The New DeFi Money Lego?

Ethereum's first native 'internet bond' introduced a base rate yield within the DeFi ecosystem which the market naturally began integrating within multiple products. With leverage returning to the system, Liquid Staking Tokens (LSTs) are back on the menu.

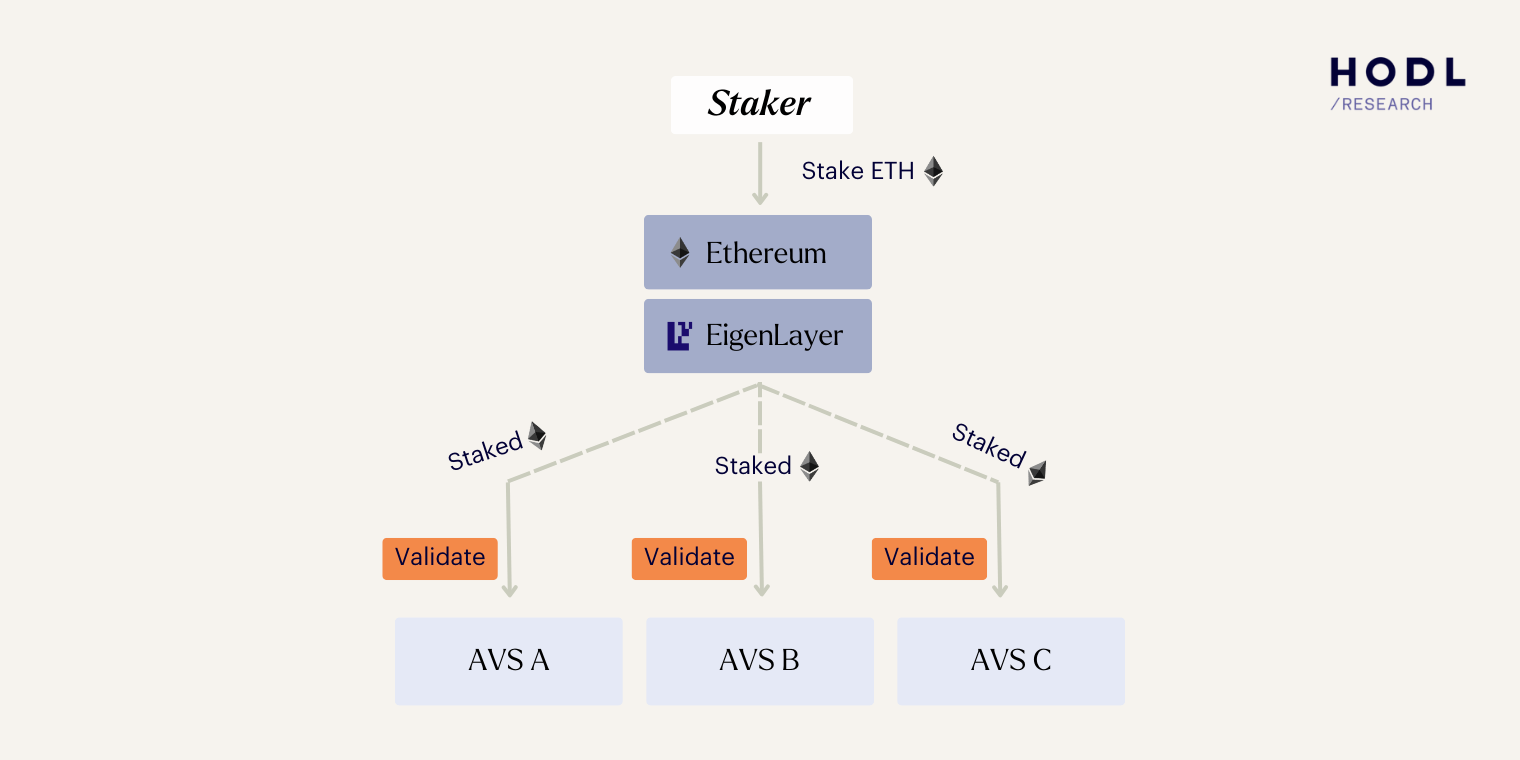

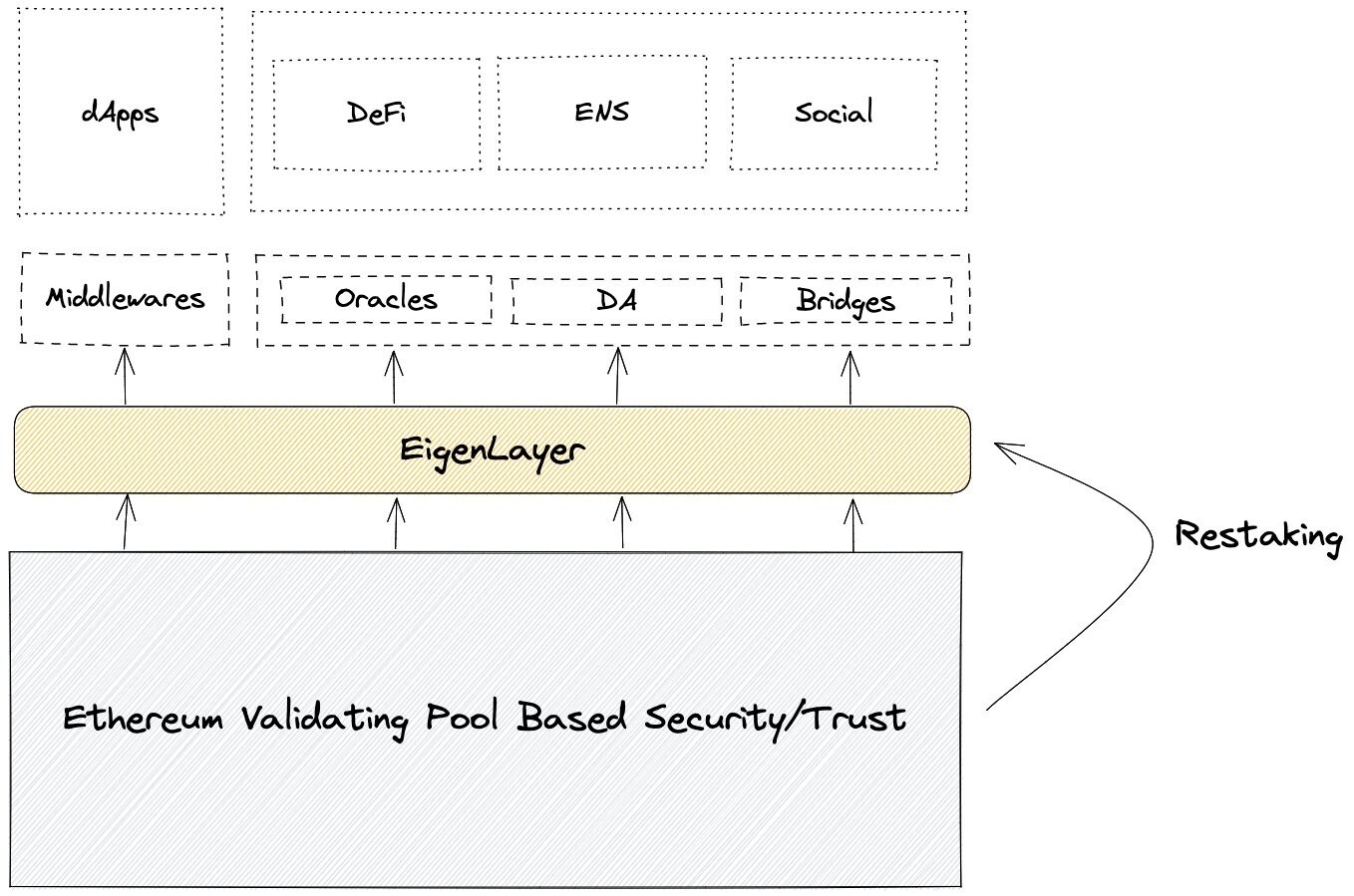

As a consequence, the rise of LSTs creates a native sink for staked Ether. Enter Eigen Labs which aims to repurpose staked $ETH to validate its own smart contracts, known as restaking. "A marketplace for Ethereum's trust" - as summarized by Sreeram Kannan. The idea here is to leverage Ethereum's pooled security at the consensus layer, and to extend this to bootstrap cryptoeconomic security across other applications. EigenLayer's infrastructure enables staked ETH to be rehypothecated through Actively Validated Services (AVS).

