Diversifying Beyond Bitcoin - Adding Digital Assets to a 60/40 Portfolio

- What is a traditional 60/40 portfolio?

- The benefits of digital assets in a portfolio

- Bitcoin vs Altcoins

- Adding digital assets to a traditional 60/40 portfolio

- What we think a modern portfolio should look like

Over a few years, digital assets have grown from a niche or even a speculative investment to a legitimate addition to an investment portfolio. With the sector maturing, new questions arise. How much of my portfolio should I allocate to digital assets? Should I invest in Bitcoin or are there other assets I should invest in?

In this article, we will take a look at the benefits of digital assets in a portfolio and showcase that a small allocation can already create significant additional value.

What is a traditional 60/40 portfolio?

If you are an investor with a moderate risk appetite, the likelihood that you have heard of or hold a 60/40 portfolio is quite high. To simplify, this portfolio consists of 60% stocks and 40% bonds, which can be further categorized into higher- or lower-risk stocks and bonds, but for now, we’ll keep it simple. This portfolio distribution is considered relatively safe, as bonds and stocks typically have a low correlation.

Usually, as stocks increase in value during risk-on periods, bonds lag, and vice versa. As a result, the traditional 60/40 portfolio has historically provided low volatility and consistent, healthy returns over long periods.

However, in an ever-changing world, discussions are emerging about whether this traditional portfolio requires further diversification. These discussions include areas such as generative artificial intelligence, renewable energy, and, more recently, digital assets.

The benefits of digital assets in a portfolio

It’s no surprise that digital assets have become increasingly popular for diversification, as they possess highly desirable traits.

Independent and Decentralized

Firstly, the majority of digital assets operate independently of traditional markets in a decentralized manner. Over long periods, the market has shown a low correlation with traditional assets, allowing investors to achieve optimal risk-adjusted returns. Additionally, as they operate outside traditional markets and government control, they offer a hedge against government overreach and monetary debasement.

Furthermore, their decentralized nature means the market is open 24/7, providing investors with a highly liquid environment where they can respond to macroeconomic events immediately.

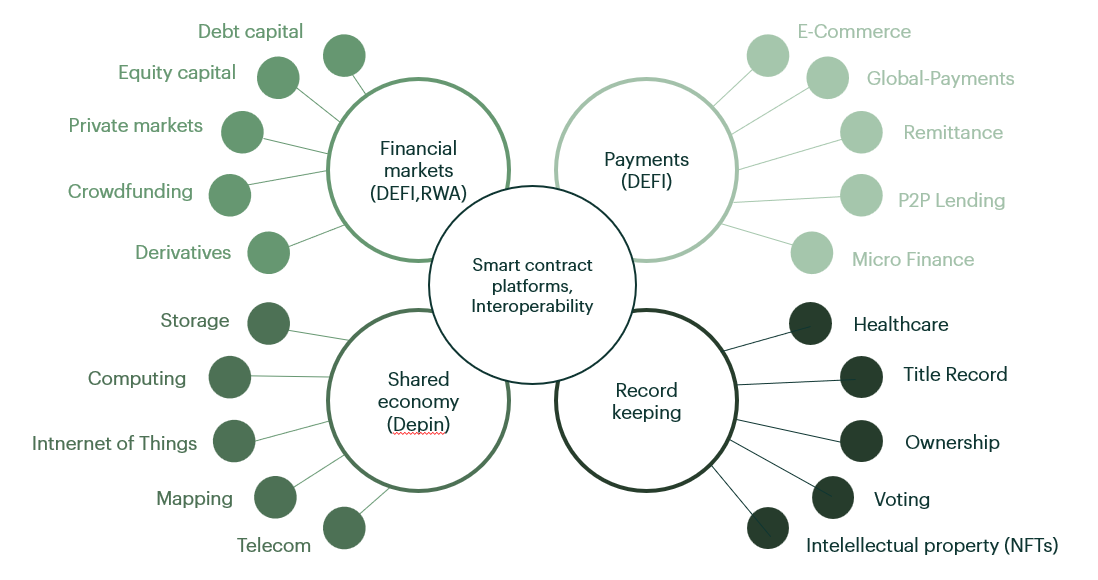

Access to innovative technologies

Secondly, due to its digital and open-source nature, the digital assets industry experiences a tremendous pace of innovation. It’s not uncommon for developers to build their products on top of other projects, and because the code is open-source, developers can leverage different technologies across various projects. This contrasts with traditional digital products, where the code is usually gatekept.

