The ETF effect: how exchange trading funds are reshaping institutional access

- Bitcoin ETFs: from novelty to necessity

- Ethereum ETFs: gaining traction, shifting perceptions

- The next frontier: Ethereum staking and altcoin exposure

- From fringe to framework: institutionalization is underway

It has been roughly 18 months since the launch of the first U.S.-listed Bitcoin ETF, and the results are beginning to crystallize. What was once considered a speculative experiment is now, undeniably, a structural bridge between traditional finance and the digital asset ecosystem. In this brief period, Bitcoin ETFs have transformed how institutions access the asset class, triggering a cascade of inflows, sparking innovation around Ethereum products, and prompting discussions about what comes next: staking exposure, and eventually, altcoin baskets.

Bitcoin ETFs: from novelty to necessity

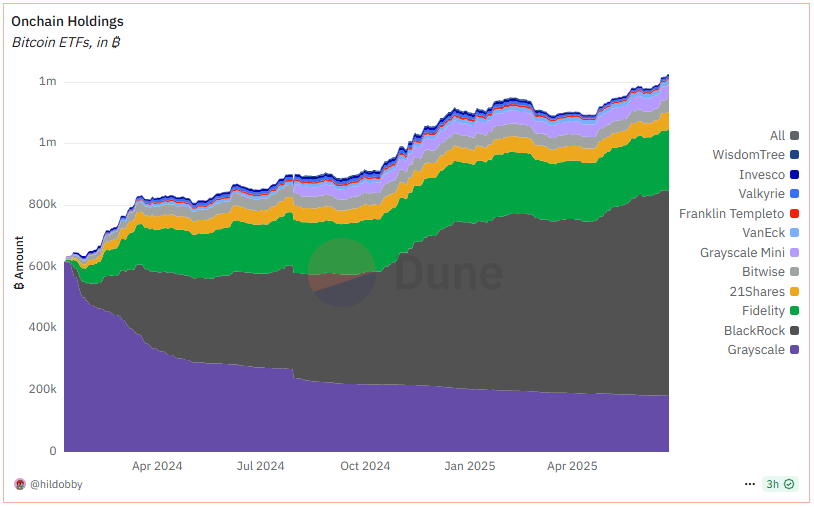

When BlackRock, Fidelity, and other heavyweight issuers launched their spot Bitcoin ETFs in early 2024, market skeptics raised concerns about limited demand and regulatory overhangs. Fast-forward to today, and those fears have largely dissipated. U.S.-based Bitcoin ETFs now collectively hold around 1.23 million BTC, which accounts for more than 6% of the total circulating Bitcoin supply. In total, these ETFs represent over $130 billion in assets under management. Remarkably, the cumulative trading volume across all U.S. Bitcoin ETFs has surpassed $1 trillion in less than 18 months.

Among these, BlackRock's iShares Bitcoin Trust (IBIT) has emerged as the dominant product, managing approximately $70 billion in assets and holding over 3% of all Bitcoin in circulation. In contrast, Grayscale's GBTC, once the leading institutional product, has seen substantial outflows due to its relatively high fee structure. While GBTC still holds roughly $19 billion, the shift in investor preference underscores the demand for cost-effective, liquid vehicles.

The appeal is straightforward. For wealth managers and institutional allocators, ETFs eliminate many of the operational headaches associated with direct digital asset exposure. There’s no need for wallet management, no concern over custody keys, and no specialized compliance overhead. Exposure becomes as simple as purchasing SPY or GLD, enabling broad-based adoption within model portfolios and discretionary mandates.

Ethereum ETFs: gaining traction, shifting perceptions

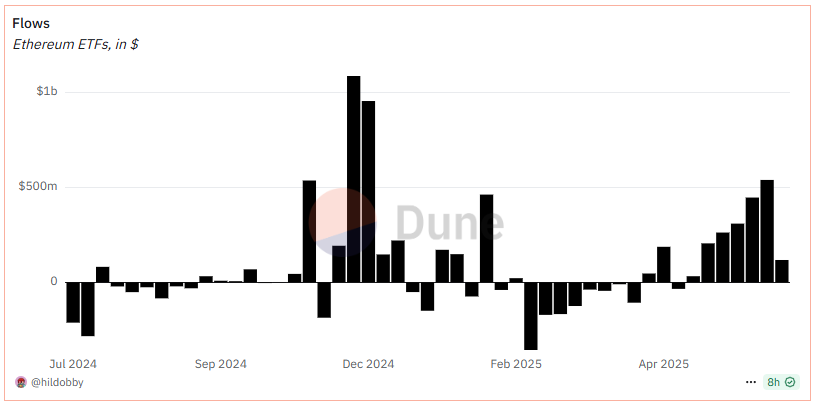

Following the SEC’s approval of several spot Ethereum ETFs in mid-2025, investor interest has accelerated. As of June 2025, these products have collectively surpassed $10 billion in AUM, with net inflows topping $4 billion in just a few weeks. June alone saw over $1 billion in new capital, up from $564 million the month before, and featured only two days of net outflows. On June 11th, Ethereum ETFs recorded a single-day net inflow of over $240 million, with BlackRocks IBIT ETF accounting for 66% of that surge.

These figures reflect a growing institutional appetite for Ethereum, not just as an alternative to Bitcoin, but as a foundational infrastructure layer for decentralized finance, tokenization, and on-chain applications. The total amount of Ethereum held by ETFs recently hit an all-time high of nearly 4 million ETH, signaling not only market confidence but also long-term positioning by allocators who see Ethereum’s evolving role in financial markets.

The next frontier: Ethereum staking and altcoin exposure

Looking forward, the market is anticipating the introduction of Ethereum staking ETFs. These products would mark a significant evolution, allowing passive investors to gain exposure to the yield generated by Ethereum’s proof-of-stake consensus. If successful, these funds could function much like dividend-paying equities, offering income without the need for technical expertise or bespoke infrastructure.

This would open up Ethereum to an entirely new class of investors. Pension funds, endowments, and income-focused portfolios could treat Ethereum not just as a growth asset, but as a reliable yield generator. In turn, that revaluation may shift how the asset is analyzed, introducing discounted cash flow models and other tools more common in traditional finance.

At the same time, asset managers are preparing for the next evolution: diversified altcoin ETFs. While regulatory approval is still a hurdle, the growing maturity of networks like Solana and Avalanche, alongside tokenized AI and DeFi applications, makes this an increasingly plausible development. The challenge will be constructing products that balance exposure with regulatory clarity and investor protection.

From fringe to framework: institutionalization is underway

Crypto ETFs have done more than just attract capital, they have validated digital assets within the machinery of institutional finance. Advisors can now recommend Bitcoin and Ethereum within client portfolios. Pension consultants are drafting strategic asset allocation frameworks that include digital assets. Custodians, risk managers, and compliance teams have developed standardized protocols to support the integration of crypto into multi-asset strategies.

We are at a pivotal inflection point. ETFs have brought scalability, simplicity, and legitimacy to an asset class that once existed on the fringes of finance. The next phase will not be about access, it will be about optimization. Staking, yield enhancement, and sector-specific exposure are already on the horizon. As these products mature, they will deepen market participation, attract new categories of capital, and transform how digital assets are perceived by the investment community.

The structural story is clear. Digital assets are no longer an exotic curiosity. They are becoming a strategic allocation, and ETFs are leading the charge.

Sign up for our newsletter to stay on top of the crypto market.