What do institutions look for in digital assets

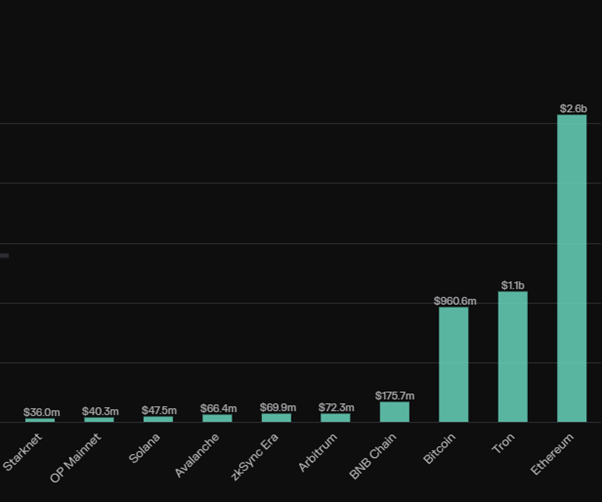

Layer one's, layer two's, modular blockchains, dApp-specific chains, omnichain interoperability platforms. The list of platforms goes on and on, along with their philosophies on scalability and user experience. Is the base layer, the best bet one can make?

Source: tokenterminal.com

Even though it's rarely the first mover that wins, it's also true that the base layer space has become saturated. Early entrants typically come with a more technically sound value proposition, but fall behind in their network effects against earlier chains. The fully diluted valuation (FDV) of these base layers is also typically high, with few launching below a $1B valuation with a generally inflationary token economy to bootstrap activity. Will such a model fit smoothly within a TradFi investment framework?

The BTC ETF listing has legitimized the crypto space and has opened the door for further crypto ETF listings such as ETH. We envision that the risk appetite will increase and that institutions will be forced to go down the top 100 in search of alpha by their client base. Thus, while somewhat adventurous, it's likely that institutions will first look at the crypto space from a 'vintage' approach, looking at cashflows rather than network effects (and memes). It's unlikely that meme coins, representing an underlying community, will get a bid.

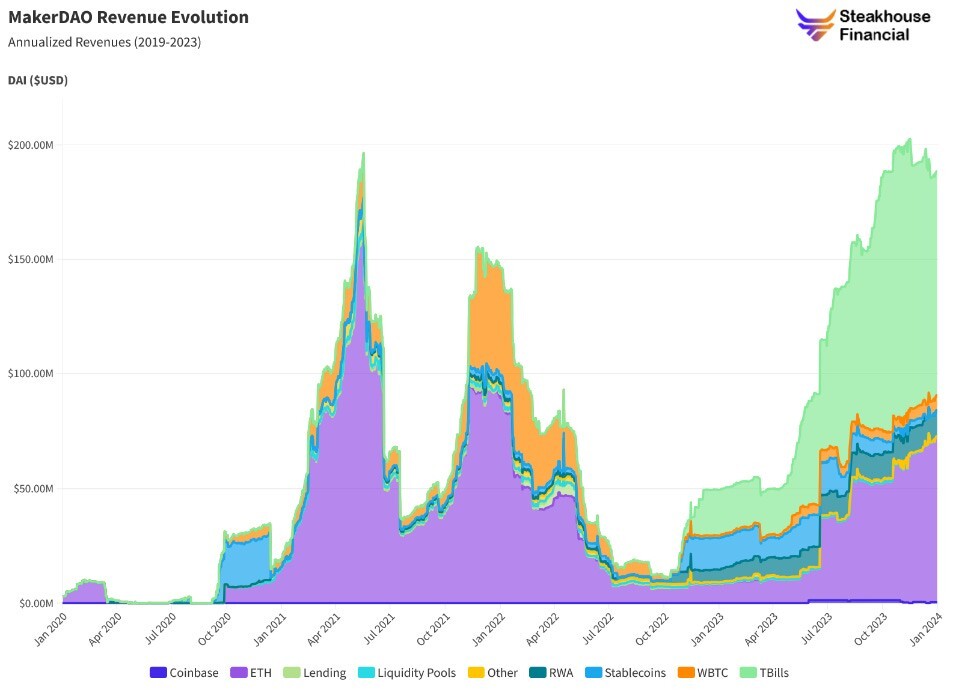

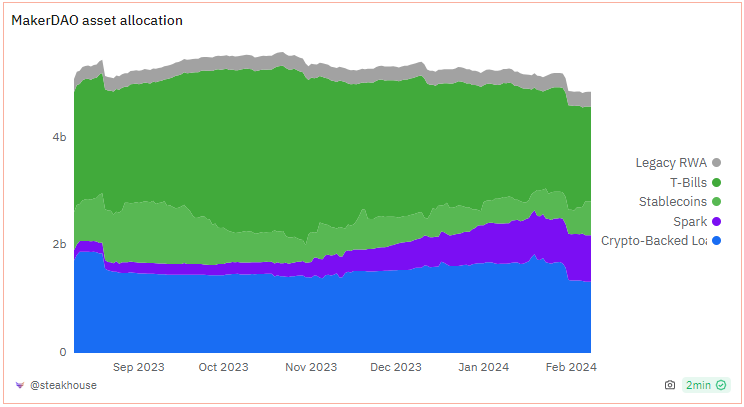

Given the novelty of the space, it is likely that revenues and expenses will become the name of the game, and dApp bottom-line profitability will be of extreme importance. All of a sudden, certain DeFi dApps become extremely attractive. Let's explore a few. One of the clearest winners in such a framework is DeFi's @MakerDAO, the $DAI stablecoin issuer. Over the years, the dApp has gathered diversified revenue sources across Real World Assets (RWA's) as well as crypto-backed yield currently annualizing $120M and trading at $2B FDV.

Source: Dune Analytics - @steakhouse

Source: Dune Analytics - @steakhouse

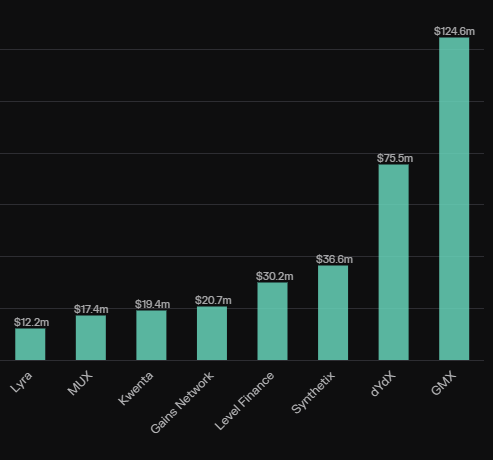

Another sector that is generally cashflow positive is Perpetual Exchanges such as GMX_IO or dYdX. Trading venues have historically been highly profitable in crypto, and the same trend has been observed in the decentralized version. $DYDX is trading at $2.2B & $GMX at $400M.

Source: tokenterminal.com

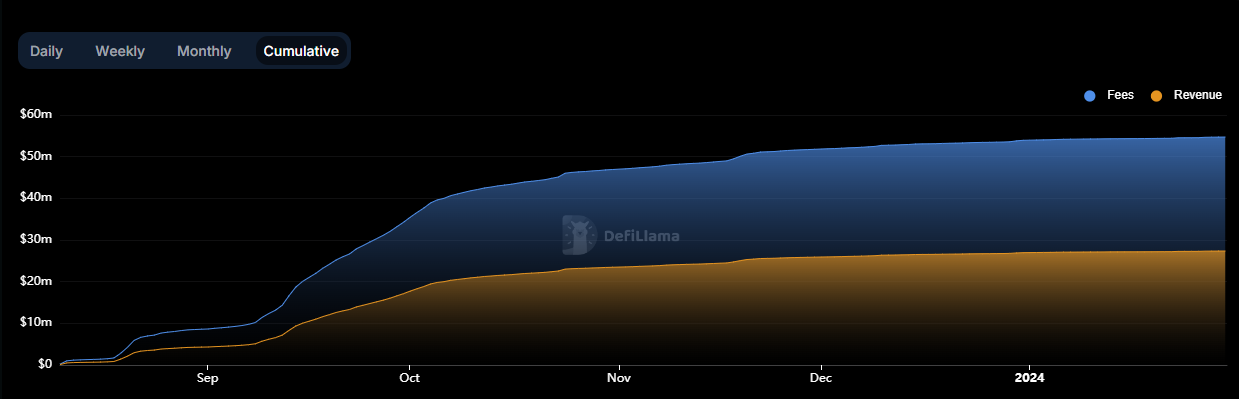

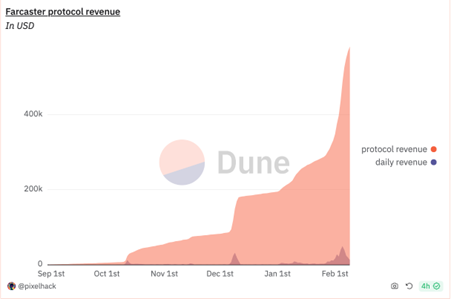

Another area that is somewhat early but has displayed signs of profitability is SocialFi. DApps such as friendtech and Farcaster have gained some traction. Despite neither having a token, one can start modeling valuation metrics for both.

Source: https://defillama.com/fees

Source: dune/pixelhack

As traditional institutions join the crypto space, the underlying profitability of each base layer and dApp will be evaluated on a P/E basis. This opens a considerable window for alpha generation as many dApps are generating considerable revenue trading at a small P/E. It's also worthy to note that dApps are making revenue however revenue sharing still presents an issue in many jurisdictions, primarily for tax reasons. In case you're interested in learning more about these valuation frameworks:

For further reading and distinguishable references to this thread include: