Ethereum spot ETFs: Where do we stand?

- What is Ethereum?

- Why an Ethereum ETF?

- What is the status after a month of trading?

- The future of the Ethereum ETF market

The first Ether spot ETFs have now been live for a month, providing a great opportunity to reflect on the progress of the investment vehicle. Have expectations been met?

What is Ethereum?

While many digital asset companies have left the battleground again over the years, Ethereum has structurally occupied the top 3 in terms of market size since 2016. It owes this to the new functionality it introduced to the market called smart contracts. This allows rules to be executed using an “if/then” method in addition to normal transactions for the first time. This allows various processes to be automated, eliminating the need for a “middleman. For example, consider a scenario in which a token on the blockchain represents ownership of a house.

When the house is purchased, the smart contract checks that the full amount has been paid, and if correct, ownership is automatically transferred, without the need for a notary. This is transparently recorded on the blockchain so that all parties have insight into the transaction.

Over the years, Ethereum has experienced strong growth but has also slowly seen increased competition from other smart contract platforms. Nevertheless, it is still the second largest blockchain network after Bitcoin and most of its capital is also on Ethereum. The biggest development it has experienced recently is the switch from Proof-of-Work to Proof-of-Stake, eliminating the network's reliance on massive computing power and energy consumption.

Why an Ethereum ETF?

While Ethereum has been tradable on (decentralized) exchanges for many years, these usually fall outside the framework in which the traditional investor is willing and allowed to invest. Thus, professional and institutional investors are often limited to investment instruments recognized by official bodies, such as in this case the U.S. Securities and Exchange Commission (SEC).

The explosive growth the digital assets market has experienced over the past 10 years has made it an interesting product for many investors to add to their portfolios. This was then reflected in the success of Bitcoin ETFs, which broke record after record in the first few months after launch. Reason enough for ETF providers to step up and expand their offerings with an Ether spot ETF. Although VanEck's first application was filed in 2021, the moment of going live was finally on July 23, 2024

What is the status after a month of trading?

After more than a month of trading, there are several interesting developments regarding the Ethereum ETF. The most notable trend is the similarity to the launch of the Bitcoin ETF earlier this year. This similarity is particularly driven by the fact that Ethereum and Bitcoin were previously available through an investment product from U.S. asset manager Grayscale.

