Why Invest When You Can Gamble?

Ever since the #BitcoinETF went live, the spotlight other than BTC, has been on... Memecoins

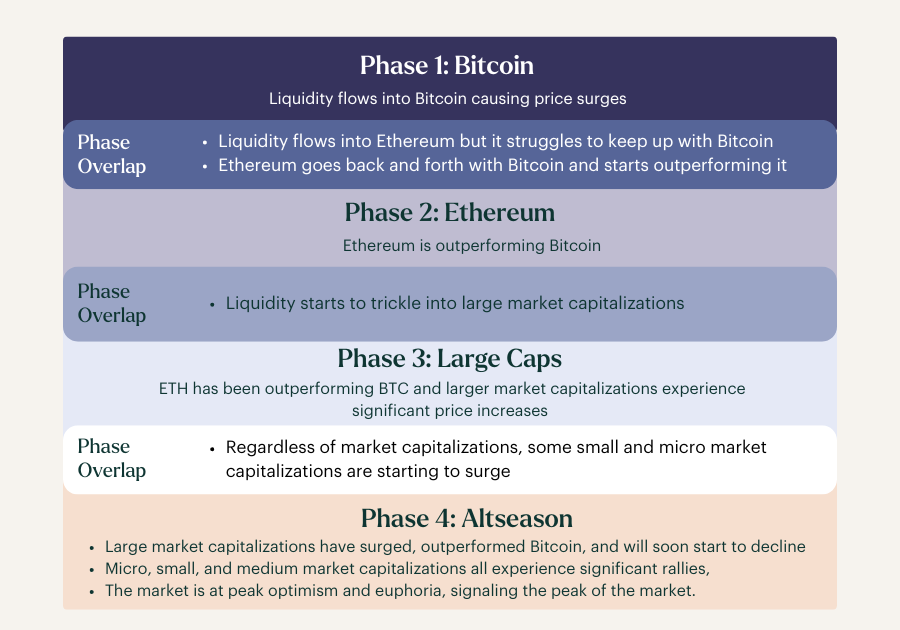

Despite the fact that it's a divisive topic, we can now look without heavy biases a few weeks after the peak mania phase. Popularized by @SecretsOfCrypto, most crypto participants have gotten used to Bitcoin leading into the bull market, with capital flowing further down the risk curve as the cycle progresses. Thus, historically, memecoins have been a phenomenon during altseason.

Path to Altseason (Source: https://twitter.com/SecretsOfCrypto)

