The Good Case for Base

Since its launch on August 9th, Base has gained significant attention, primarily because it is incubated by Coinbase, which aims to leverage its products and distribution channels. In short, this could potentially onboard over 100 million users onto its Layer 2, with incentives.

Those who recall when Binance pushed its users onto BSC, leading to the craze in the first half of 2021, may find this strategy familiar. However, the key difference is that Base is an Ethereum L2, rather than its own chain. It is the first L2 to join the Optimism Collective and advance the Superchain vision. This setup is arguably a clean way to circumvent regulatory uncertainties in the US and enter the Ethereum ecosystem, which is already regarded as sufficiently decentralized.

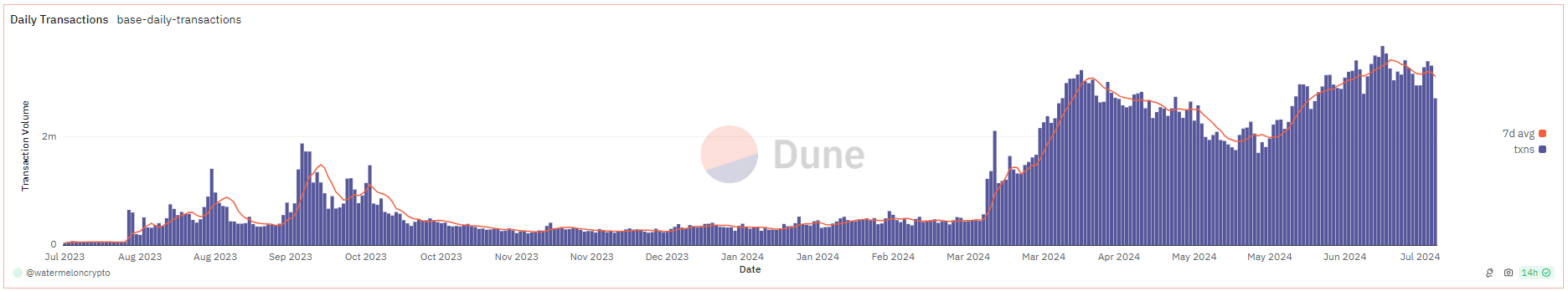

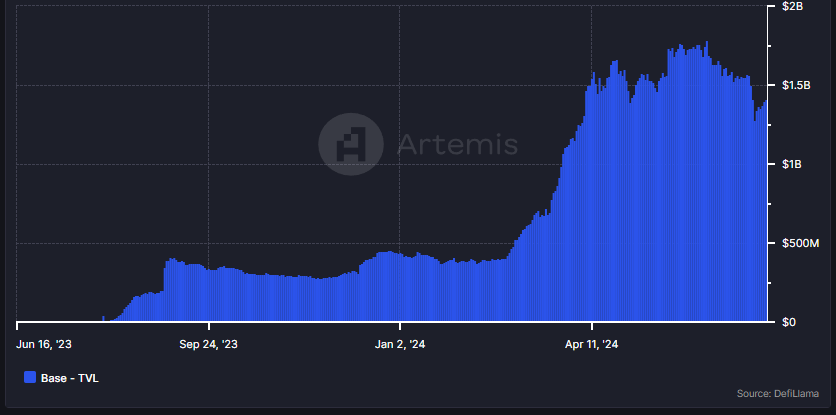

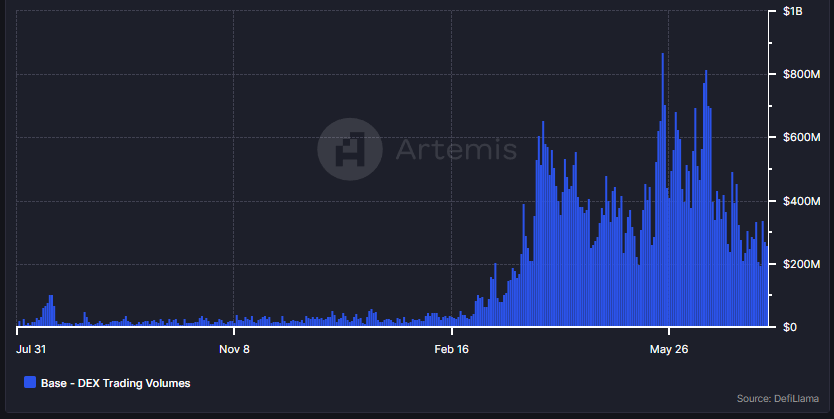

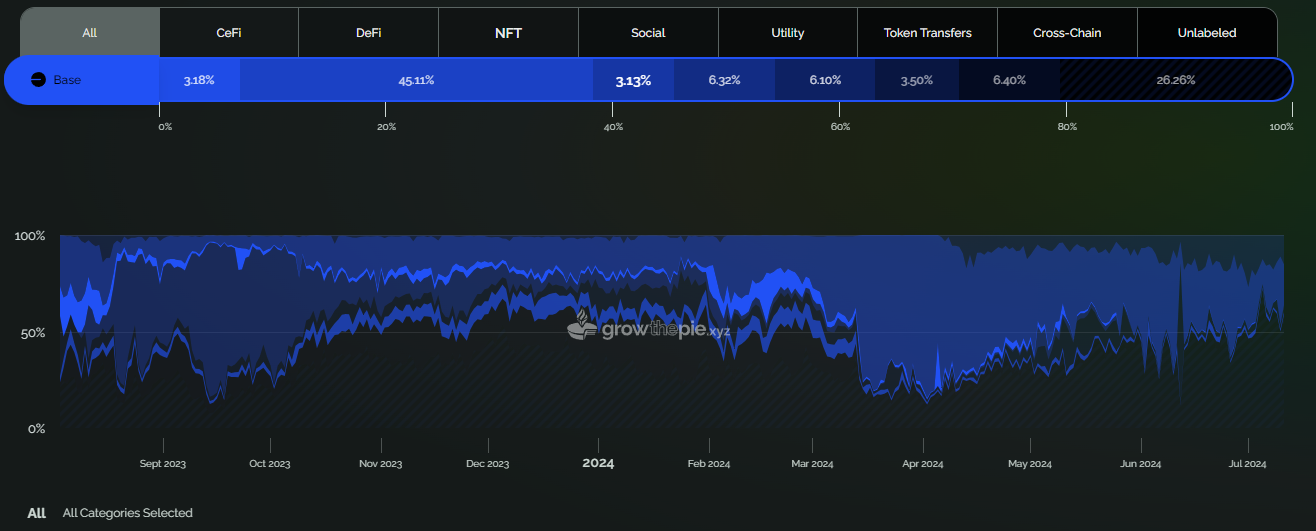

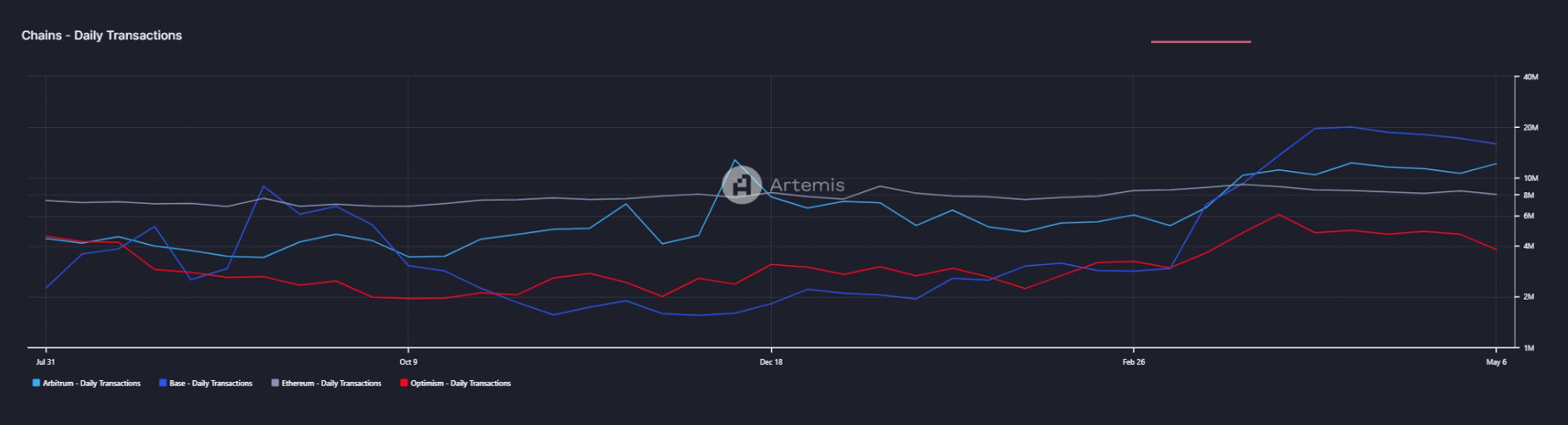

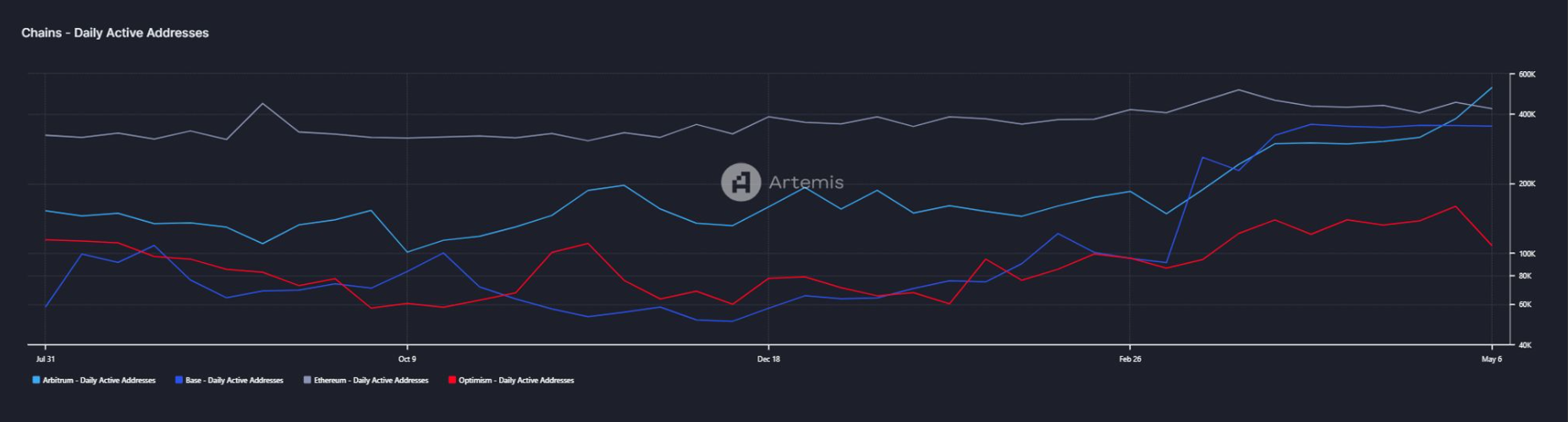

Although it took some time, overall usage statistics for Base have been increasing. Since March 13th, daily active users have tripled, and transaction counts have increased by over 500%. A similar trajectory can be observed with Total Value Locked metrics, closing in on $2 billion. The primary use case for Base has been DeFi. The breakthrough consumer app, Friend.tech, constitutes 7% of all-time gas fees paid, reaching as much as 77% of all fees at one point.

Source: https://dune.com/queries/2834571/4732339

Source: https://app.artemis.xyz/project/base?tab=fundamentals

Source: https://www.growthepie.xyz/chains/base

In less than one year on the market, Base is emerging as a solid winner in the Layer 2 space. As the youngest generalized-EVM layer, it showcases competitive metrics against Optimism, Arbitrum, and Ethereum. This is likely due to the desire of builders to leverage the distribution capabilities of a brand like Coinbase and users seeking new, yet perceivably safer, pastures.

