How does Hodl implement Artificial Intelligence and Machine Learning?

- What is Artificial Intelligence?

- What is Machine Learning?

- Hodl’s implementation of AI and ML

- A look into Hodl’s platform

- Want to learn more?

Throughout human history, we have experienced various economic revolutions, moving from steam power engines to assembly lines, from mass production to automation. Today, our economies are becoming increasingly digital through the introduction of the Internet and, consequently, we are more dependent on data. Now, we are moving towards the next economic revolution: the mass adoption and integration of Artificial Intelligence (AI). The development has gained significant traction and it's just a matter of time before it becomes widespread. But let’s first start with the basics.

What is Artificial Intelligence?

You get AI, you get AI, everyone gets AI! For the past two years, the word AI has been thrown around everywhere and it seems that everyone is implementing it in their daily lives or just wants to jump onto the wagon, but what is it? Simply put, AI is a technology that enables computers and machines to simulate human intelligence and problem-solving capabilities, allowing them to perform tasks that would otherwise require human intelligence, and/or vast amounts of human resources.

What is Machine Learning?

On the other hand, machine learning (ML) is different, although the two are often mentioned together. ML is a branch of AI that focuses on using data and algorithms to enable AI to imitate the way that humans learn. The key idea is that the system improves its performance over time as it is exposed to more data. So, ML is a specific approach to achieving AI, where the system is trained on data rather than being explicitly programmed to perform a task.

Hodl’s implementation of AI and ML

AI and ML can be integrated into all kinds of business processes but for us, it’s a little obvious, that we can derive the most value from this development in the analysis of market movements and the investments in our strategies. We have created an AI/ML platform that supports forecasting market movement, calculating correlations between investments, and earning opportunities when swapping between assets. But how does this work?

Firstly, these technologies require vast amounts of data related to movements, prices, and other variables. This data can be acquired from centralized exchanges such as Binance, which have enormous amounts of data due to the activities on their platforms. The data is then aggregated into the platform, where it undergoes rigorous analysis to achieve the aforementioned goals. This is the ML component of the platform, as it processes the data to make predictions and, if done correctly, it becomes more accurate over time. The AI element of the platform is the voting algorithm, which automatically classifies the predicted prices into client-defined categories (Fibonacci, grid, custom) to indicate the level of increase or decrease of digital assets and the probability of such an increase or decrease.

A look into Hodl’s platform

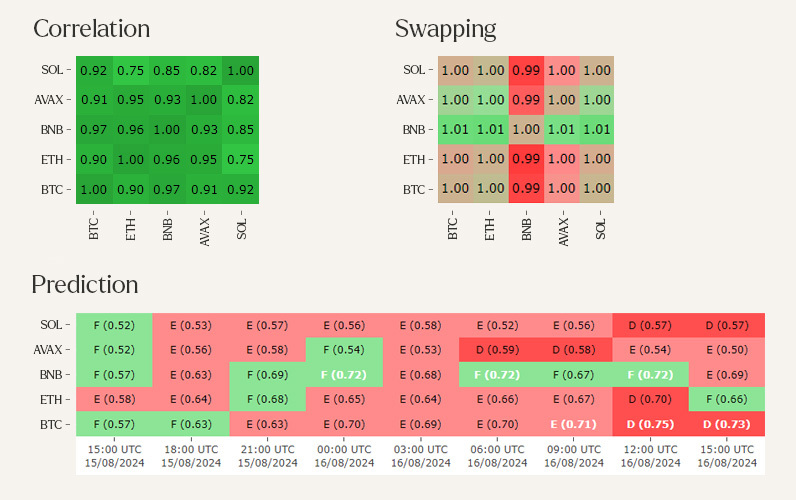

It may be difficult to imagine what this platform looks like, so we would like to give you a couple of examples, divided into three categories: correlation, prediction, and swapping.

The first is rather simple, the ML algorithms provide a correlation matrix of the different assets within the fund, and a comparison between these correlations for any given historical timeframe. In this matrix, a score of 1 concludes a perfect correlation, a score of -1 is a negative correlation, and a score of 0 means that there is no correlation. This allows the research analysts to create a more efficient risk-return ratio, this matrix is mainly used in the Actively Managed Strategy.

The second feature of the platform is the forecasting analysis. This feature provides a forecast of a potential price increase or decrease, the likelihood of it occurring, and the time frame in which it should take place, all based on historical and real-time exchange data. As shown in the illustration, there is a letter and a number. The letter represents the potential change, with "A" indicating a decrease of 15%, "E" a slight decrease between 0% and -2%, "F" a slight increase between 0% and 2%, and "J" an increase of 15% or more. The number represents the probability of this change occurring. In this case, the forecast predicts a 0% to 2% increase in Bitcoin with a 57% probability.

This feature is used in the Actively Managed, we are exploring the possibilities of implementing it in our Algorithmic Trading strategie. The research analysts of the Actively Managed fund use it as a complementary tool to identify potential buying or selling moments or levels.

The last feature is swapping, which is quite unique. Based on the potential price increase or decrease from previous calculations, it provides a prediction of the loss or gain one would incur if they converted an asset to another today. For example, as illustrated below, if you swap your Ethereum for BNB, and swap it back after a certain period, you will earn 1% more Ethereum than if you didn’t. This allows the research analysts of the Actively Managed strategy to swap one asset for another to increase the holdings of a desired asset.

Want to learn more?

Do you wish to learn more about our AI/ML platform and how it’s implemented in our investment strategies? Schedule an open appointment with one of our specialists to learn more about our platform and our investment strategies.