Hodl Funds migrates from Ledger Vault to Fireblocks

- What is Fireblocks?

- How does Fireblocks work?

- What is the difference between Fireblocks and Ledger Vault?

- How will this affect participants of the Hodl Funds?

During the past months, we have decided to transition from our custodian Ledger Vault to Fireblocks.

Fireblocks is one of the leading custody solutions providers in terms of cold storage, although Ledger Vault is also an incredible solution, Fireblocks provides an environment which better suits the needs of our funds.

What is Fireblocks?

Fireblocks is a self-custody solution that provides a suite of tools for securely managing and transferring digital assets, specifically tailored for institutional use. It is widely adopted by businesses such as digital assets exchanges, asset managers, banks, and fintech firms.

Through the integration with Fireblocks, we retain control of the private keys, therefore the client’s assets, while Fireblocks provides a comprehensive asset overview and facilitates secure interactions with the blockchain.

How does Fireblocks work?

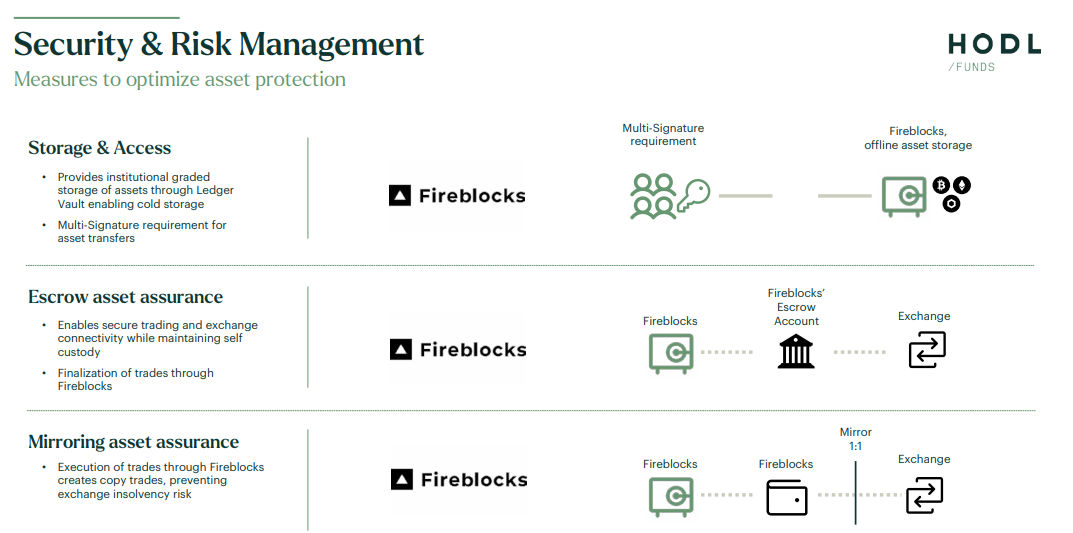

To ensure transparency, security, and operational efficiency, the funds are structured into distinct vaults, each governed by a robust set of customizable rules. For instance, primary assets are safeguarded within Vault 1, which is designated for maximum security.

Within these vaults, governance mechanisms are implemented to enforce controls such as withdrawal limits and multi-signature requirements. This ensures that fund withdrawals are authorized only with the consensus of designated stakeholders.

Furthermore, specialized vaults can be created to accommodate specific operational needs, such as providing direct trading access to select traders. These traders are empowered to act swiftly in response to market opportunities while operating under strict oversight protocols.

Besides the safeguarding of the funds in cold storage, Fireblocks offers another suitable solution that benefits our Algorithmic Trading strategy. Usually for algorithmic trading bots to perform efficiently, the assets need to be located on the exchange as these algorithms execute thousands of transactions per day. However, this introduces the possibility of exchange failure, leading to a potential loss of funds.

To counter this issue, a certain amount of digital assets is placed into an escrow account within the Fireblocks environment, and these digital assets are mirrored on the exchange. At the end of each day, Fireblocks provides a P&L statement that the exchange and we must agree upon. In the event of a loss, the difference will be deducted from the escrow account. In the event of a profit, the exchange settles the difference into the escrow account.

If either party disagrees with the statement, a specified period is allowed for presenting evidence and reaching a resolution. Fireblocks enable asset mirroring to exchanges, effectively eliminating counterparty risk associated with the mirrored assets. In the event of an exchange failure, the only potential loss would be the daily trading results, minimizing overall exposure.

What is the difference between Fireblocks and Ledger Vault?

While Ledger Vault offers similar functionalities to Fireblocks, the key differences lie in asset selection and execution speed. Ledger Vault supports a limited range of assets, which poses a challenge for our operations, as we also invest in lower-market-cap assets that are often not supported. Fireblocks, on the other hand, allow us to manually add these assets by integrating their smart contracts into the supported environment, ensuring the security of our client's holdings.

Given the fast-paced nature of the digital asset industry, our traders must be able to react swiftly to changing market conditions. While Ledger Vault provided exceptional security, its execution speed was a drawback—particularly when moving funds from cold storage to an exchange. Fireblocks address this limitation, enabling faster transactions without compromising security.

How will this affect participants of the Hodl Funds?

Our participants will not be impacted in any way by the transition between custodians as most of the assets have already been transferred to Fireblocks. This change enhances security while enabling our analysts to respond more efficiently to evolving market conditions.

To learn more about the importance of self-custody in digital assets and how we integrate it across its investment strategies, download our self-custody report below.