Investment Thesis: Scaling Solutions

- What are scaling solutions?

- Why are scaling solutions important?

- Why should scaling solutions be part of a portfolio

- Interesting scaling solutions

- Hodl’s takeaways

- For further reading

The digital assets industry encompasses diverse sectors, each presenting unique strengths and investment potential. The strategic allocation of capital across these sectors can define the difference between a well-diversified portfolio generating positive returns and a concentrated one overly reliant on specific sectors.

In this series, we aim to highlight interesting sectors and explain why the Hodl Funds chose to invest in them. Among these sectors lies scaling solutions with a special focus on Bitcoin’s and Ethereum’s Layer 2’s (L2s).

What are scaling solutions?

When Bitcoin and Ethereum were launched, the industry was in its early stages and technology wasn’t as advanced as the networks we have today. This is also observed in the number of transactions per second (TPS) that Bitcoin and Ethereum networks can process, approximately seven and fifteen per second, respectively. Although this was more than sufficient at the time, onboarding millions of users has created a significant problem as the network’s activity surpassed its TPS threshold.

To execute a transaction, users must provide a gas fee, which is a reward for the network operators for including you in a block. When network activity is low, these operators will include almost anyone to fill a block and create revenue. However, when activity is high, operators can choose which transactions they want to include in a block, and of course, the ones with higher gas fees will be included. Therefore the fee can also be used as a bribe. This creates a snowball effect as increasingly more users increase their gas fees to be included in the next block, creating moments where gas fees surpass $50 per transaction, which is quite inconvenient.

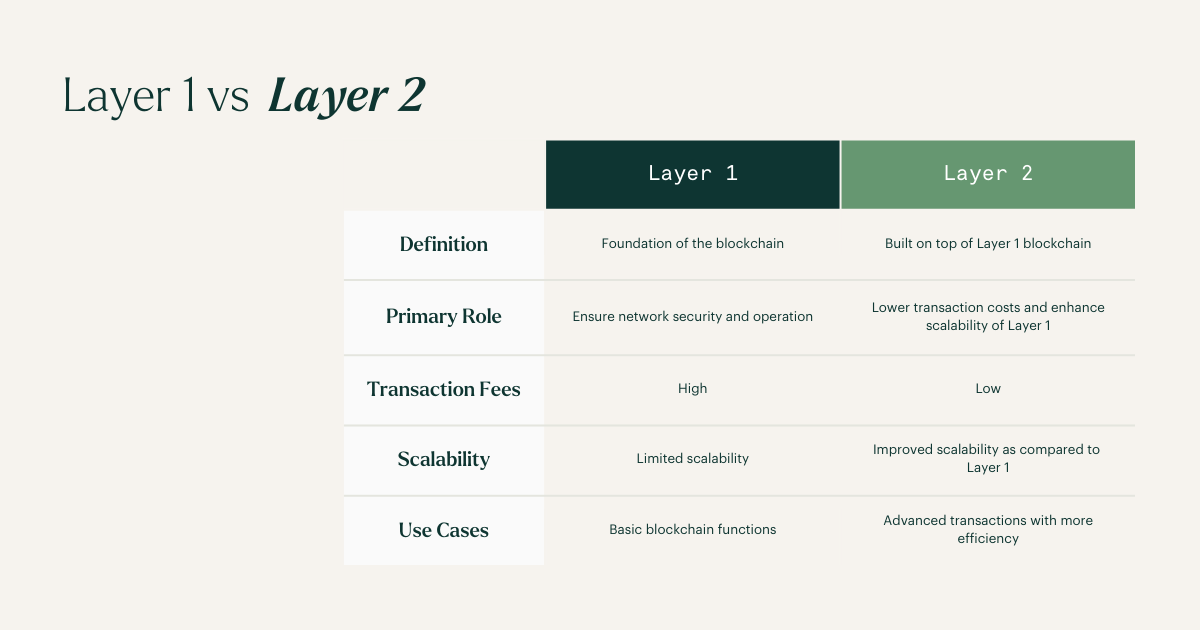

To tackle this problem, developers began exploring possibilities to scale the networks, with L2 solutions becoming increasingly popular. These networks operate on top of the main network, leveraging its security without being stand-alone blockchains. They execute transactions off the main network and send summaries of thousands of transactions back to it. As less data is required to process these summaries, the transaction throughput of the network is increased while providing significantly cheaper transactions.

Why are scaling solutions important?

As the industry continues to attract new users, the congestion issues on Bitcoin and Ethereum will continue to persist. Furthermore, scaling the main blockchains has proven to be incredibly difficult as it introduces the “Blockchain Trilemma”, the trade-off between 3 critical aspects of blockchain technology: Security, scalability, and decentralization. So, currently, L2 solutions have been the main focus of addressing the scalability issues, especially in Ethereum’s case.

Source: CryptoRank.io

So to manage the new users entering the industry and provide new and old users with a good user experience, the L2 will be increasingly important, especially because transactions in the L2 environment are incredibly cheap and fast compared to their main network counterparts.

Why should scaling solutions be part of a portfolio

The majority of L2 solutions are built on Bitcoin and Ethereum, as these are the oldest blockchains in their respective fields—Bitcoin being the first blockchain ever created, and Ethereum the first smart contract network. As a result, these networks rely on older technologies compared to newer networks, which can process thousands of transactions per second from the outset. However, with their first-mover advantage, these networks have attracted the most users and capital, making them crucial for the market's overall health. Additionally, they have served as gateways for new users, and as time progresses, more users are expected to join these networks, especially as both assets enter the U.S. financial markets through spot ETFs.

As scalability issues persist and we anticipate that this challenge will continue with the influx of new users and the introduction of more efficient technologies, we see unique opportunities in scaling solutions. Moreover, these solutions could present an interesting opportunity as a beta play on Bitcoin and Ethereum.

Interesting scaling solutions

Bitcoin Layer 2, Stacks

Stacks, the main network launched in 2018, is an L2 solution built on top of the Bitcoin network, introducing smart contract capabilities that are not available on Bitcoin. As aforementioned, L2’s leverage the security of its main network, as a result, transactions made on Stacks are as irreversible as Bitcoin’s. Since its inception, Stacks has become one of the leading L2s in Bitcoin’s ecosystem with a market capitalization of $2 billion and a total value locked of ~$380 million.

Ethereum Layer 2, Optimism

Optimism, the main network launched in 2021, is an L2 solution on Ethereum. It's a universal purpose environment meaning that it can execute all functions that are also available on Ethereum. The biggest difference between the two is that it can execute transactions way cheaper and faster than Ethereum. It has gained significant popularity and at times it has surpassed the daily transaction count of its main network, illustrating the importance and friendliness of these environments. As a result, Optimism has grown its market capitalization to ~$1,5 billion.

Hodl’s takeaways

Over the past few years, Layer 2 solutions have become increasingly important as the market has continued to attract millions of new users. Solutions on Bitcoin and Ethereum have significantly increased the transaction throughput on their networks, offering cheap and fast transactions for both existing and new users. Although most of the total value locked is still on the main network, we believe that these Layer 2 networks will attract more capital in the coming years. This will create a snowball effect, as users and developers tend to gravitate toward networks where more capital is concentrated.

Additionally, Bitcoin and Ethereum remain the most important and popular networks in the industry, and as time goes on, they will continue to attract new users. We expect that scalability challenges will persist, and even as they are addressed, ongoing innovation will introduce more efficient solutions, creating new opportunities.

However, it is important not to concentrate all your capital on this sector, as this would create an unbalanced portfolio. Additionally, investors need to decide whether to invest in one or multiple projects within the sector, each option has advantages and disadvantages.