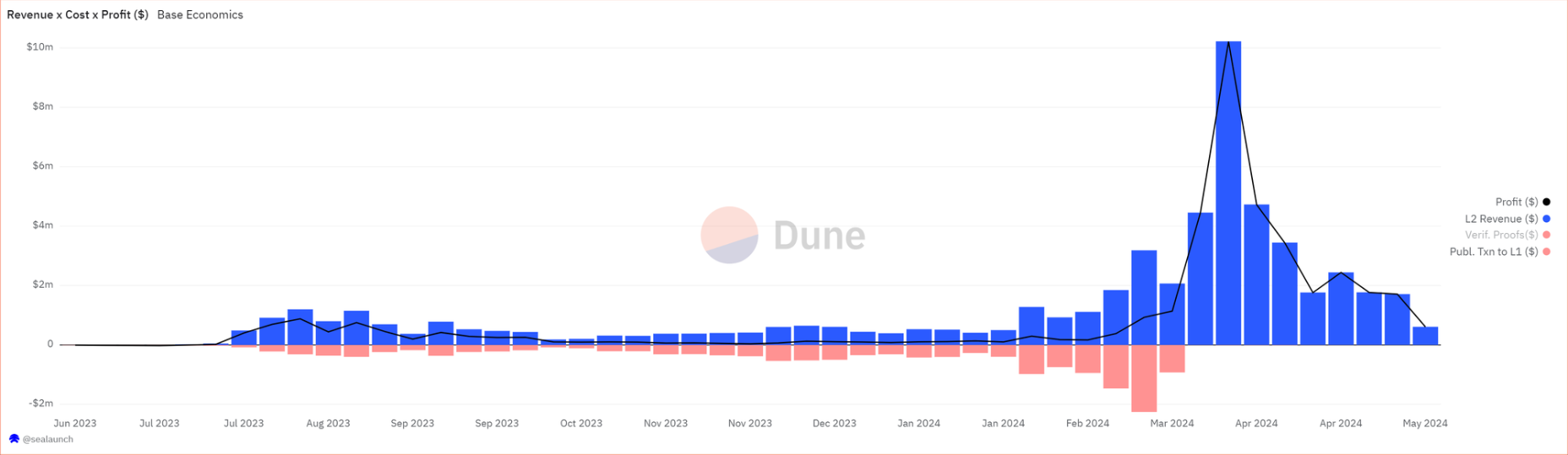

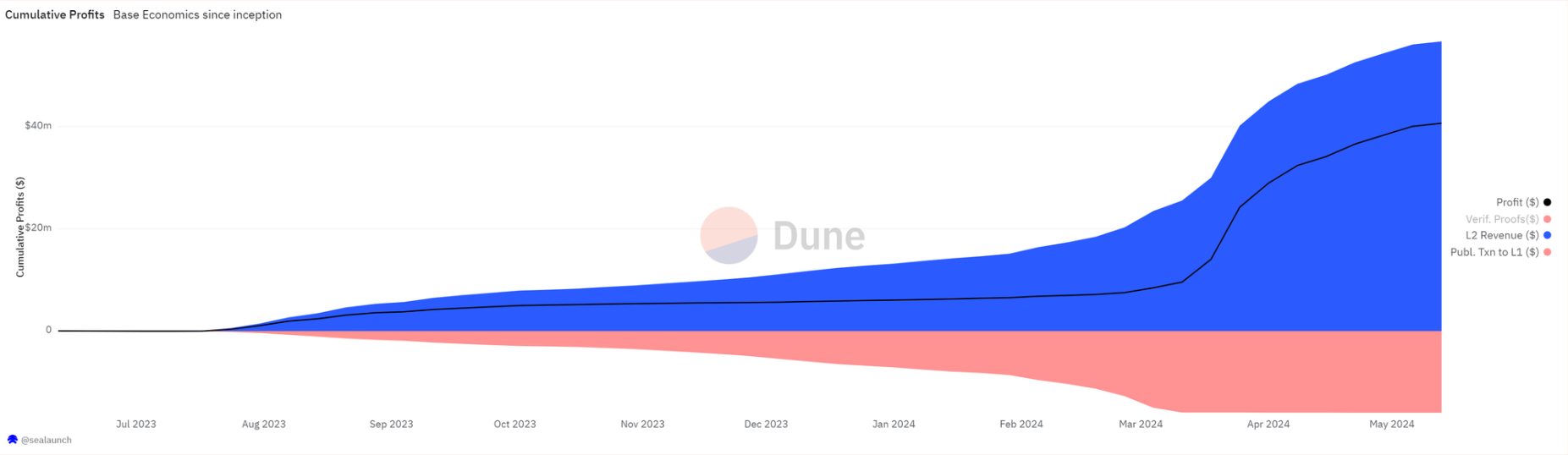

All the on-chain activity highlighted above has a strong impact on the economics of running a sequencer for these rollups. Notably, Base has been the most profitable in terms of the magnitude of profit generated and has displayed the highest profit margin due to its relative infancy compared to other rollups. In total, Base showcases $56.7M in revenue generated and $16.0M in data availability costs paid to Ethereum.

