ZK Series: What are Market-Neutral strategies?

- Introduction to Market-Neutral Strategies

- What is Market-Neutral?

- How Market-Neutral Strategies Work

- Example: The Cash & Carry Trade

- Benefits of Market-Neutral Strategies

- Market-Neutral vs. Delta-Neutral

- Conclusion

Key Takeaways

- Independence from market direction: Market-neutral strategies are designed to generate returns whether the overall market rises, falls, or moves sideways.

- Profit from relative value, not direction: These strategies earn returns from price differences, funding rates, or spreads – not from forecasting whether Bitcoin will go up or down.

- Lower correlation, higher Sharpe: By removing market direction from the equation, market-neutral strategies can deliver more consistent, risk-adjusted returns – the foundation of a strong Sharpe Ratio.

Introduction to Market-Neutral Strategies

Most investors are familiar with the traditional approach: buy an asset, hope it rises, and sell for a profit. But what if you could generate returns without having to predict market direction at all? That is the core idea behind market-neutral strategies. Rather than betting on whether Bitcoin or other assets go up or down, these strategies aim to profit from market dynamics such as price differences between related instruments, funding rates, and temporary mispricings.

For investors seeking stable, risk-adjusted returns in volatile markets like crypto, market-neutral strategies offer a compelling alternative to traditional directional investing.

What is Market-Neutral?

A market-neutral strategy is one that aims to generate returns independent of overall market movements. Whether the crypto market rallies 50% or crashes 50%, a well-executed market-neutral strategy should deliver consistent performance because it doesn't rely on market direction for its profits.

Think of it this way: a traditional investor is like a sailor who needs the wind to blow in the right direction. A market-neutral investor is like a sailor who has learned to harness the wind regardless of which way it blows.

The key characteristic of market-neutral strategies is their low correlation to broader market indices. When Bitcoin drops 20%, a directional long position loses 20%. A market-neutral position, by design, should be largely unaffected.

How Market-Neutral Strategies Work

Market-neutral strategies typically work by taking offsetting positions that cancel out exposure to market direction. The most common approach combines a long position (which profits when prices rise) with a short position (which profits when prices fall).

Example: The Cash & Carry Trade

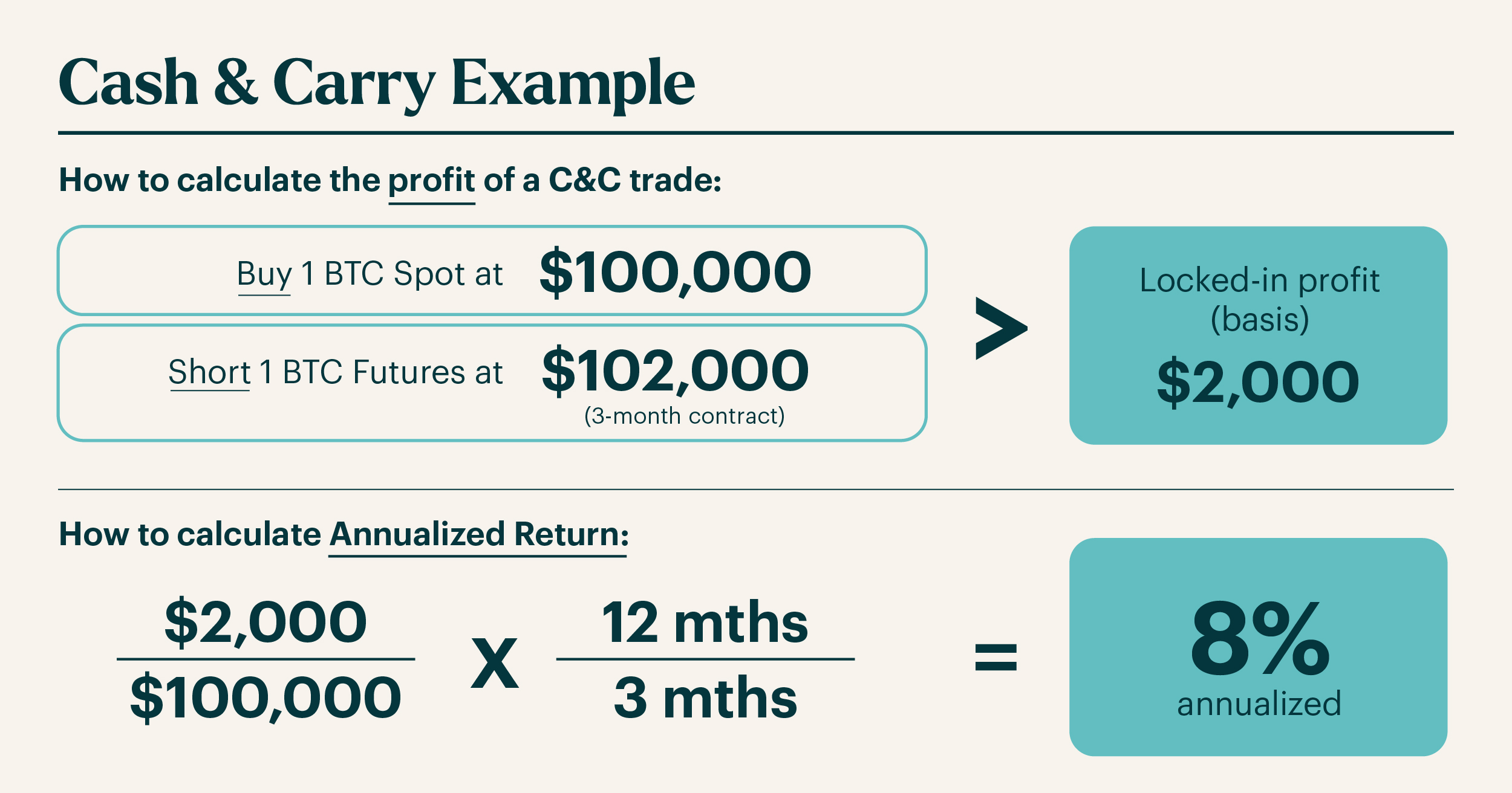

The cash & carry trade (also called a basis trade) is one of the most straightforward market-neutral strategies. It exploits the price difference between the spot market (where you buy the actual asset) and the futures market (where you agree to sell it at a future date).

How It Works

In crypto markets, futures contracts often trade at a premium to spot prices. This premium, called the basis, reflects factors like demand for leverage, funding costs, and market sentiment. By buying spot and simultaneously shorting futures, you lock in this premium as guaranteed profit.

Why It Works

At contract expiry, the futures price converges with the spot price – this is guaranteed by arbitrage mechanics. Whether BTC is at $80,000 or $120,000 at expiry doesn't matter: your long spot position and short futures position offset each other perfectly. You keep the $2,000 basis you locked in at the start.

This is the essence of market-neutral investing: capturing yield from market structure, not market direction.

Benefits of Market-Neutral Strategies

Market-neutral strategies offer several advantages, particularly in volatile markets like cryptocurrency:

- Market Independence: Returns don't depend on price direction

- Lower Volatility: Reduced portfolio swings and drawdowns

- Higher Sharpe Potential: Better risk-adjusted returns over time

- Consistent Performance: Steadier returns in all market conditions

As we discussed in Part 1 of this series, the Sharpe Ratio rewards strategies that deliver strong returns with low volatility. By removing market direction from the equation, market-neutral strategies are inherently designed to optimize this metric.

Market-Neutral vs. Delta-Neutral

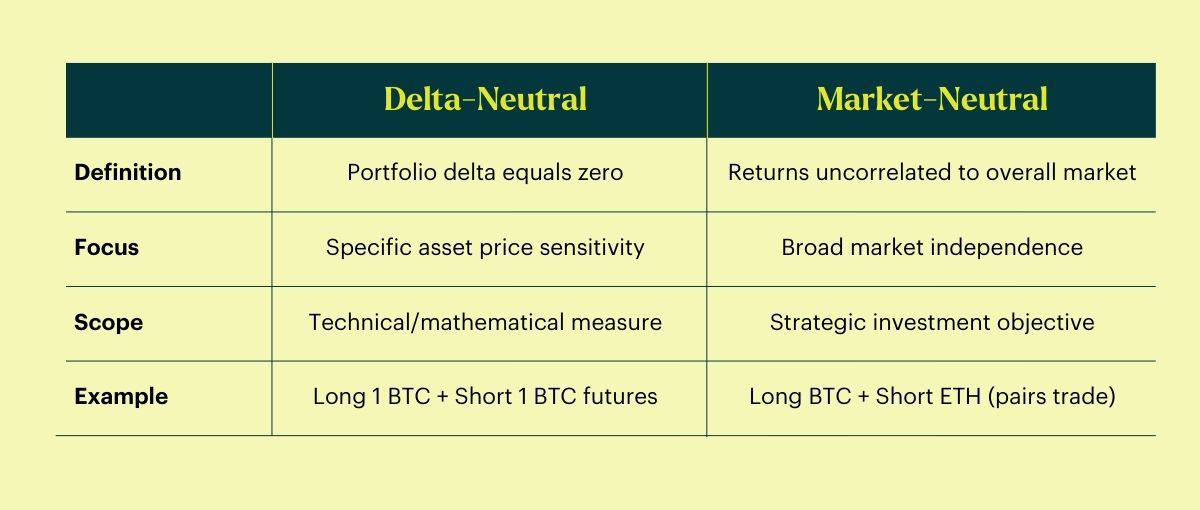

You may encounter both market-neutral and delta-neutral when researching investment strategies. While these terms are often used interchangeably, they have distinct meanings.

Delta-Neutral: A Technical Measure

Delta is a measure of how much a position's value changes when the underlying asset moves by one unit. A delta-neutral position has a total delta of zero, meaning it has no direct exposure to price movements in a specific asset. For example, if you hold 1 BTC (delta = +1) and short 1 BTC futures contract (delta = -1), your net delta is zero.

Market-Neutral: A Strategic Objective

Market-neutral is a broader concept focused on generating returns that are uncorrelated to overall market movements. A market-neutral strategy might involve positions across multiple assets, sectors, or instruments, designed so that general market trends don't affect performance.

How They Relate

Think of delta-neutral as a tool and market-neutral as a goal. Delta-neutral positioning is one technique used to achieve market neutrality, but it's not the only one. A well-constructed market-neutral strategy typically uses delta-neutral positions as building blocks to ensure overall portfolio independence from market direction.

Conclusion

Market-neutral strategies represent a sophisticated approach to investing. One that prioritizes consistency and risk management over speculative bets on market direction. By structuring positions that profit from market inefficiencies rather than price movements, investors gain access to return streams that are uncorrelated with traditional market swings.

The ZK Fund is built on these principles. Our strategies are designed to be market-neutral, targeting stable, risk-adjusted returns with a Sharpe Ratio of at least 3.0 over time. While the cash & carry example above illustrates the concept, the ZK Fund employs more advanced techniques to capture opportunities across the digital asset ecosystem and generate an annual return of 20-25% gross.

Want to learn more?

Do you want to learn more about how the ZK Fund applies market-neutral principles to generate returns? We are hosting several knowledge sessions in our office in Rotterdam. You can sign up via the button below. Not able to come to our office? Schedule a personal (online) appointment with one of our specialists or download the Key Fact Sheet.