The Bull Market in Stablecoins

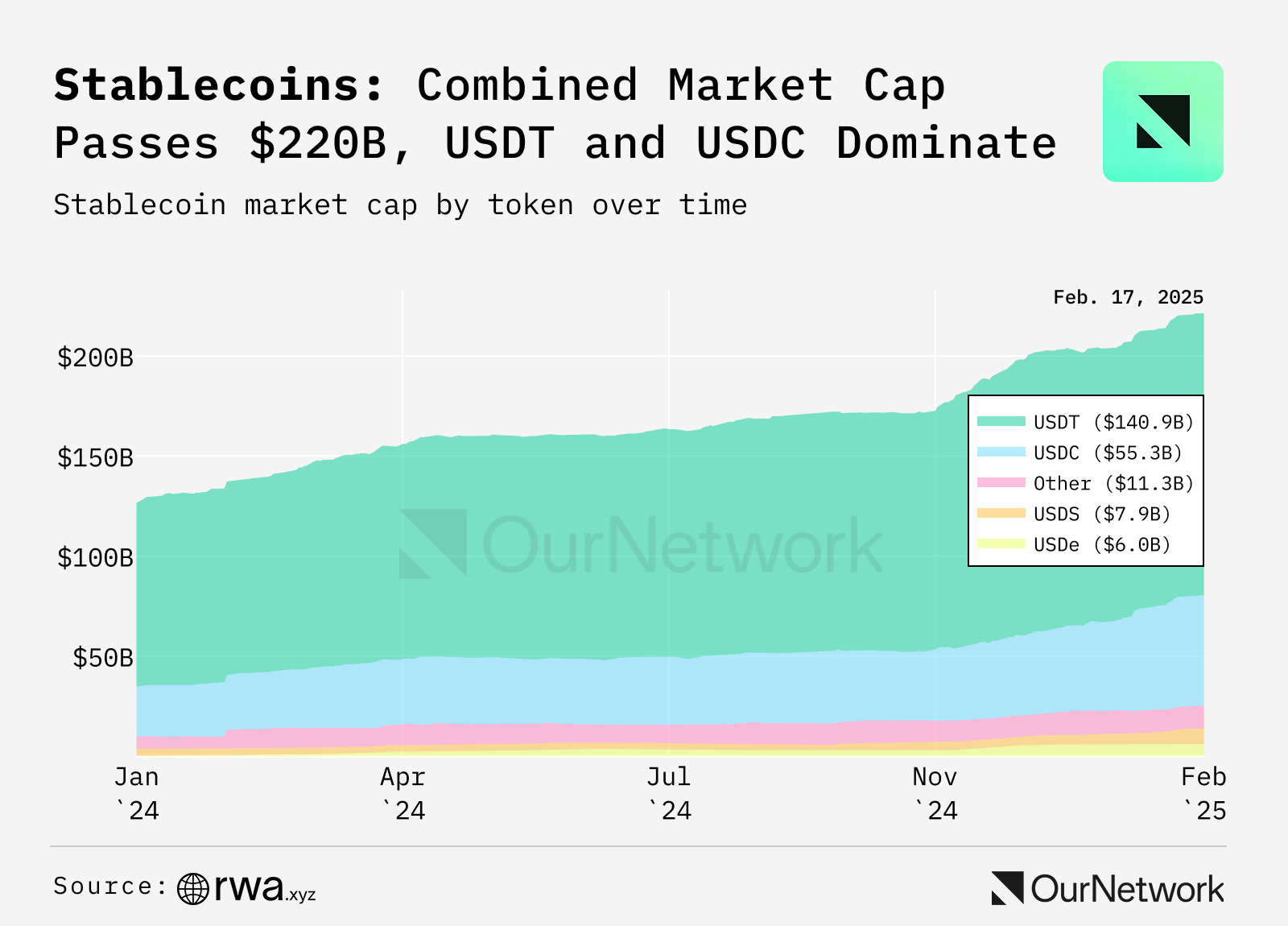

In the volatile crypto world, one asset class has emerged as an anchor of stability: stablecoins. These fiat-pegged digital tokens have grown from niche experiments into a market exceeding $220 billion and now represent over 1% of the U.S. M2 money supply.