Furthermore, the digital assets market is gradually integrating with various sectors, such as traditional finance through tokenization, supply chain management through transparency and immutability, and much more. As a result, the market observes widespread innovation across its industry.

Future adoption and potential use

Lastly, the digital assets space is still expanding at a tremendous pace. With over 500 million users worldwide, market observers expect this number to grow to 1 billion by 2030. Beyond individual users, an increasing number of businesses are experimenting with the market. Additionally, due to ongoing innovation, the potential use cases continue to grow, making it difficult to predict where the market will eventually settle. These factors offer investors a unique opportunity to diversify their portfolios with digital assets.

Bitcoin vs Altcoins

That digital assets provide a unique diversification opportunity has become clear but many investors struggle with the choice between investing in Bitcoin or altcoins, which is understandable as both have their pros and cons.

Bitcoin

The pros of Bitcoin are clear. It is the first decentralized digital asset developed and serves as the industry’s flagship. Over the years, it has evolved from its initial use case as decentralized cash to a store of value, often compared to digital gold. This comparison stems from Bitcoin's scarce nature, as only 21 million will ever exist, with nearly 20 million already in circulation. This scarcity makes Bitcoin particularly appealing, as increasing demand coupled with a fixed supply drives its value higher.

Furthermore, as the industry’s flagship, Bitcoin has experienced significant adoption, exemplified by its historic achievement of becoming the first digital asset to secure the "holy grail" of investing: spot ETFs. Lastly, the digital assets market is heavily influenced by Bitcoin's price action—when Bitcoin rises, the market generally follows, and when it falls, the market tends to decline as well.

Altcoins

Altcoin is a term used to describe all digital assets except Bitcoin. These altcoins are characterized by smaller market capitalizations; Ethereum, the largest altcoin, currently holds only 25% of Bitcoin’s market capitalization. Due to their smaller market caps, altcoins are known for heightened volatility, as less capital is needed to influence their prices. However, beyond their price action, altcoins are at the forefront of market innovation.

While Bitcoin has seen minimal innovation and operates on relatively old technology, new altcoins incorporate cutting-edge advancements, enabling significant achievements. For instance, the Layer 1 blockchain SUI can execute over 297,000 transactions per second (TPS), compared to Bitcoin’s 7 TPS. Other projects, like Maple Finance and Clearpool, focus on tokenizing financial instruments such as credit and U.S. Treasuries. Whereas Bitcoin is often viewed as an investment for its store-of-value properties or as a hedge against monetary debasement, altcoins are seen as investments driven by their technological advancements and innovations in the market.

In our view, investors should hold a diversified portfolio of digital assets. Solely investing in Bitcoin means missing out on the immense value being created across the industry.

Adding digital assets to a traditional 60/40 portfolio

At Hodl, we provide investors with two strategies to incorporate digital assets into their portfolios: Actively Managed and Algorithmic Trading. In the Actively Managed strategy, a team of experienced analysts manages a portfolio of 20 to 30 digital assets across high-potential sectors such as Artificial Intelligence and Real-World Assets.

With the Algorithmic Trading strategy, our proprietary trading platform and bots leverage the daily volatility of the digital assets market to generate additional assets.

