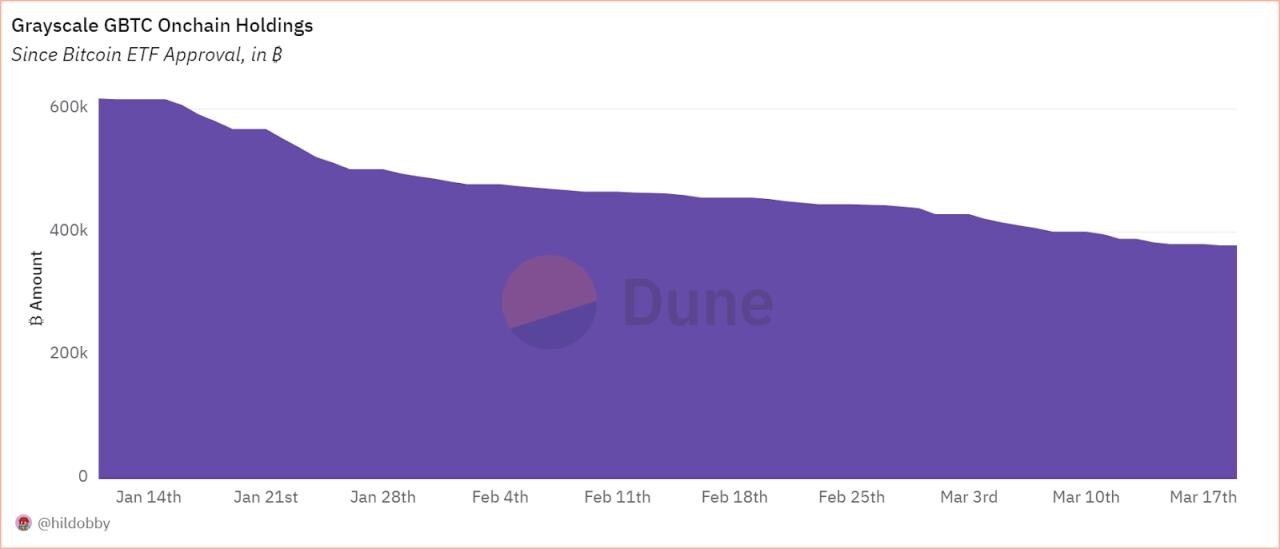

On January 11th, the market eagerly anticipated the first trading session of the eleven approved Bitcoin spot ETFs. The spotlight was particularly on Grayscale ETF (GBTC), which started trading with a substantial headstart in assets under management (AUM), holding over 610,000 Bitcoin. It garnered attention not only for its sizable AUM but also for its notable outlier status in terms of fees; while most Bitcoin ETFs charged fees around 0.2% to 0.25%, GBTC charged a hefty 1.5%.

Bleeding out

As the first trading day started, all ETFs witnessed inflows except for GBTC, which saw $95 million flow out of the fund—a modest number considering what followed. Over the next two months, GBTC continued to experience significant outflows, amounting to billions of dollars. Initially starting with approximately 617,000 Bitcoin, GBTC's holdings dwindled to 380,000 by March 18th. We anticipate this trend will continue until GBTC adjusts its fees, as there is little financial justification for choosing a more expensive ETF when cheaper options are available.

