ERC-3643: the token standard for tokenization

What is ERC-3643?

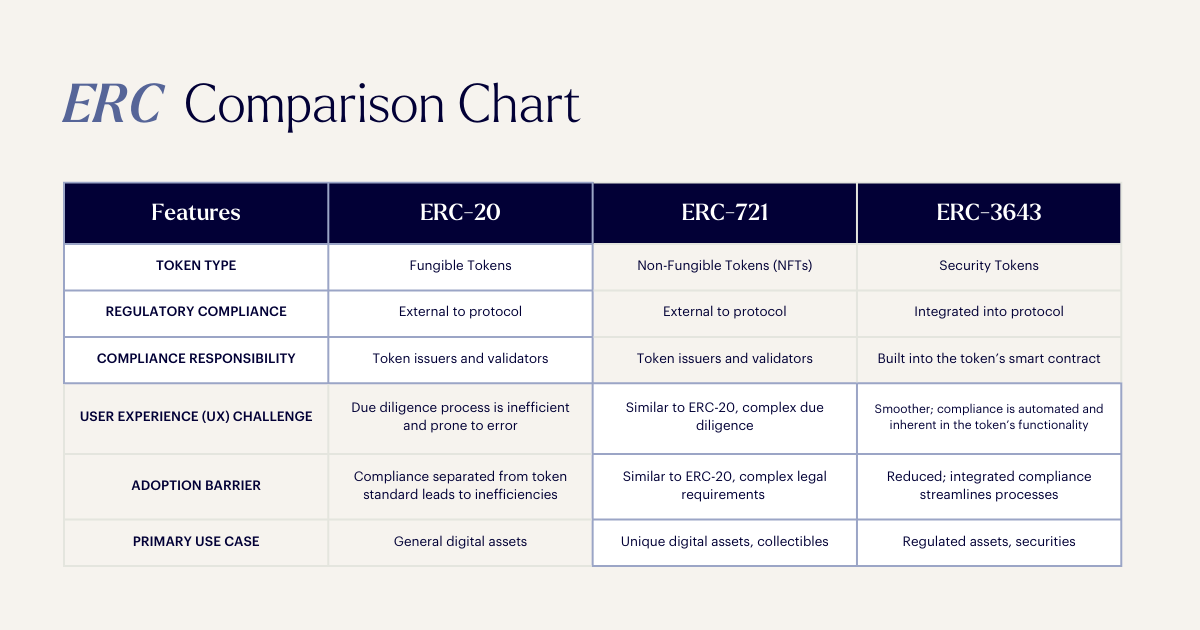

Tokenization has become an increasingly popular topic in the digital assets market and most of these tokenized assets are located on Ethereum. Within the Ethereum ecosystem, you have various token standards, such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens also known as NFTs. Although they are perfect for your normal digital assets, these token standards do not sufficiently align with regulatory requirements, which presents challenges in tokenizing Real-World Assets (RWAs) and securities while maintaining legal compliance and mitigating risks for issuers and investors.

To tackle this problem, the ERC-3643 standard was introduced. This token standard enables the issuance, management, and transfer of permissioned tokens. This ensures that the issuers and investors of these assets are fully compliant with regulatory requirements.

This compliance is achieved by integrating regulatory compliance directly into the token’s smart contract framework. So, the token can only be transferred when both the investor rules (via ONCHAINID) and offering rules are fulfilled. These rules can elements such as sufficient balance by the sender, whitelisting and verifying the receiver in the Identity Registry, and compliance with rules set in the Compliance smart contract.

Implementation of ERC-3643

Since its official recognition in 2021, ERC-3643 has gained significant traction, with over 40 tokens created and more than $28 billion in assets tokenized. This includes traditional financial institutions like ABN AMRO, which used ERC-3643 to issue digital bonds on Polygon for their institutional clients Vesteda and DekaBank. Although the issuance was for only €5 million, it is encouraging to see traditional firms adopting ERC token standards.

With tokenization becoming an increasingly hot topic and growing institutional interest in the market, we anticipate continued growth in this area. This trend was already evident earlier this year when BlackRock launched its first tokenized investment fund, drawing widespread attention. Blockchain networks offer a more efficient settlement layer and transfer of ownership compared to traditional systems. As the trend advances, ERC-3643 is likely to see broader adoption or be replaced by a new standard if developers introduce improvements.