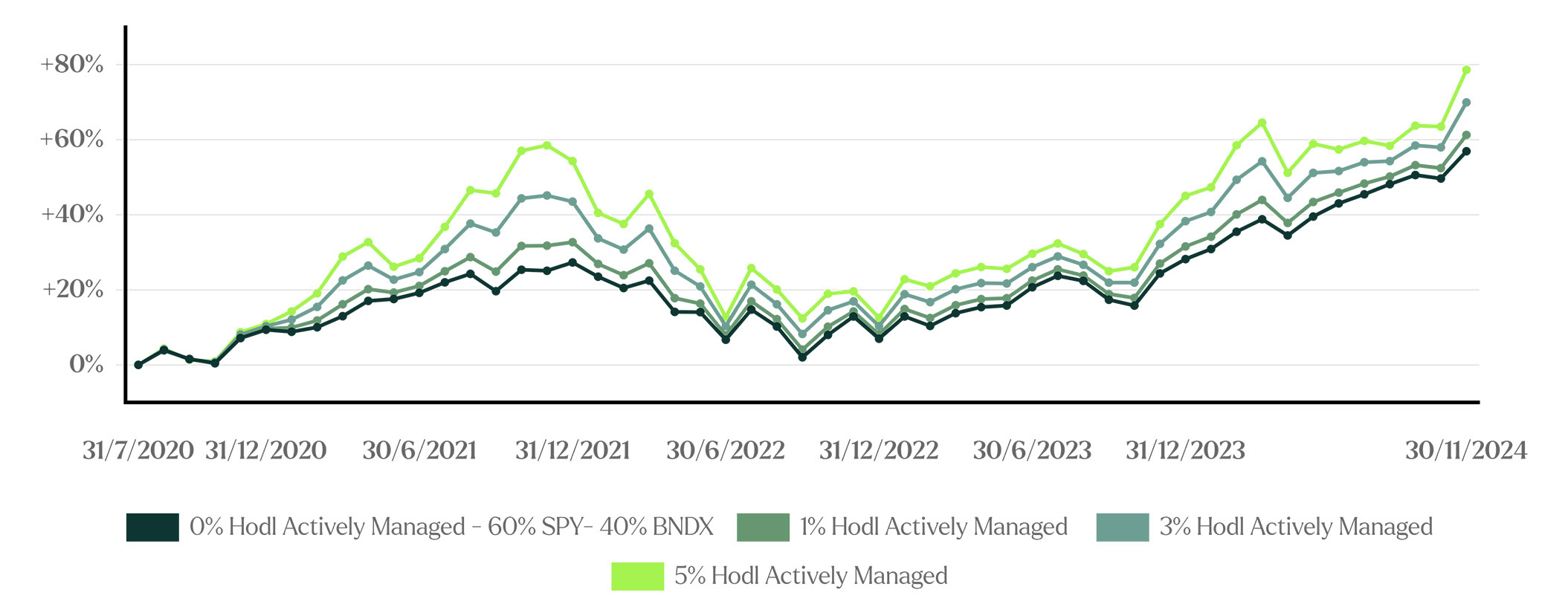

In the paragraphs below, we illustrate how these strategies would have impacted a traditional 60/40 portfolio by adding allocations of 1%, 3%, and 5%.

For this calculation, we used the adjusted closing prices (including dividends) of the SPDR S&P 500 ETF Trust (SPY) and the Vanguard Total International Bond Index Fund ETF (BNDX). The portfolio has a start balance of $10,000,000

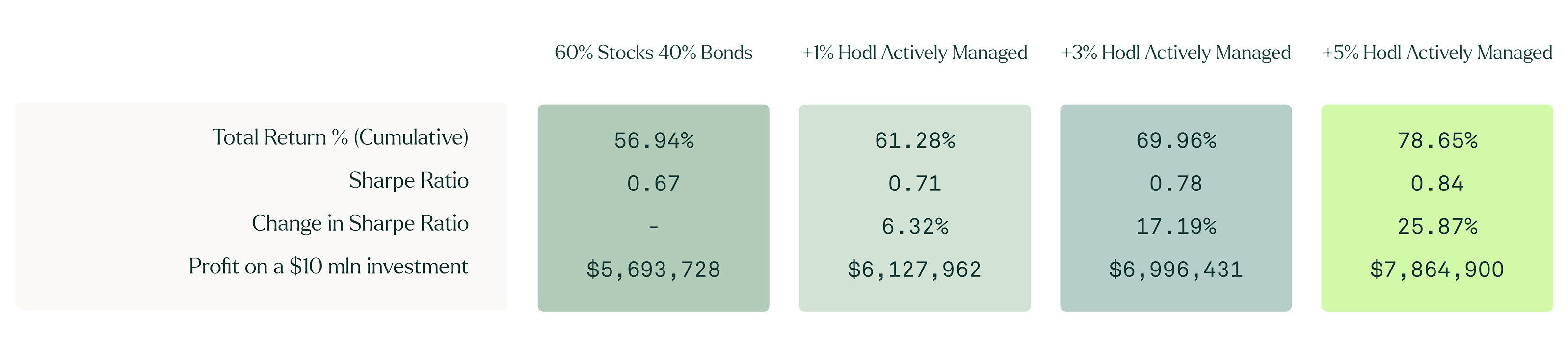

Actively Managed strategy

0% Hodl Funds allocation

In the base scenario, during the timeframe from July 31, 2020, to November 30, 2024, the traditional 60/40 portfolio generated a return of 56.94%, and a total return of $5,693,728 on a $10,000,000 portfolio. Additionally, the Sharpe ratio, a mathematical formula which we will simplify to reward earned divided by the risk taken, for the base scenario is 0.67, which is an undesirable ratio as it indicates that the reward earned was lower than the risk taken. A Sharpe ratio above 1 indicates that the reward generated was higher than the risk taken, above 1 and between 2 is good, and above 2 is excellent.

1% Hodl Funds allocation

When adding 1% of the Hodl Actively Managed strategy, the portfolio generates a total return of 61.28%, worth $6,127,962, while achieving a Sharpe ratio of 0.71. In monetary terms, adding 1% of Actively Managed generates an additional $434,234.

3% Hodl Funds allocation

When adding 3% of the Hodl Actively Managed strategy, the portfolio generates a total return of 69.96%, worth $6,996,431 while achieving a Sharpe ratio of 0.78. In monetary terms, adding 3% of Actively Managed generates an additional $868,469.

5% Hodl Funds allocation

When adding 5% of the Hodl Actively Managed strategy, the portfolio generates a total return of 78.65%, worth $7,864,900 while achieving a Sharpe ratio of 0.84. In monetary terms, adding 5% of Actively Managed generates an additional $868,469.

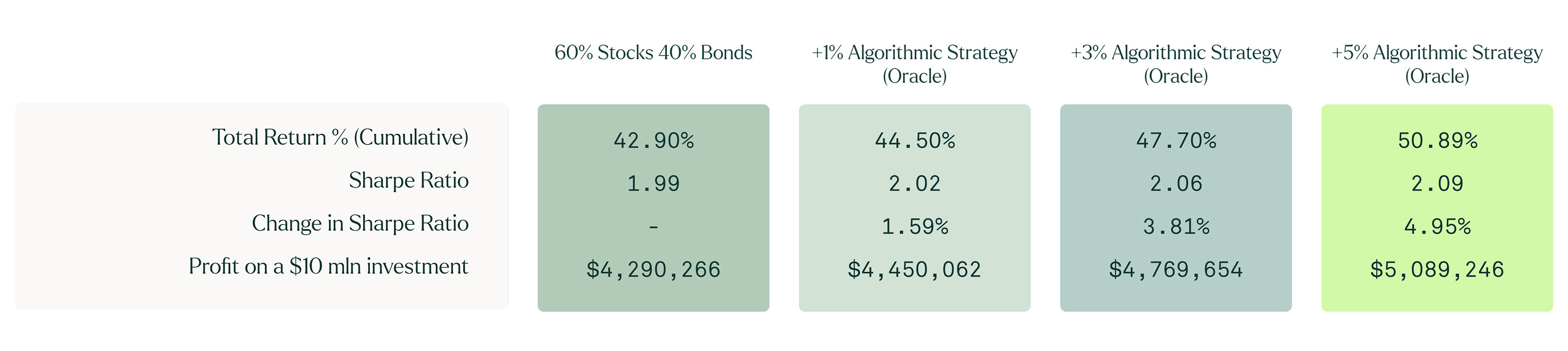

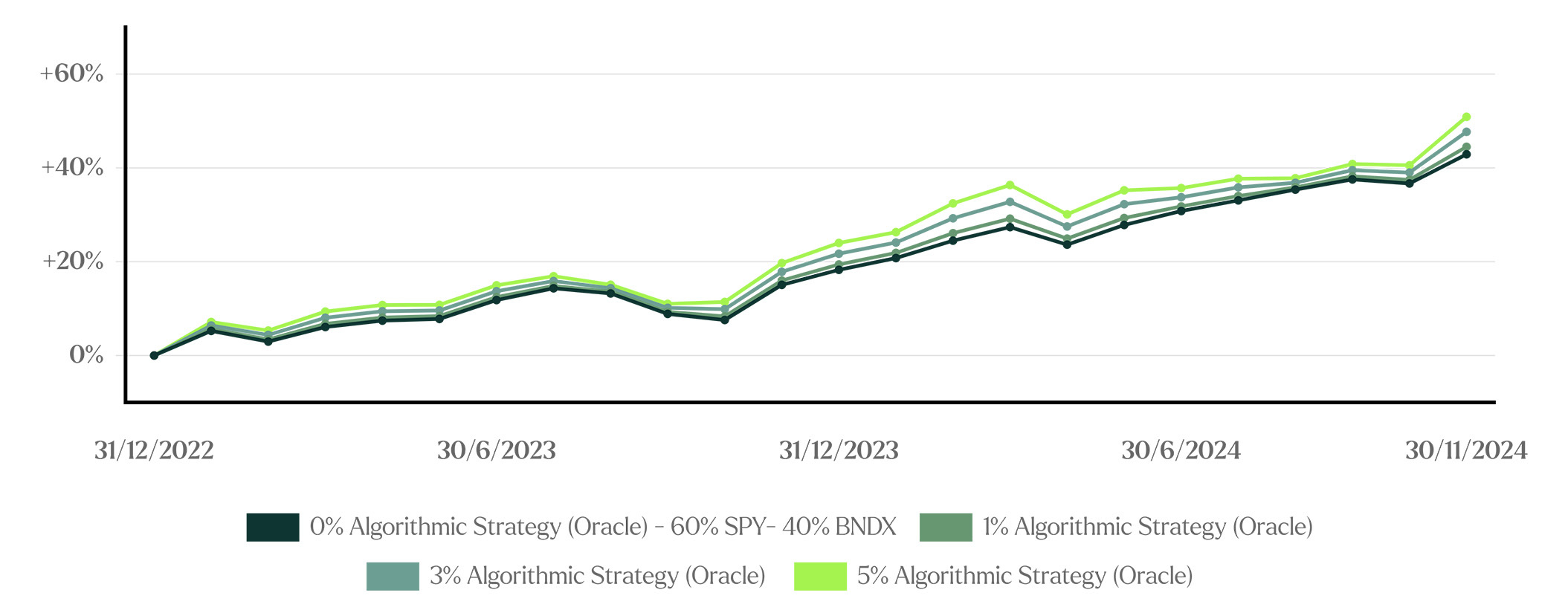

Algorithmic Trading strategy

0% Hodl Funds allocation

In the base scenario, during the timeframe from December 31st, 2022, to November 30, 2024, the traditional 60/40 portfolio generated a return of 42.90%, achieving a Sharpe ratio of 1.99 and a total return of $4,290,266 on a $10,000,000 portfolio.

1% Hodl Funds allocation

When adding 1% of the Hodl Algorithmic Trading strategy, the portfolio generates a total return of 44.50%, worth $4,450,062, while achieving a Sharpe ratio of 2.02. In monetary terms, adding 1% of Algorithmic Trading generates an additional $159,796.

3% Hodl Funds allocation

When adding 3% of the Hodl Algorithmic Trading strategy, the portfolio generates a total return of 47.70%, worth $4,769,654, while achieving a Sharpe ratio of 2.06. In monetary terms, adding 3% of Algorithmic Trading generates an additional $319,592.

5% Hodl Funds allocation

When adding 5% of the Hodl Algorithmic Trading strategy, the portfolio generates a total return of 50.89%, worth $5,089,246, while achieving a Sharpe ratio of 2.09. In monetary terms, adding 5% of Algorithmic Trading generates an additional $319,592.

What we think a modern portfolio should look like

As always, it’s crucial to consider your own risk tolerance and investment horizon and consult a financial advisor before changing your portfolio. Digital assets remain an emerging market with high levels of volatility, so a high asset allocation is not suitable for most investors.

In our view, a modern portfolio should include a modest allocation of 1% to 5% of digital assets. This allocation allows investors to leverage the potential of the emerging market while maintaining balance in their portfolio despite the volatility.

As demonstrated in the previous simulations, adding digital assets can enhance a traditional portfolio's total returns and Sharpe ratio. Therefore, we believe a small allocation of 1% to 5% is a step in the right direction to optimize your portfolio.

If you’re interested in exploring the potential of adding digital assets to your portfolio, schedule an appointment with one of our specialists using the link below.