Source: dune.com/hildobby/btc-etfs

A clear winner

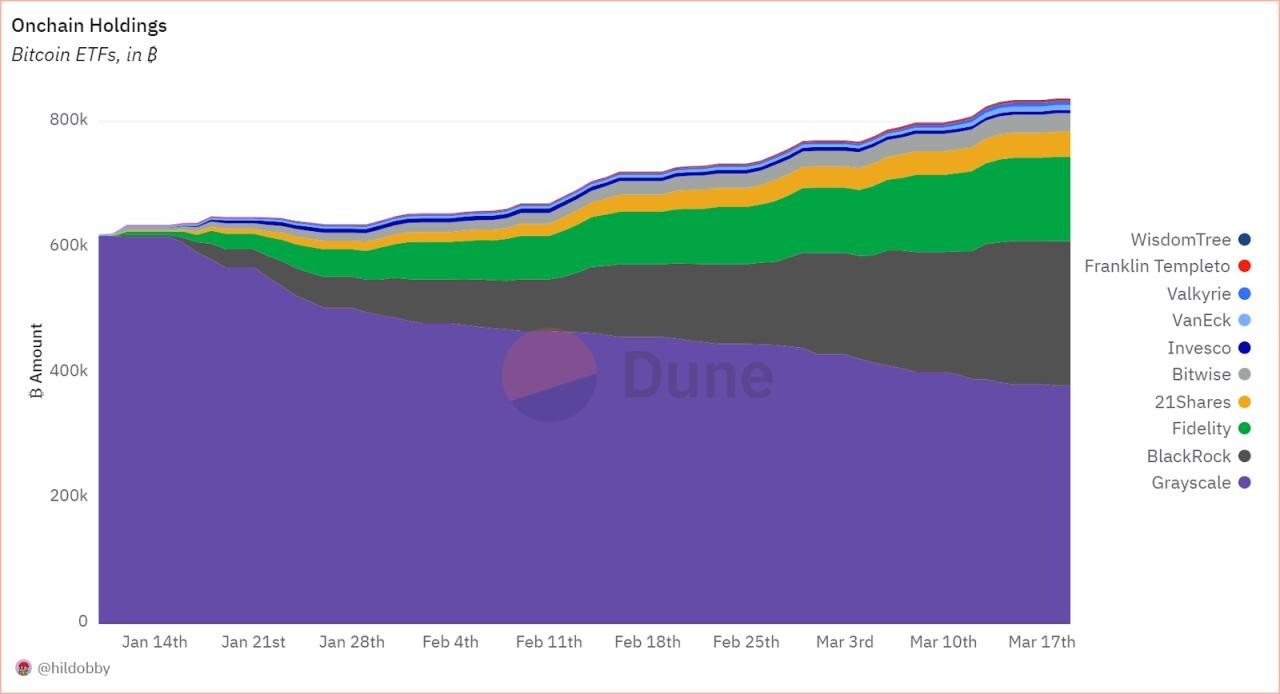

Where GBTC is bleeding, BlackRock’s ETF IBIT is the clear winner. Since its inception, IBIT hasn’t seen a single day of net outflows and set the record for the fastest ETF to reach $10 billion in AUM. As of March 18, IBIT has surpassed $15B in AUM and has captured 27.4% of the BTC spot ETF market share. While looking at the illustration below, we observe that Grayscale is losing its market share at a great pace while other ETFs such as IBIT are gaining momentum. If Grayscale doesn’t lower its fees, it's only a matter of time before BlackRock catches up with Grayscale.

Source: dune.com/hildobby/btc-etfs

The future of the Bitcoin ETF market

When observing the Bitcoin ETFs collectively, their combined holdings have reached approximately 833.6K Bitcoin, equivalent to around $53 billion, constituting 4.26% of the total BTC supply. With current inflows, this number will only continue to increase; the primary question remains: how big can the market become? According to a report by JPMorgan Securities, analysts anticipate the Bitcoin ETF market to expand to $220 billion over the next two to three years.

While there may be months when ETFs experience outflows, the long-term outlook for these financial instruments remains exceptionally positive. Furthermore, the ETFs have provided another significant benefit, the effortless allocation of digital assets in a modern portfolio. Signs of this integration are already seen. Grant Engelbart, Carson Group VP and investment strategist, notes advisors allocating an average of 3.5% of Bitcoin ETFs to client portfolios, a notable development given the ETFs' recent launch. So, the coming years will be incredibly exciting to follow as digital assets slowly integrate with traditional markets.