The Best of Both Worlds: Tokenizing US Treasuries

For years, digital asset market participants have advocated that cryptocurrency and traditional financial services will integrate or even replace it. In the early days of the market, this was just a mere dream as most market observers loathed at the industry. Today, we witness a slow integration, for example with tokenizing US treasuries.

US treasuries spearheading tokenization

By tokenizing treasuries, a Decentralized Finance (DeFi) project or institution creates a representative token of the treasury and launches it on a blockchain. This process leverages the technology's features, such as transparency and low transaction costs. This trend is still emerging; the first institution to launch tokenized bonds on a public blockchain was asset manager Franklin Templeton, with its Franklin OnChain U.S. Government Money Fund on Stellar, in 2023.

For institutions, these tokenized funds provide more cost-efficiency. However, for DeFi projects, these financial instruments allow them to earn revenue or yield outside the digital asset market. As a result, they are less exposed to the market’s cyclical nature, providing them with a steady income. So, for both industries, there is something to win.

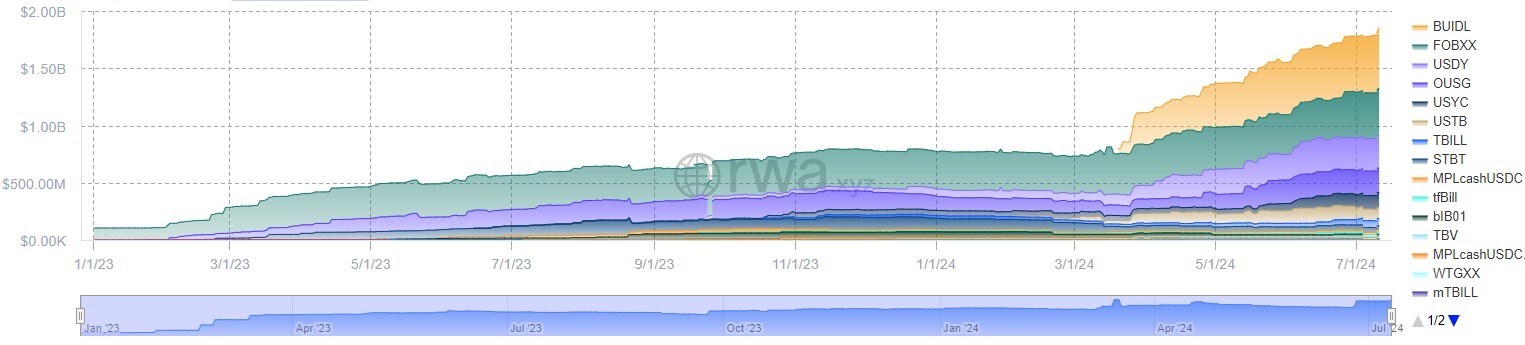

In 2023, the tokenization trend gained momentum, amassing over $670 million by the first of March 2024. This trend accelerated when the world’s largest asset manager, BlackRock, announced its first tokenized investment fund on a public blockchain, Ethereum.

Source: https://app.rwa.xyz/treasuries

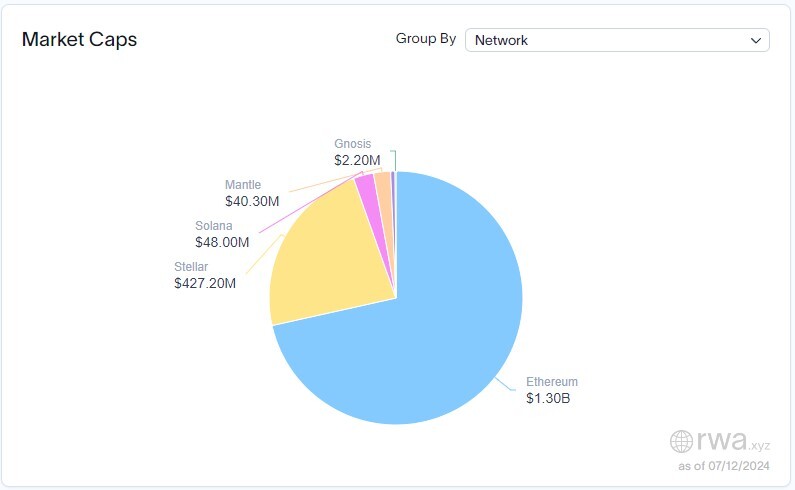

The BlackRock USD Institutional Digital Liquidity Fund ($BUIDL) allows professional investors to invest in US treasuries through the Ethereum network. The introduction of $BUIDL was an incredible success, attracting over $200 million in its first week. After two weeks, it became the largest tokenized treasury fund, surpassing Franklin Templeton’s one-year-old tokenized treasury fund. As a result, the total tokenized treasury value on public blockchains has surged to over $1.57 billion as of June 2024. The lion's share of these treasuries is located on Ethereum which, for now, leads as the blockchain for US Treasuries and other tokenized assets as Stellar’s value comes solely from Franklin’s tokenized fund.

Source: https://app.rwa.xyz/treasuries

Although this is just a small fraction of the US Treasury market, which has an outstanding value of $27 trillion, nevertheless, the future looks promising. Crypto-native firms and big banks like JPMorgan and Citigroup are racing to bring more traditional assets, such as bonds and credit, onto blockchain rails, eyeing more efficient operations and lower costs.

In our eyes, tokenization and therefore the real-world asset remains an interesting narrative to follow in the upcoming years. Not only US treasuries but also tokenized private credit and commodities can provide interesting opportunities.