Investment thesis: Why we invested in Maple Finance $syrup

On November 13th, Maple Finance launched a migration portal, enabling token holders to convert their $MPL tokens into $SYRUP. This strategic move unifies governance and aligns incentives across Maple’s institutional lending platform and its DeFi-native Syrup Finance platform. By consolidating the tokens, Maple streamlines decision-making and ensures that all stakeholders—lenders, borrowers, and community members—are working toward shared goals.

Maple Finance and Syrup Finance are interconnected platforms within the Maple ecosystem, designed to provide institutional and DeFi lending solutions, respectively, with a focus on Bitcoin-collateralized loans. Launched in 2021, Maple Finance is a permissioned platform tailored for institutional-grade lending. It offers products like the BTC Yield Product and the Blue Chip Secured Lending Pool, both leveraging overcollateralized BTC/ETH loans to generate reliable yield for accredited investors. This permissioned approach ensures compliance and security, making it a trusted choice for institutional clients seeking exposure to crypto lending markets.

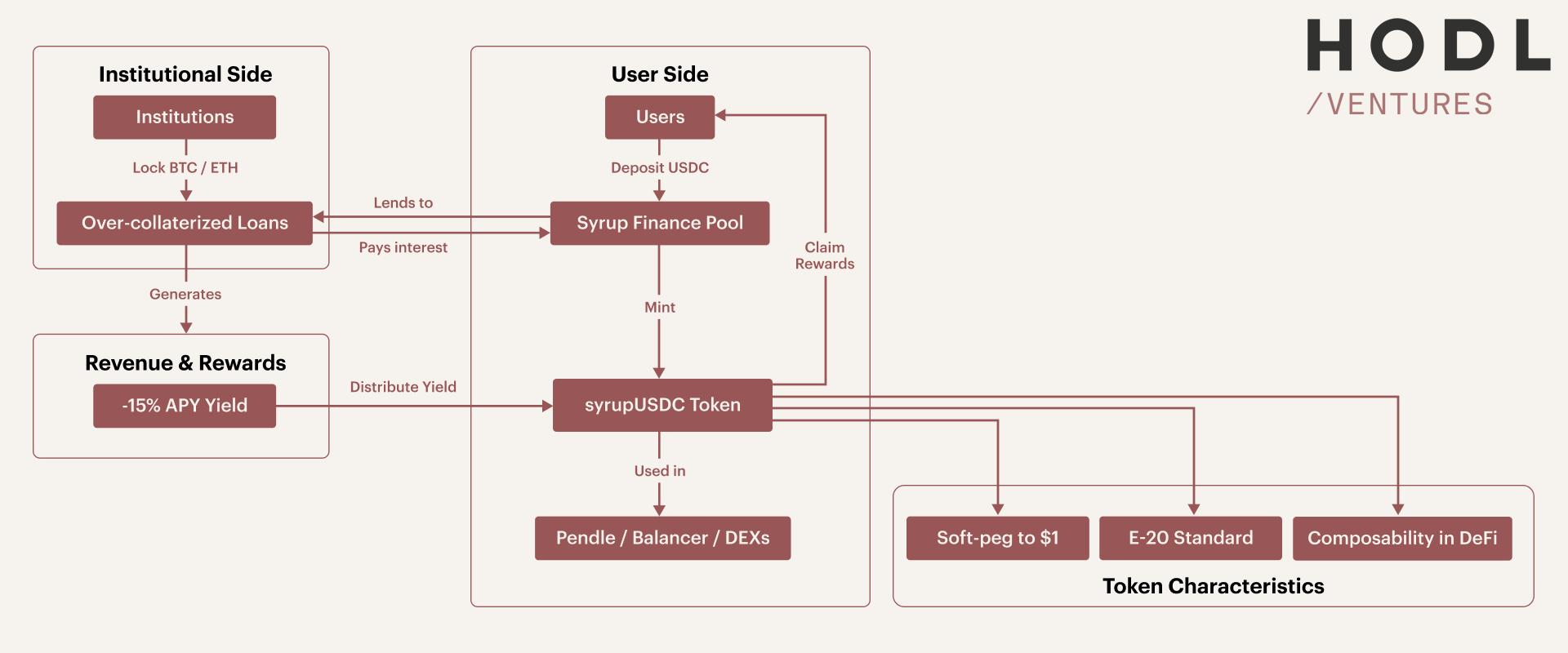

In contrast, Syrup Finance, launched in May 2024, extends Maple’s lending engine to a permissionless DeFi audience, broadening access to the ecosystem’s opportunities. Syrup Finance taps into on-chain liquidity—pools of assets provided by users across the DeFi space—to fund loans for institutional borrowers such as hedge funds and crypto firms. This innovative approach channels capital from everyday DeFi participants to meet institutional demand, creating a symbiotic bridge between decentralized and institutional finance. For regular users, Syrup offers a compelling opportunity: anyone with a crypto wallet can deposit stablecoins like USDC into the High Yield Secured pool to earn up to 15% APY, paid out via SyrupUSD tokens. These high, reliable yields are powered by the same BTC/ETH-collateralized loans to institutions that underpin Maple’s offerings, making institutional-grade returns accessible to retail DeFi users without accreditation barriers.

The relationship between Maple Finance and Syrup Finance is further strengthened by their shared use of the SYRUP token. This token serves dual purposes:

- Governance: SYRUP holders can participate in decision-making across both the institutional and DeFi sides of the ecosystem, fostering a unified community.

- Fee-Sharing: Holders benefit from the revenue generated by both platforms, aligning economic incentives across the ecosystem.

This interconnected model has proven highly effective, driving a combined total value locked (TVL) of $1.5 billion as of May 2025. Maple Finance provides the robust, permissioned infrastructure for institutions, while Syrup Finance amplifies the ecosystem’s reach into the DeFi space by leveraging on-chain liquidity and offering accessible, high-yield opportunities to regular users. Together, they create a powerful synergy that bridges the strengths of both worlds.

Syrup Finance, originally an offshoot of Maple, is one of our strongest investment convictions for the years ahead. Its ability to bridge institutional finance with DeFi—by sourcing liquidity from DeFi to serve institutions and delivering institutional-grade yields to retail users—offers a unique value proposition. The token migration from $MPL to $SYRUP marks a pivotal step in this evolution, solidifying the ecosystem’s foundation for future growth.

In the sections ahead, we’ll unpack our full investment thesis on Syrup, diving deeper into its market potential, competitive edge, and the strategic importance of this unified ecosystem.

Our thesis leans on several key points which we will discuss in order of importance:

1. Fits in the RWA vertical

Real-world assets (RWA) represent the on-chain tokenization of traditional financial instruments, such as U.S. Treasury bills and debt securities, enabling fractional ownership, enhanced liquidity, and DeFi composability. At Hodl Ventures, we view RWA as one of the most promising verticals in decentralized finance due to the vast potential of traditional assets to benefit from DeFi’s programmability. Maple Finance and its DeFi-native arm, Syrup Finance, exemplify this opportunity by pooling USDC from retail depositors to fund institutional borrowers, creating on-chain credit backed by overcollateralized loans—typically secured by liquid assets like Bitcoin and Ethereum.

Over the past year, institutional adoption of digital assets has surged, driven by regulatory advancements, particularly the approval of crypto ETFs in the U.S. This favourable environment has directly benefited Maple and Syrup, enabling them to onboard a growing number of institutional borrowers. Maple’s ability to bridge traditional finance with DeFi has attracted significant institutional backing. Notably, Bitwise Asset Management, managing over $12 billion in assets, partnered with Maple in March 2025 to leverage its Bitcoin-backed lending product, marking a milestone in institutional DeFi adoption (source). Similarly, Grayscale included Maple Finance among its top 20 crypto investments for Q2 2025, signaling strong confidence in its growth potential (source).

2. Utility: Reliable High Yield and DeFi Composability

The product suites composing the Maple/Syrup ecosystem deliver exceptional yields, resilient even in bearish markets like 2024, positioning them as a cornerstone of on-chain credit. Maple’s permissioned platform offers institutional investors products like the yield-bearing Bitcoin product, yielding 5.6% APY with over 1,600 BTC staked (source). Syrup extends these opportuntities to regular DeFi users, allowing anyone to deposit USDC into pools and return up to 15% APY via syrupUSD tokens. These yields, backed by overcollateralized BTC/ETH loans to vetted institutional borrowers, remained stable last year due to Maple’s rigorous underwriting and conservative collateral ratios, shielding returns from market volatility.

SyrupUSD’s composability amplifies its appeal, with Spark’s $50 million allocation in April 2025 integrating it into the USDS stablecoin to enhance staker yields (source). Similarly, Pendle’s October 2024 integration enables users to tokenize SyrupUSD yields into Principal and Yield Tokens, driving Syrup’s TVL to $300 million by fostering advanced DeFi strategies (source).

3. Mispricing Toward Ondo

As of writing, Ondo Finance is perceived as the market leader in the RWA sub-sector. In our opinion, Maple Finance is an asymetric bet and significantly undervalued compared to Ondo Finance. To put it in numbers, Ondo boasts $1.2bln TVL (source) versus Maple’s $1.4bln (source) and has a fully diluted valuation of $8.9bln (source) versus Maple’s $377mln FDV (source). A difference of 23x. Additionally, Maple’s comprehensive product suite and DeFi access surpasses or at least matches Ondo’s tokenized treasury offerings in utility and yield reliability. While Ondo benefits from high-profile partnerships like BlackRock’s Buidl Fund, Maple’s partnerships with Bitwise and Spark demonstrate comparable institutional traction.

Overall, this gap is too big to justify and suggests Maple is mispriced and undervalued to say the least. Another small positive characteristic of Maple is that most of the tokens are already in circulation, unlike those of Ondo. This means that there is no future inflation or dilution which is another contributing factor for our investment.

We were well-positioned ahead of the token migration in November, and our conviction in Maple has only grown stronger since. The team has consistently demonstrated sharp intuition in navigating both the crypto and tradfi sector. They’ve not only continued to ship meaningful, high-impact products, but have also executed an impressive recovery from the bad debt challenges they faced in 2021 — a testament to both resilience and vision.

We are long utility and RWA. Maple is the perfect convergence of the two.