This impressive growth highlights the critical role of stablecoins in the crypto ecosystem: they offer both a stable medium of exchange and a reliable store of value amid extreme market fluctuations. By merging the stability of traditional currencies with the 24/7, borderless efficiency of blockchain technology, stablecoins are now indispensable for traders, DeFi users, and increasingly, institutions.

From facilitating instant payments to serving as on-chain collateral, their rise signals a new era where digital dollars fuel the broader crypto economy.

Market Growth & Adoption

Stablecoin growth has been explosive over the past year. The total stablecoin supply increased by roughly $100 billion in 2024, reaching approximately $225 billion by early 2025. Major players Tether (USDT) and USD Coin (USDC) continue to dominate, holding a combined market share of about 89%. However, market dynamics are shifting—USDT’s share has declined from 73% to 64%, while USDC’s has risen from 20% to 25%. Notably, emerging stablecoins like Ethena’s USDe and Sky Protocol’s USDS have swiftly grown to multi-billion scales, intensifying competition in the sector.

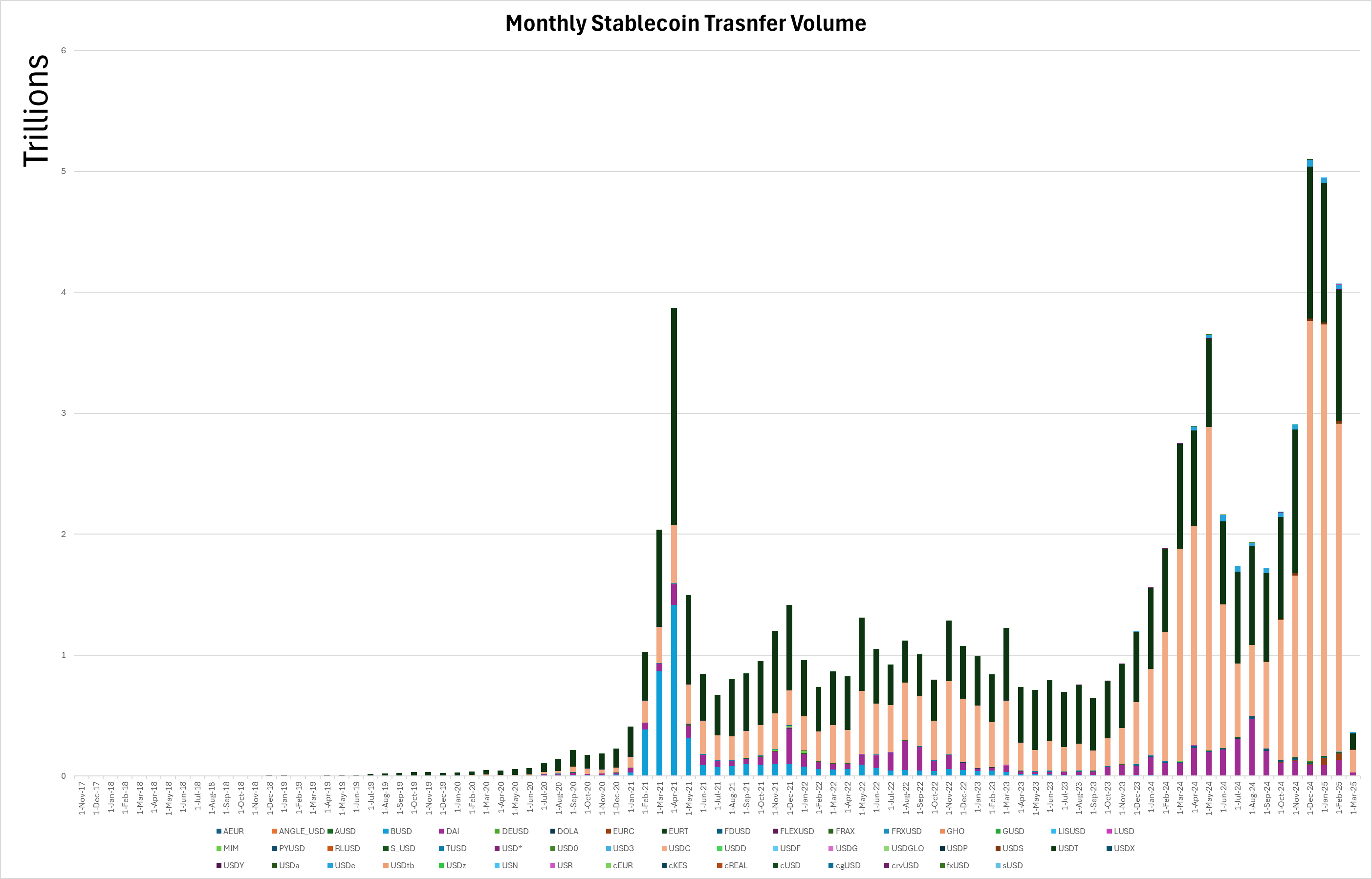

Adoption metrics likewise tell a bullish story. On-chain stablecoin transfer volume reached $27.6 trillion in 2024, even surpassing the annual volumes of Visa and Mastercard combined. This reflects stablecoins’ role as the lifeblood of crypto trading and DeFi, where they serve as a liquid base currency. They enable deep liquidity for exchanges and protocols, with Tether alone accounting for ~80% of stablecoin trading volume.

Beyond trading, stablecoins are increasingly used as digital cash in everyday transactions and remittances. In inflation-stricken economies like Argentina, Turkey, or Venezuela, people turn to dollar-pegged tokens as a refuge from currency devaluation. A recent analysis found that in regions such as Africa, Eastern Europe, and Latin America, stablecoins make up nearly half of all crypto transaction volume – outpacing even Bitcoin – due to their use as a low-volatility medium for payments and savings.