Bootstrapping economic security is challenging, as it is expensive and time-consuming and could be perceived as inefficient for some applications. Instead of building a network from the ground up, a project could opt-in into EigenLayer.

The advantage of this is that it introduces capital efficiency and additional yield sources from the onboarded apps/services. However, the drawback is that it comes at the expense of additional technical complexity (security risks) as well as the risk of centralization.

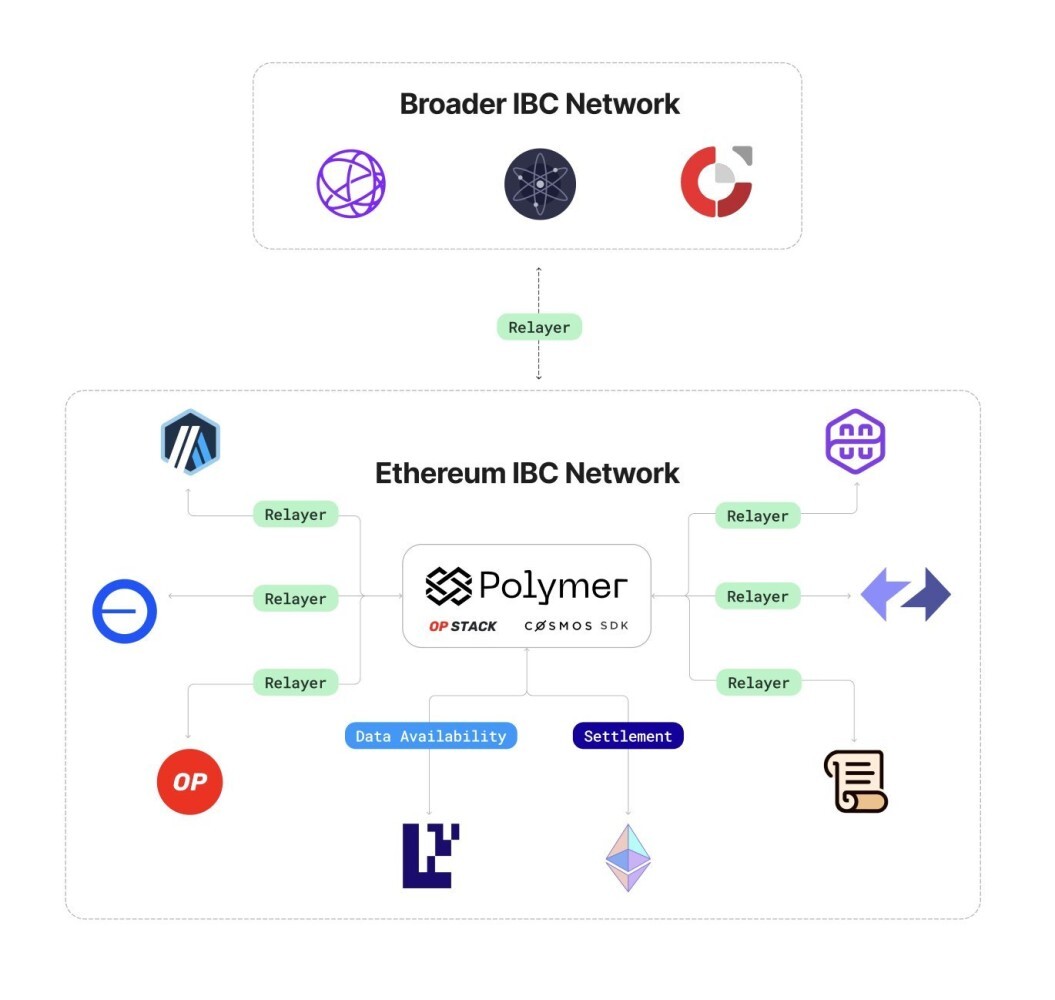

The potential of EigenLayer has been making a lot of noise across the Ethereum ecosystem. A project that caught our attention is Polymer Labs which plays into the modular rollup scene, using Eigen Layer for data availability and applying the Cosmos SDK for development.