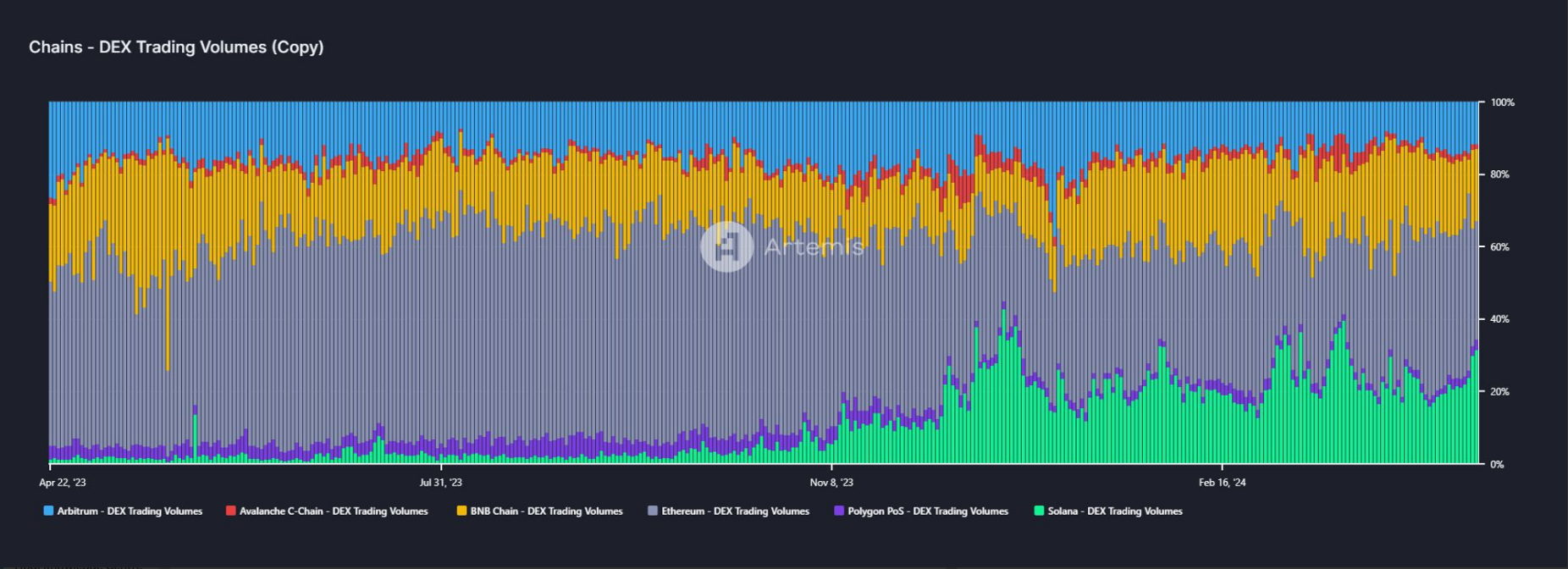

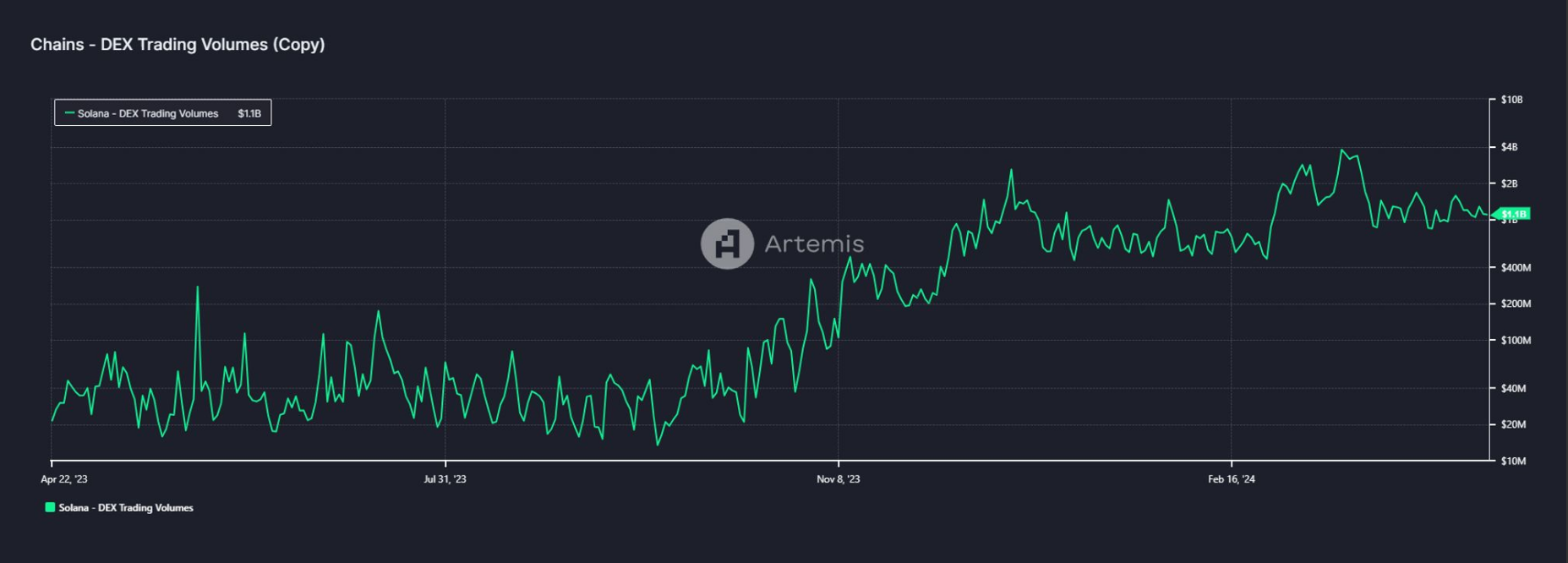

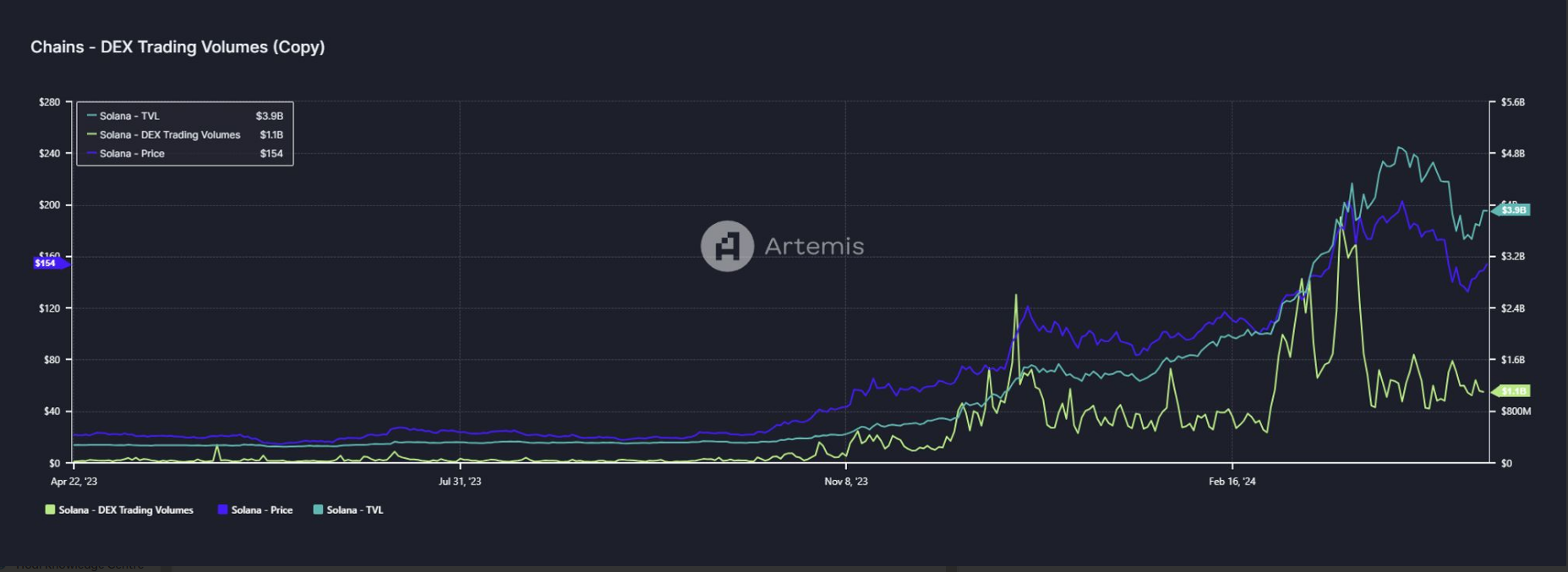

This time around, market participants decided to skip a few steps and jump straight into the fully speculative part. The L1 which lead this movement was clearly Solana, as visualized by the DEX Trading Volumes below, mostly due to its low transaction fees.

Source: https://app.artemis.xyz/

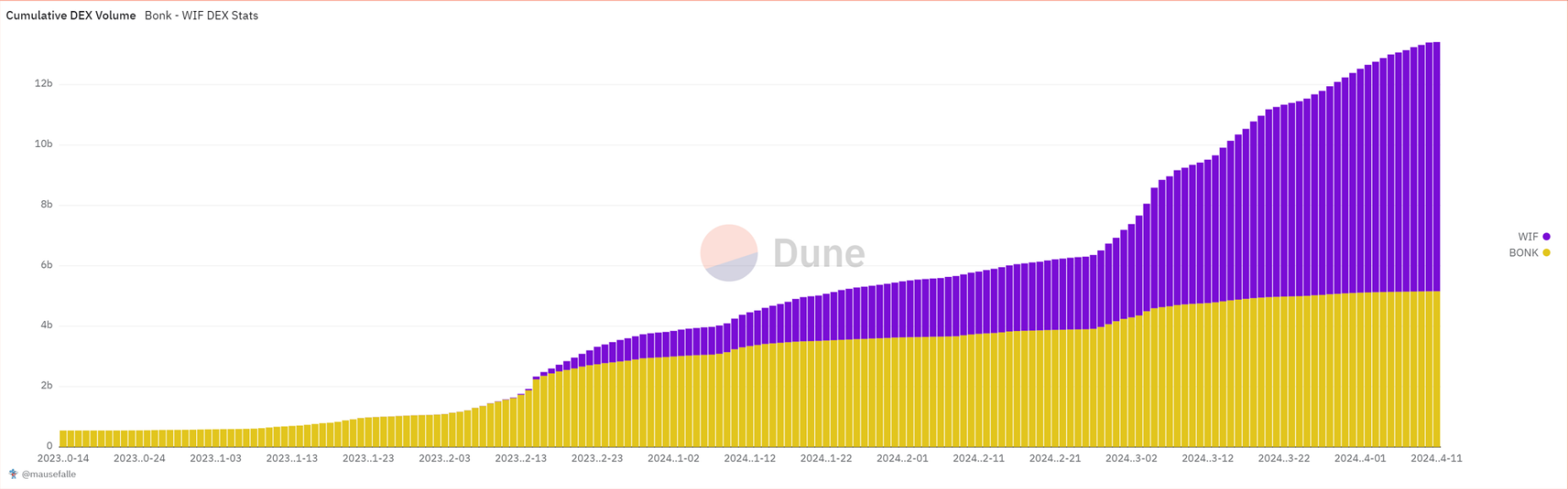

Tokens such as $BONK and later $WIF led the speculative trend, with a cumulative DEX Volume crossing $10B. Notably, this growth closely matches the increase of the price of SOL and the TVL growth on the chain, mostly as a result of the price appreciation of its base asset.

Source: https://app.artemis.xyz/

Source: https://dune.com/mausefalle

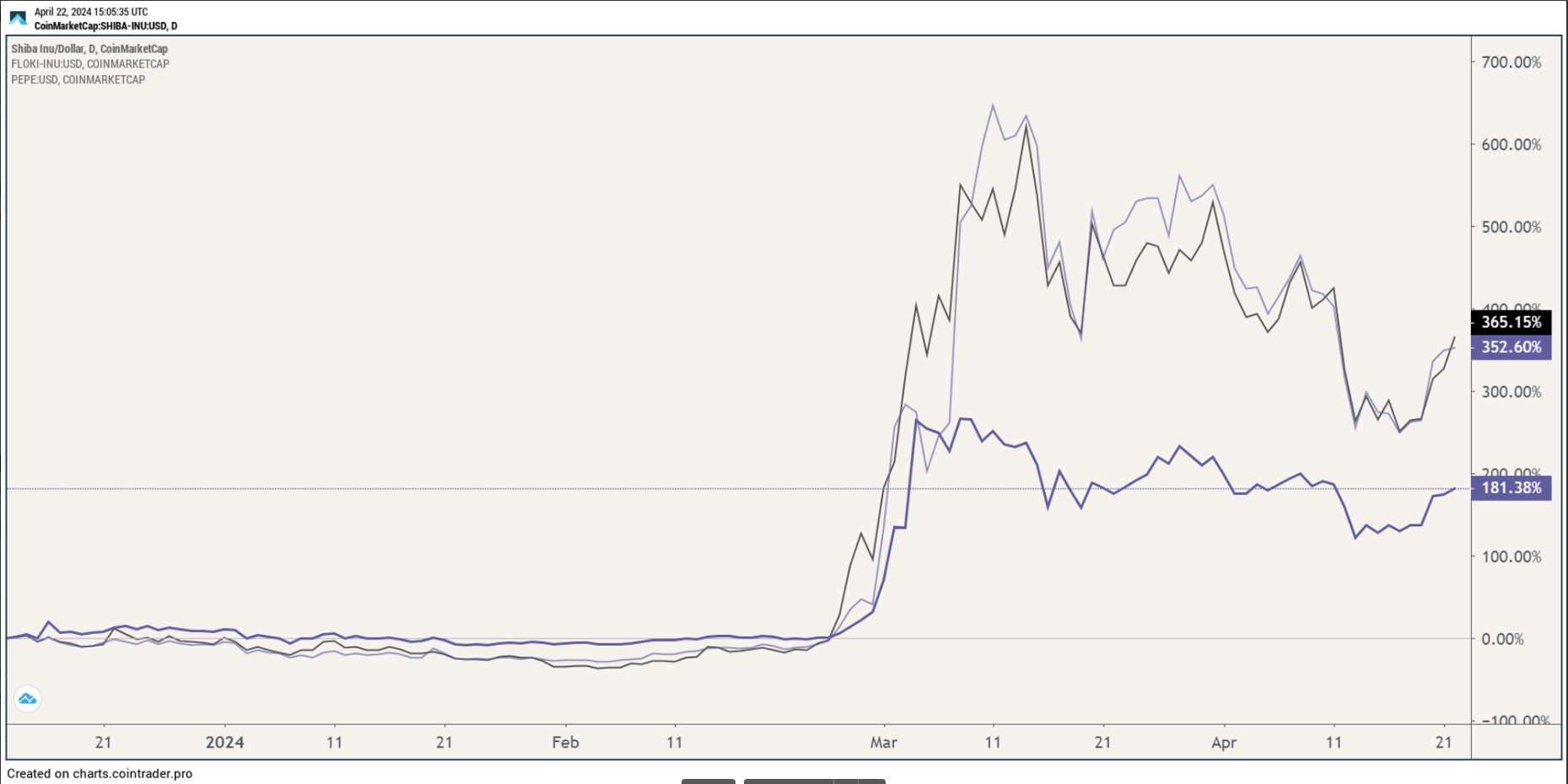

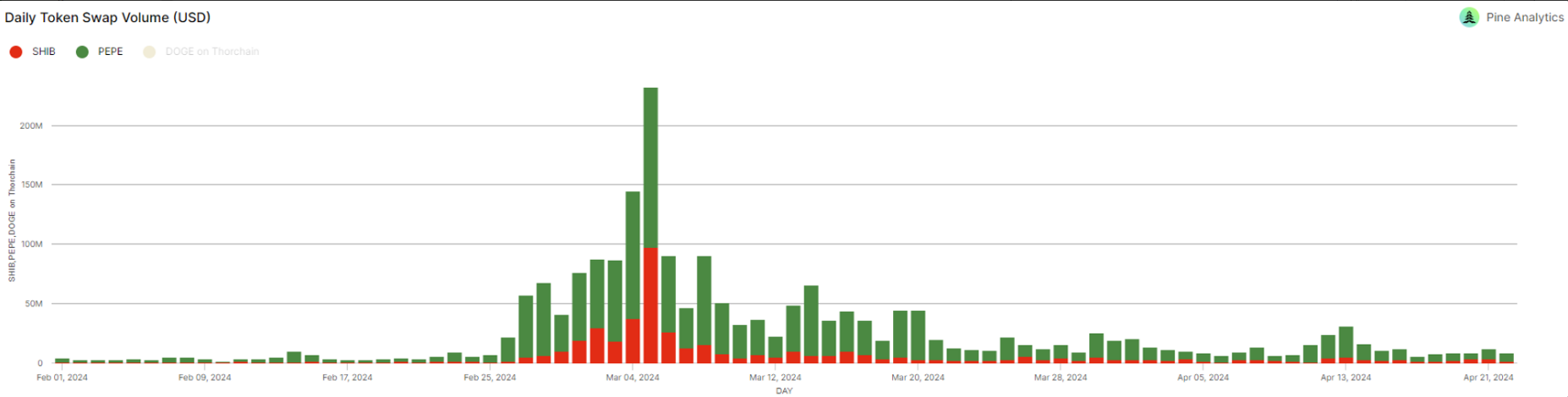

In essence, this represents the fact that Solana has moved beyond being an alternative layer 1, displaying deep on-chain liquidity to accommodate for speculative assets such as memecoins and an engaged community that will participate in such 'game'. Much of the same action was observed on Ethereum, with $SHIB, $PEPE and $FLOKI, following the overall trend, with a notable volume spike on March 5th, thus far marking the local pause of the trend.

Source: Tradingview.com

Source: Pine Analytics

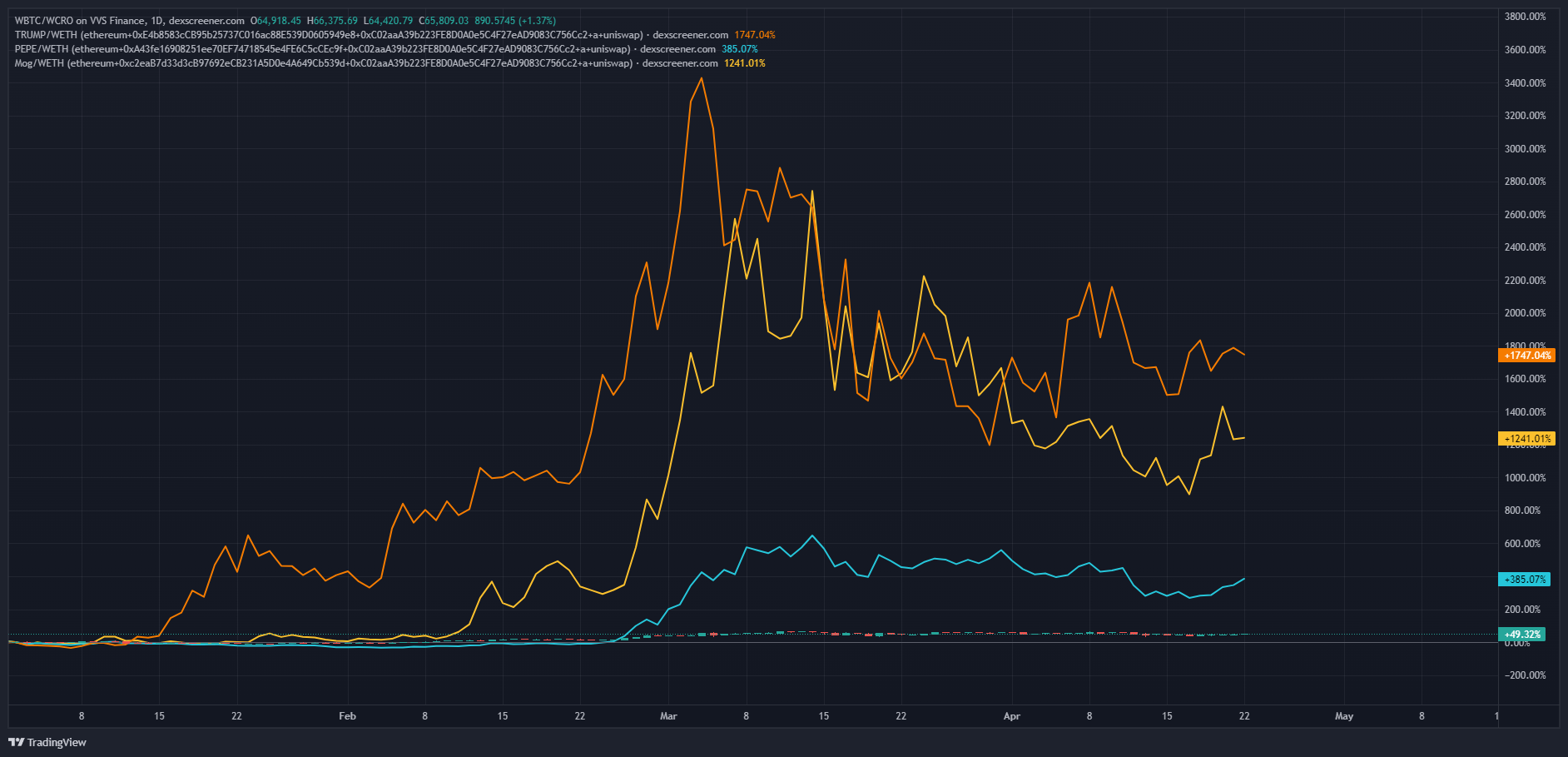

Arguably what causes the most dissonance is the relative outperformance of coins such as $TRUMP or $Mog relative to Bitcoin. After all, multiple dApps generate steady cash flow, and those do not display such price appreciation.

Source: Tradingview.com

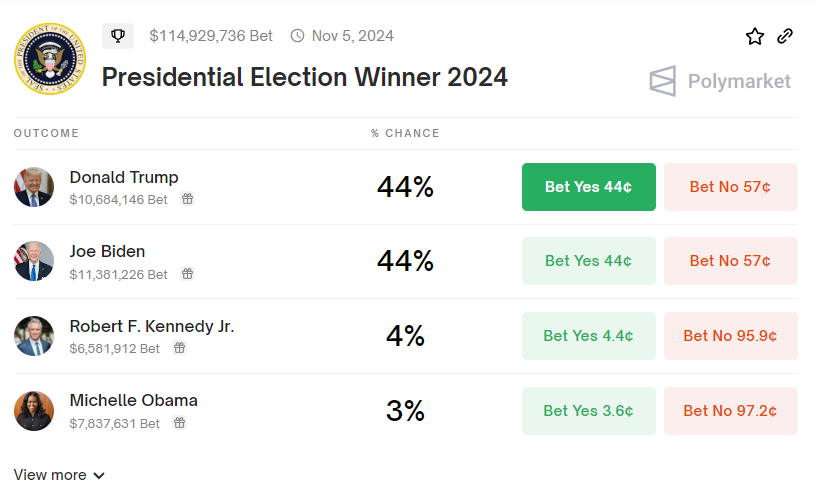

Memecoins operate in the internet's attention economy: the more ridiculous it is, the more notice it gets, and the more market participants speculate. Also, coins like $TRUMP or $BODEN are interesting US election option plays, carrying higher upside than prediction markets. On Polymarket the odds of betting in either opponent return $2.27 on each dollar, whilst it's likely that higher upside can be experienced on $TRUMP or $BODEN. Also, in case of a wrong prediction, the liquid markets allow to recoup some losses back.

Source: Polymarket

In short, it is critical to understand the attention game one is playing with memecoins. It's hard to argue against the performance of some of these assets, yet, we will never cover the thousands of memecoins that did not reach escape velocity. As Hodl Funds we do not engage in trading memecoins but since it's part of the crypto ecosystem, it is a category worthy of understanding and to keep monitoring.