From failure to (possible) success

Sui and Aptos share several similarities. Both are Layer 1 networks designed to be fast and cost-efficient, and both are heavily backed by venture capital. As is often the case with such projects, they achieved remarkable valuations—$2 billion for Sui and $4 billion for Aptos—despite having tokenomics that favored VCs and the founding teams over other investors. Initially, they attracted users through airdrops, but many left shortly afterward, leading to the belief that these networks would remain small. However, in recent months, both Sui and Aptos have gained momentum, attracting more users, projects, and capital.

A T-sui-nami of adoption

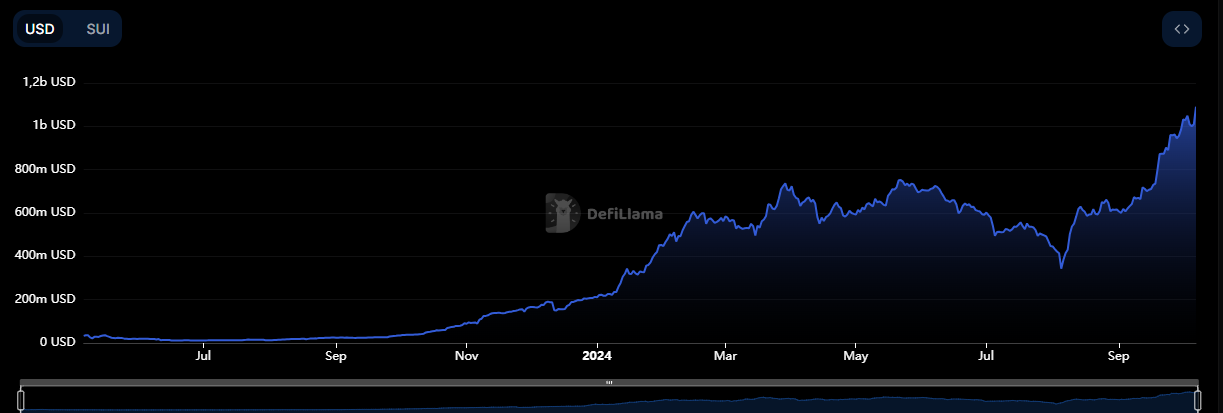

When Sui launched in May 2023, its Total Value Locked (TVL), the amount of capital located on the network, ranged between $11 million and $30 million, which is low for a layer 1 network. However, by September, more capital began entering the network, pushing the TVL to approximately $212 million by year-end. Around this time, the number of transaction blocks, transactions, and daily active wallets also steadily increased, illustrating the increasing activity of users on the network and growing popularity. This upward trend continued until May 2024, when TVL peaked at around $740 million.

A downturn in the broader digital assets market, fueled by disappointing US economic data and a delayed interest rate cut, caused the TVL to drop to $340 million. The market found a bottom in August, as concerns over a US recession and corrections in Asian markets eased. With improving macroeconomic conditions, Sui's TVL steadily rose, surpassing $1 billion by October 4th. Furthermore, of this TVL, a whopping $400 million is in stablecoins, illustrating that users still have enough buying power on Sui.