Source: https://app.artemis.xyz/stablecoins

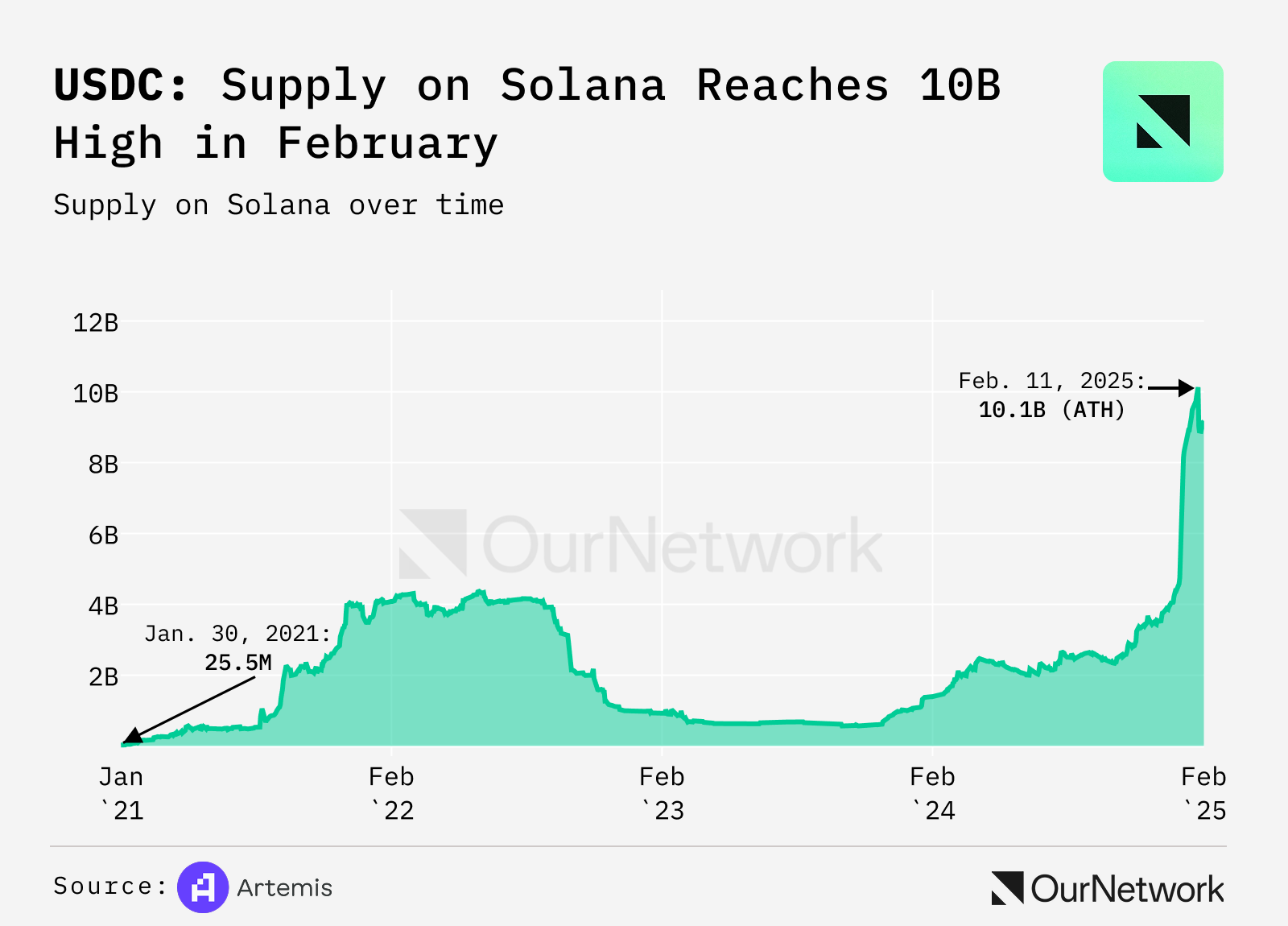

Stablecoin supply growth has also spread across multiple blockchains: for instance, USDC’s rapid expansion on Solana and Layer-2 networks added over $7.7B of USDC outside Ethereum, driving its outperformance against USDT. Whether for high-frequency trading bots on Solana or everyday users seeking stability, stablecoins’ adoption curve remains sharply upward.