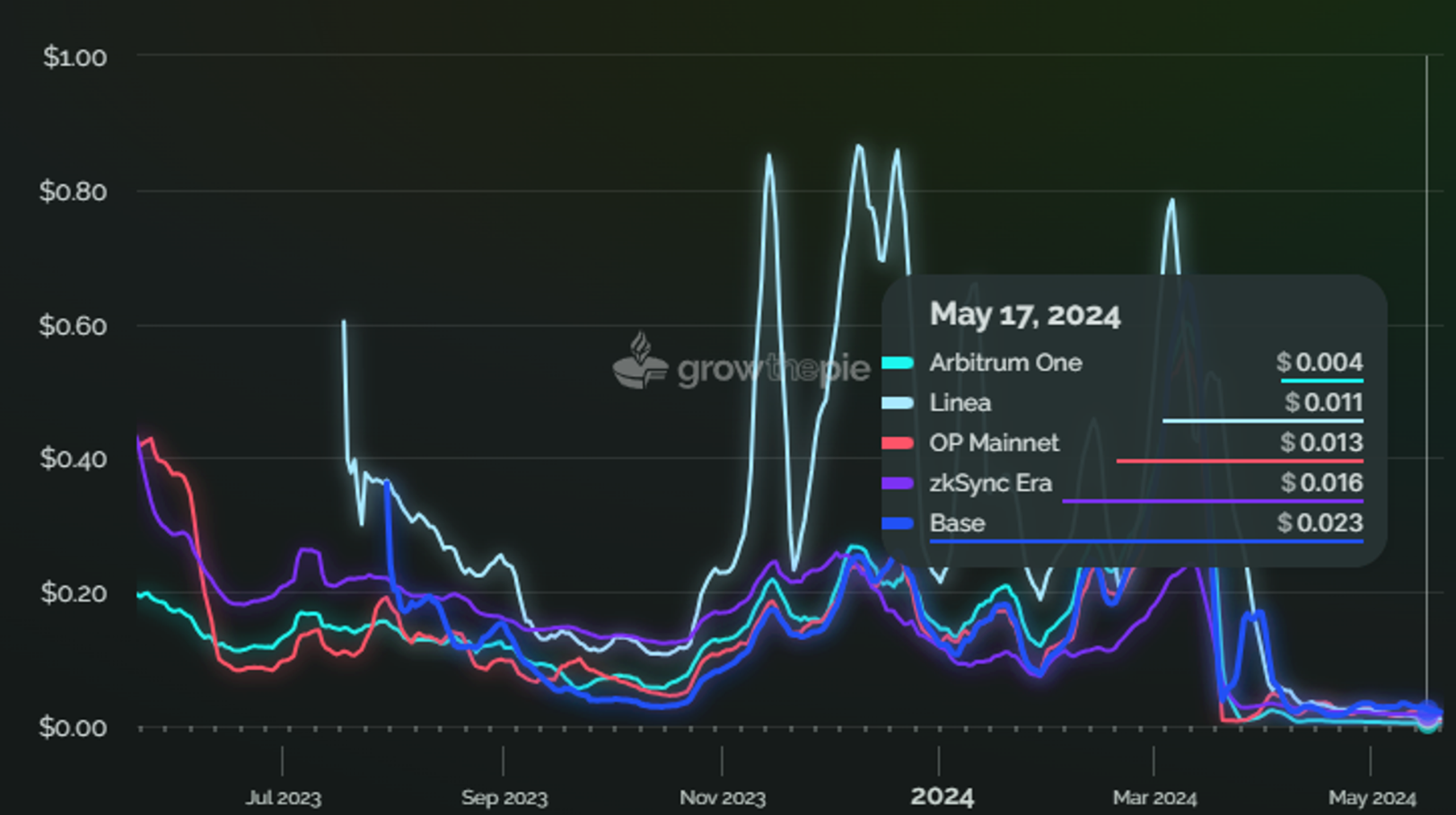

On March 13th, Ethereum launched a major L2 upgrade: Blobs, a cost-effective data storage solution. This upgrade drastically reduced the cost of publishing data back to Ethereum, allowing for lower transaction fees.

Source: https://dune.com/sealaunch/rollups-profits

Source: https://www.growthepie.xyz/fundamentals/transaction-costs

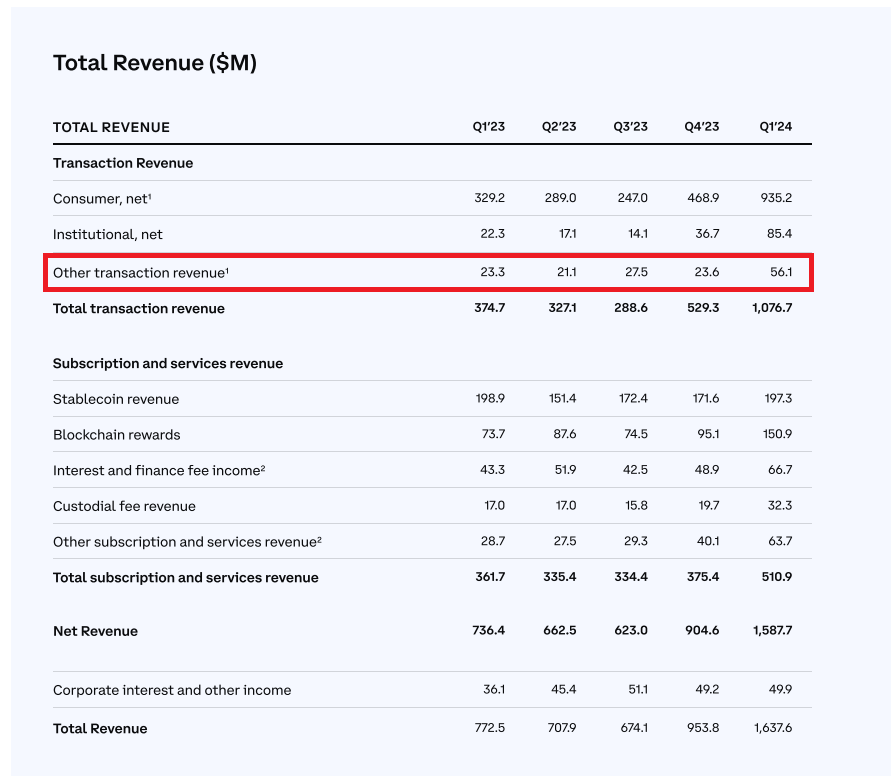

Base sequencer fees have been included in Coinbase’s quarterly earnings reports as ‘Other transaction revenue,’ which is visibly growing and up 138% quarter-over-quarter, challenging its Institutional transaction revenue. This provides an interesting blueprint for other regulated companies to participate in permissionless crypto ecosystems while generating a solid business case around it.

In this regard, Coinbase is paving the path within the crypto space by merging with traditional corporate frameworks to cross the chasm, and bring cryptocurrencies mainstream.