Adopting Aptos

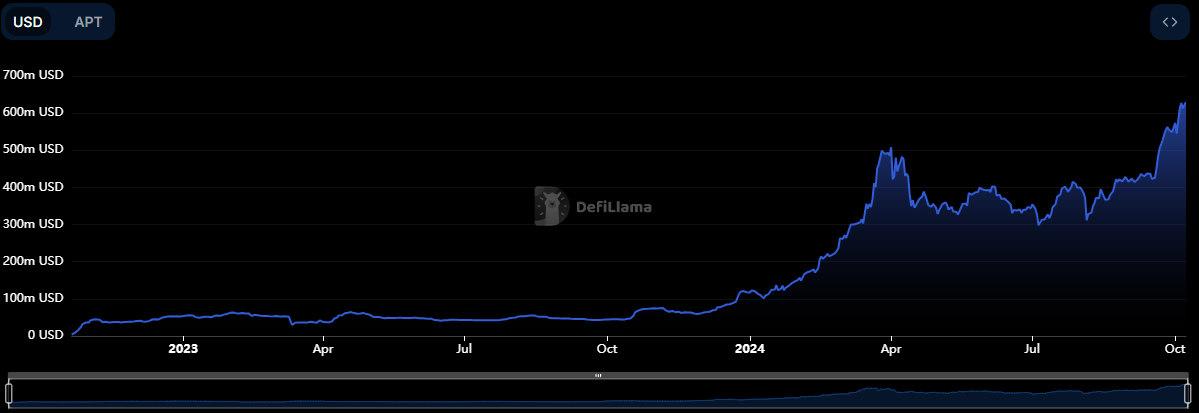

Aptos, launched in October 2022, was initially met with controversy due to its high valuation and questionable tokenomics. Of particular concern was the allocation of 51% of the total token supply for "community" purposes, without clear details on how it would be distributed. A significant portion was also reserved for private investors and the team, raising further skepticism. Despite these issues, Aptos attracted approximately $40 million in Total Value Locked (TVL) within two weeks of launch, eventually reaching around $60 million before stabilizing. The TVL fluctuated between $40 million and $60 million until October 2023, when a sudden inflow of $20 million pushed the TVL upward, ending the year at $116 million. The most significant capital growth occurred in Q1 2024, with the TVL surging to $508 million by the end of the quarter.

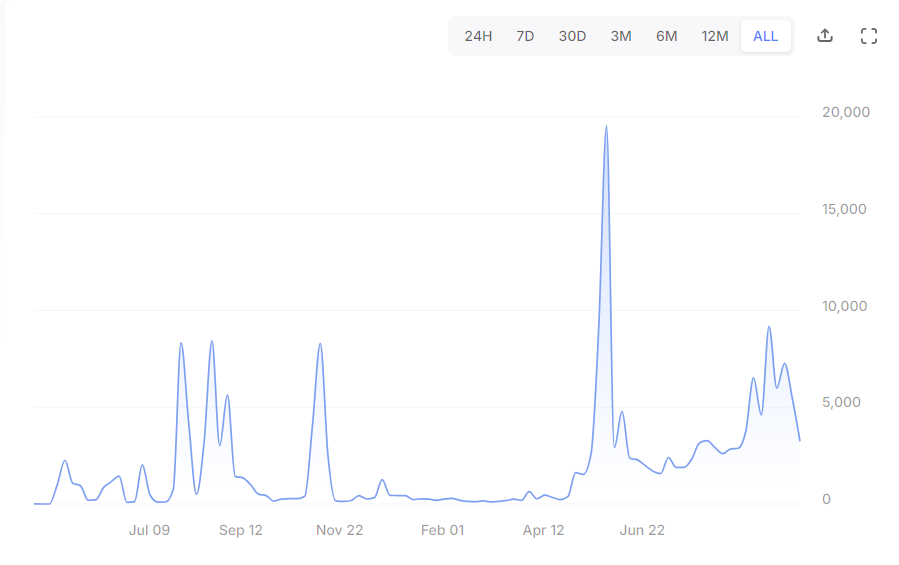

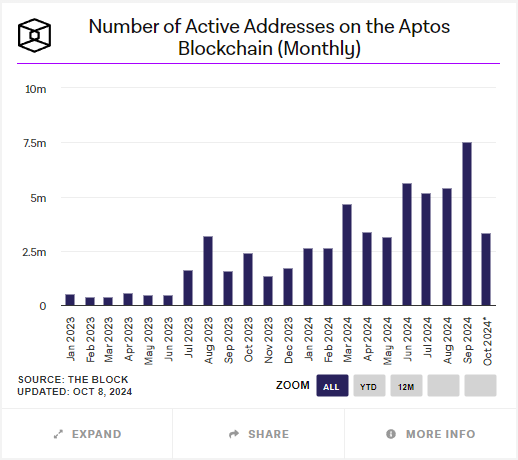

Like Sui, Aptos faced challenges from worsening market conditions, causing its TVL to drop to approximately $300 million. However, this trend reversed, and the TVL peaked at $580 million. Aptos also saw steady network adoption, which was initially slow in 2023 but accelerated in 2024. Monthly transaction counts increased from 19.62 million in December to 30.33 million in March. While there were two significant outliers in May and August, with 349.95 million and 578.74 million transactions, the network maintained stable growth, reaching 44 million transactions by September. The monthly active addresses grew from around 500,000 to over 7,400,000 with new address creation also steadily rising.

What lies ahead?

Looking at the adoption of Sui and Aptos, it's clear that existing digital asset users are migrating to and exploring these new chains, particularly as retail investors show growing interest in the digital assets space. Both networks are potentially laying a strong foundation for the next significant wave of investors. These chains are especially appealing to new users due to their low transaction costs and high speeds. Additionally, their user-friendly wallet interfaces help lower the entry barrier for beginners.

If the current trend of new users entering and increasing TVL continues, we may see new investment opportunities emerging on these chains or through their native tokens. However, past performance does not guarantee future results, and this is not financial advice. Always conduct your own research.