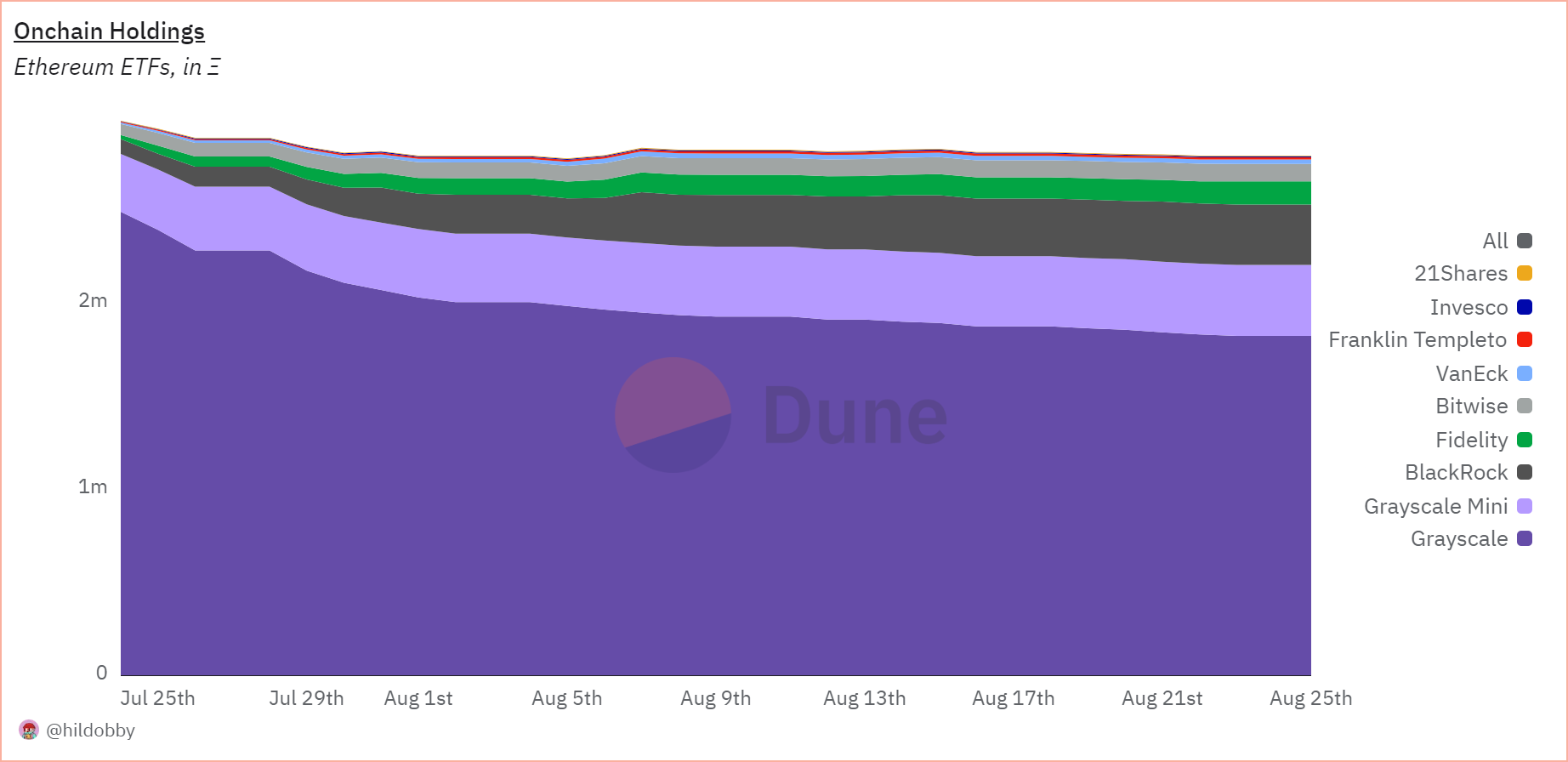

For example, the Grayscale Ethereum Trust saw its first inflow of capital as early as 2018, after which it peaked at total assets under management of over 3,176,757 Ethereum in January 2021. However, due to its closed-end structure, investors couldn't exit for a long time. This changed with the advent of the ETF. Consequently, in the first month, this resulted in an outflow of over 660,000 Ethereum with a market value of nearly $2.5 billion. However, there is one big winner among ETF providers, namely BlackRock, which has now acquired more than $1 billion in assets under management with its iShares Ethereum Trust ETF.

Source: https://dune.com/hildobby/eth-etfs

In percentage terms, the outflow from Grayscale's Ethereum is significantly higher, at 30.7% compared to 25.4% after 25 trading days. This could be due to the higher cost of this instrument compared to that of its competitors. In addition, investors' capital was blocked for a long time or it was tax disadvantageous to sell. With the launch of the ETF, this is now possible. This bears similarities to the launch of Bitcoin's ETF, where the market also initially saw a large outflow. However, Ethereum's ETF thus has even higher outflows.

We do see a big difference when it comes to inflow into the other ETFs. Whereas with Bitcoin there seemed to be a large group of investors ready to diversify their portfolios, for the Ethereum ETF this group seems considerably smaller. While the Bitcoin ETFs experienced a total net inflow of over +$4.8 billion in the first month, the Ethereum ETFs came out to a net outflow of nearly $520 million.

Outflows from the Ether ETF market and deteriorating macroeconomic conditions caused Ethereum's price to trend downward. The price fell from about $3200 to about $2700, a drop of about 15% within one month.

The future of the Ethereum ETF market

As the digital assets market moves further down the cycle in the coming months, we expect investors to gradually explore Ethereum's potential alongside Bitcoin. However, for traditional investors, Ethereum is more difficult to understand than Bitcoin, which many consider to be digital gold. Bitcoin has a relatively simple concept, while Ethereum is a complex network on which applications can be built.

Nevertheless, eight of the nine Ether ETFs have positive net inflows, while only Grayscale's Ethereum Trust shows net outflows. However, the outflows at Grayscale are such that they negatively impact the entire Ether-ETF market. As noted earlier, this was also the case with the introduction of Bitcoin ETFs, with Grayscale's ETF also putting pressure on the market.

On the positive side, outflows at Grayscale are gradually decreasing. Nevertheless, inflows to the other eight ETFs remain on the low side, mainly due to uncertain macroeconomic conditions. Like Bitcoin, Ethereum is a high-risk and thus a risk-on asset, so we expect the ETFs to see larger inflows only when the likelihood of a U.S. recession diminishes and macroeconomic conditions improve.