Source: https://app.artemis.xyz/stablecoins

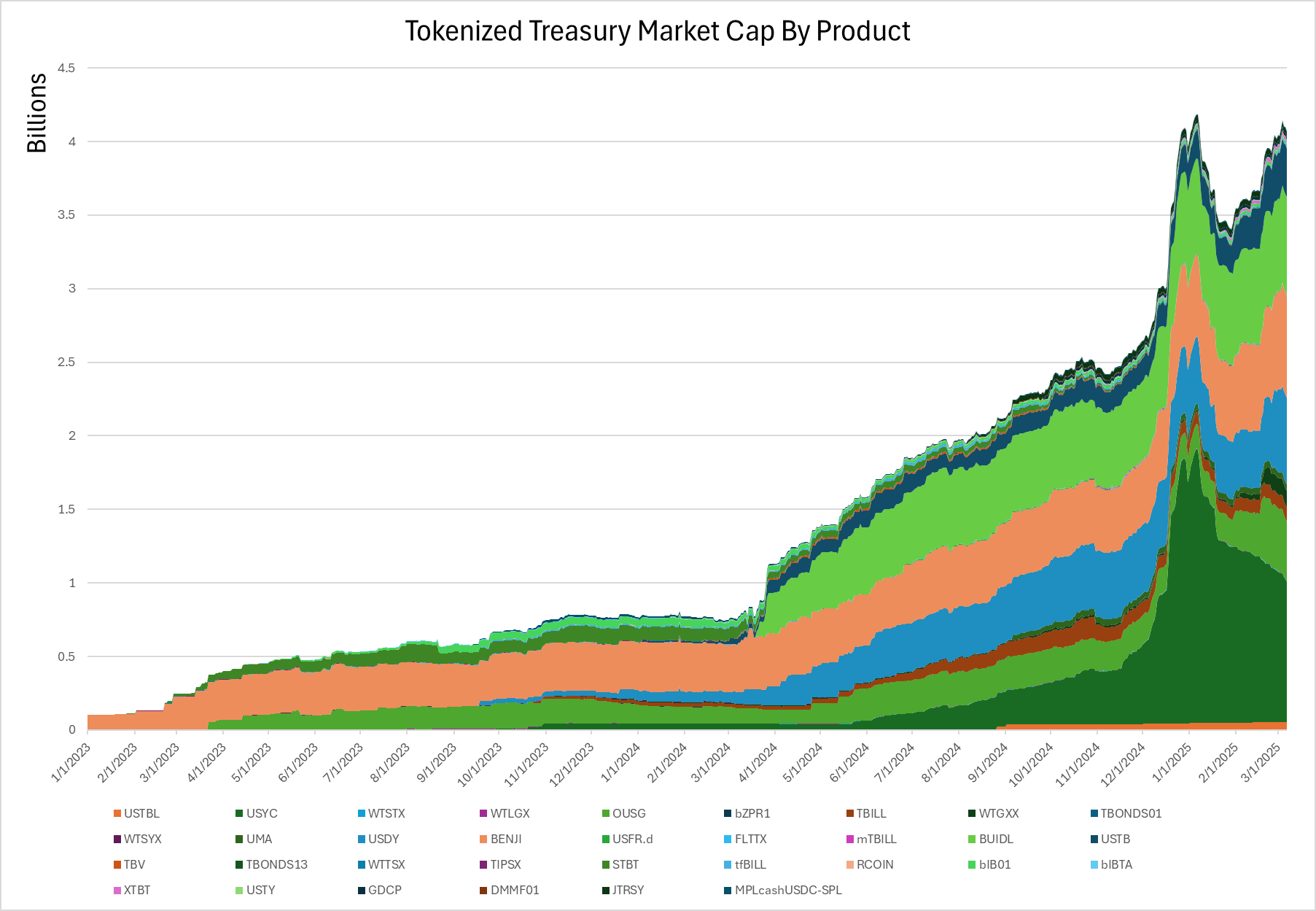

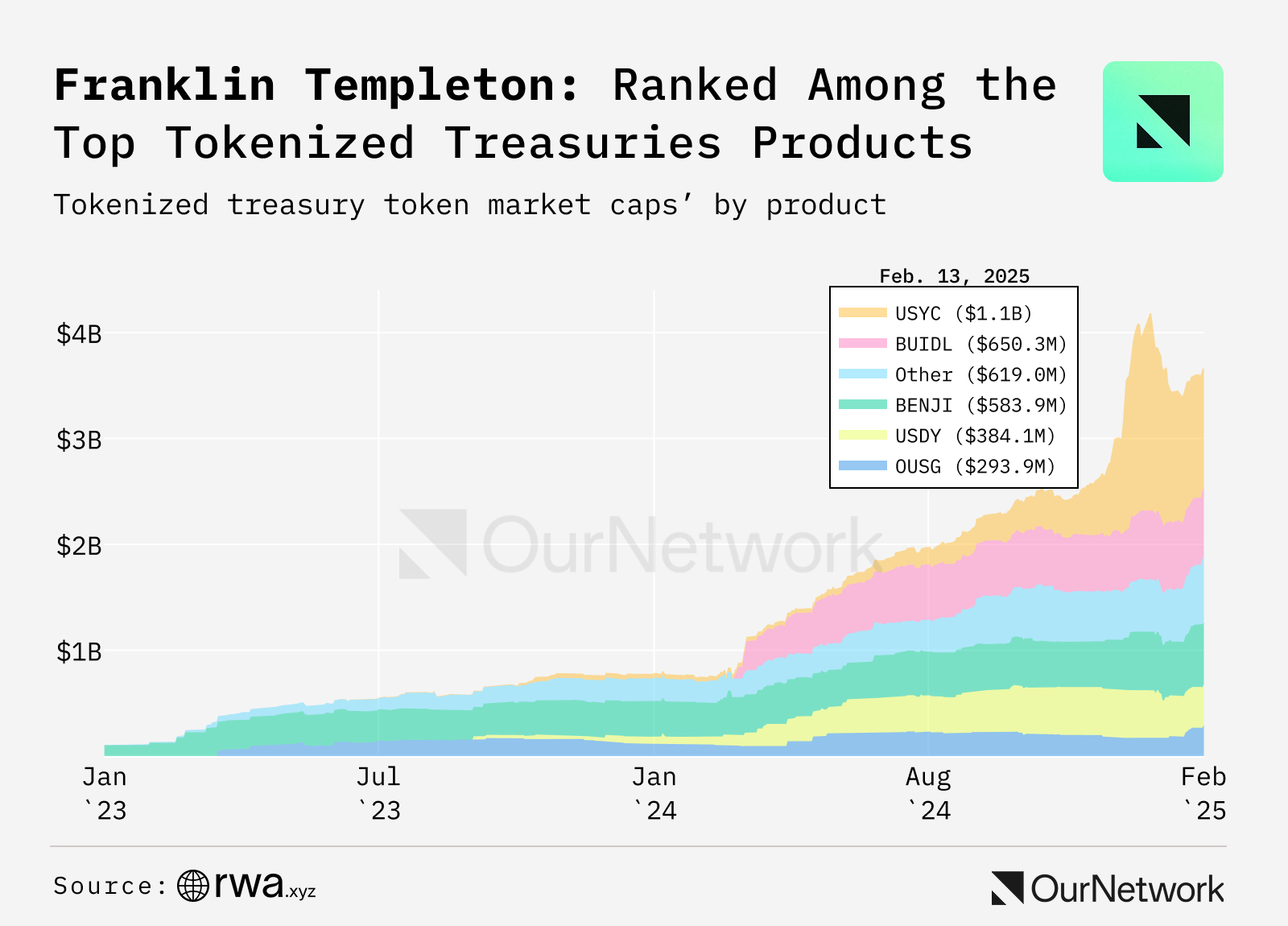

Even conservative asset managers are exploring on-chain dollars. For example, BlackRock’s tokenized money market fund (BUIDL) now integrates with stablecoin infrastructure, and Franklin Templeton’s funds have adopted USDC for on-chain settlement. On the decentralized side, projects like Maple Finance offer institutional lending pools where deposits are in stablecoins, blending TradFi capital with DeFi yields. Overall, the institutional embrace of stablecoins – from fintech payment rails to asset management – is validating their utility as a bridge between crypto and traditional finance. (use one of these two images - they are representing the same).

Source: https://app.rwa.xyz/treasuries

Challenges & Opportunities

As the stablecoin market booms, it faces a mix of challenges and opportunities that will shape its future. Regulatory uncertainty remains significant, with global policymakers still determining how best to supervise these quasi-money instruments. In many regions—including the U.S.—draft bills are under discussion, but no comprehensive framework currently exists, leaving both issuers and users in a regulatory grey area.

This situation has sparked concerns over consumer protection and systemic risks, such as potential bank runs on major stablecoins. In contrast, regions like the EU and Singapore are proactively implementing stricter rules to ensure transparency and reserve quality, which could boost stablecoin legitimacy for institutional use—if applied carefully to avoid stifling innovation.

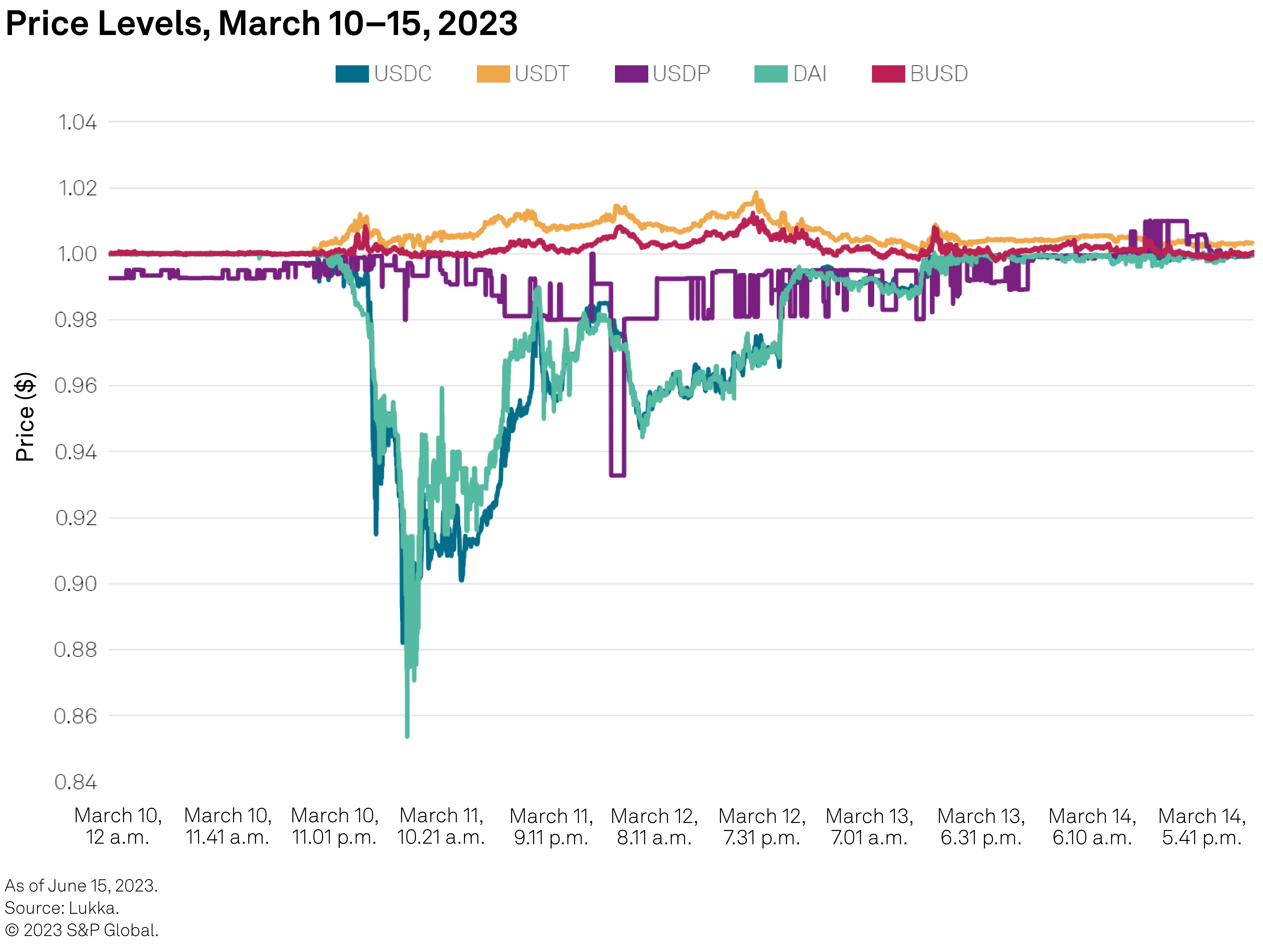

At the same time, inherent market and design risks continue to affect even fiat-backed stablecoins. Issues such as reserve transparency, technical vulnerabilities, Tether’s past auditing concerns, and brief USDC de-pegging events highlight the urgent need for robust reserve management and more frequent, real-time audits.

Source: https://www.reddit.com/r/CryptoCurrency/comments/174qgb9/the_last_year_has_been_so_insane_do_you_guys/?rdt=60849

However, the competitive landscape is also spurring significant innovation, with new hybrid and yield-bearing stablecoins emerging that blend traditional assets, such as U.S. Treasuries, with algorithmic mechanisms. Enhanced interoperability across multiple chains, along with advanced bridge protocols, is further broadening their use cases —from DeFi lending to everyday payments—positioning stablecoins as increasingly resilient and versatile digital assets.

Conclusion

The bull market in stablecoins signifies more than a surge in supply—it marks the maturation of a technology that bridges the gap between decentralized finance and traditional money. Macroeconomic forces (like demand for dollars in uncertain times and the search for yield) are fueling stablecoin adoption, while technical innovations are making them more resilient and useful.

Though challenges around regulation and design remain, the trajectory is clear: stablecoins are moving from the periphery of crypto into the mainstream of global finance. In the coming years, we can expect these digital dollars to be further woven into payment systems, financial markets, and everyday commerce.