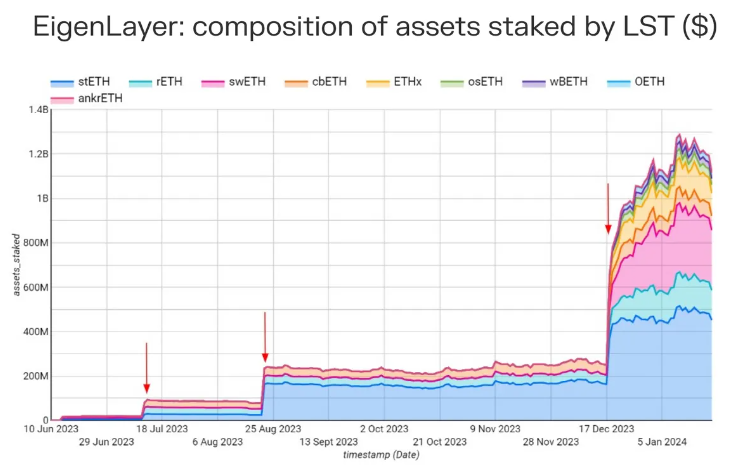

Restaking is one of the most prevalent trends, having amassed over $1B of LSTs in less than a year, and without any of the products being live on mainnet. Below, arrows market the dates when staking limits were adjusted, with stETH and swETH tokenholders leading the way.

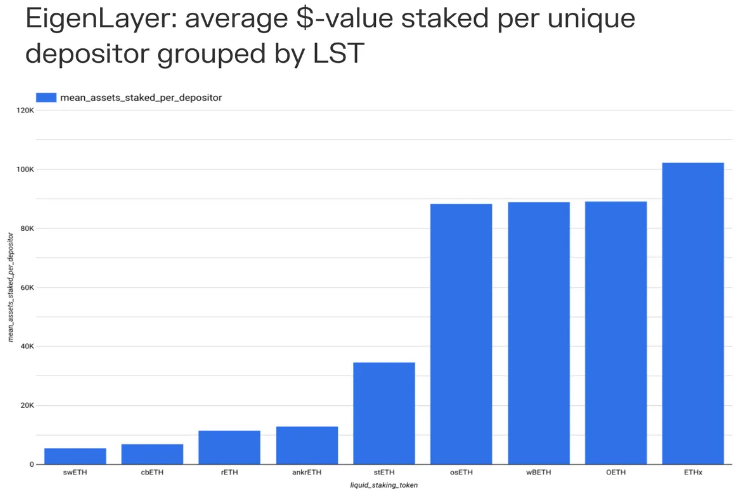

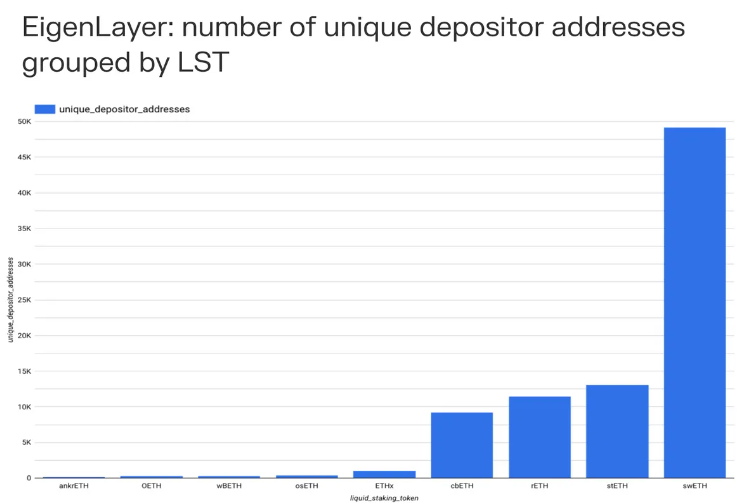

Looking further into the work of Token Terminal, one can observe that the biggest deposits are from $ETHx holders, the LST of Stader Labs. Whilst the biggest unique liquid staking depositor LST belongs to Swell Labs with its $swETH.

It is fairly clear that Eigen Labs has captured the imagination as a marketplace for selling Ethereum's trust. Despite its complexities, this innovation re-introduces leverage onto Ethereum which is likely to stream its way across multiple chains and dApps.

For further reading and distinguishable references to this thread include: