Market Update: The (lagging) performance of altcoins

- A challenging 2024

- Altcoins in 2024

- Where are we in the market cycle?

- Our expectations for altcoins

- How will this impact the Hodl investment strategies?

A challenging 2024

As the digital assets market departed from its hibernation in 2023, all eyes and attention were put on 2024. It started spectacularly as the industry witnessed the introduction of US Bitcoin spot ETFs, consequently, causing an upward trend in the market. Bitcoin reached a new all-time high while most digital assets were still far from their highest point. Since March/April, the market has experienced a downward trend due to the postponement of interest rate cuts as inflation remained high, followed by the fear of a possible US recession.

While Bitcoin has remained relatively stable, altcoins failed to find strong footing within these macroeconomic conditions, leading to lower performance than expected. As our funds have a higher concentration in altcoins, they have lagged in performance against Bitcoin in 2024. In this update, we will dive deeper into the performance of altcoins in 2024, where we stand in the market cycle, and our expectations of altcoin performance in the upcoming months.

Altcoins in 2024

As Bitcoin gained upward momentum until the end of March, and the beginning of April, altcoins followed this trend. After this, Bitcoin initiated a downward trend due to worsening macroeconomic factors but has remained relatively stable. However, when observing altcoins, we observe a completely different picture. If we observe established altcoins such as Avalanche and Chainlink, we see that they have decreased by 43% and 37% in 2024, and are a 580% and 430% increase away from their all-time highs, a sharp contrast with Bitcoin’s performance.

Source: tradingview.com

Nearly all sectors within the altcoin market have faced a challenging year, with one notable exception: meme coins. These assets have had an exceptional year, with several, such as Dogwifhat, increasing by over 900%. However, 'investing' in these coins is highly speculative, as fundamental analysis is nearly impossible. The primary factors for analysis are community activity, liquidity, and trading volume, but speculation remains the dominant driver.

But why hasn't the altcoin market started an upward trend yet, and could this be part of a typical market cycle?

Where are we in the market cycle?

Since its inception, the digital assets market has followed a cyclical pattern, this market cycle can be divided into a phase where initially Bitcoin is dominated causing its price to increase, this is then later followed by “altcoin-season”. In this phase, altcoins start to perform better than Bitcoin. This phase usually follows this sequence, first Bitcoin’s dominance rises during bear markets. This dominance continues to increase in the early stages of a bull market. As the cycle unfolds, investors start allocating capital to higher-risk assets such as Ethereum and other altcoins. As a result, Bitcoin’s dominance begins to decline.

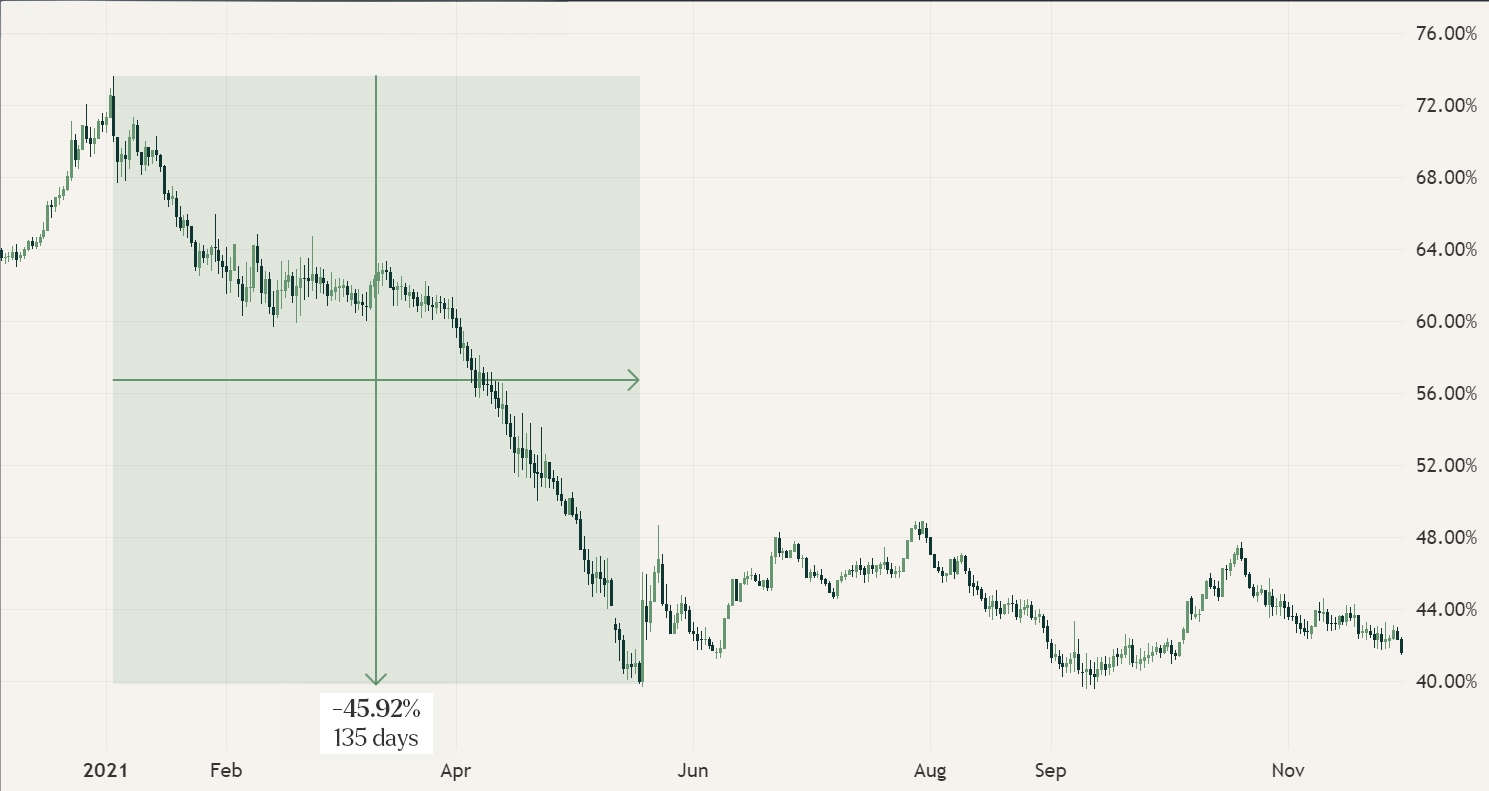

Source: tradingview.com

Unfortunately, this scenario hasn’t unfolded yet. Since November 2022, approximately the bottom of the last bear market, Bitcoin’s Dominance has increased steadily. Its dominance is above 57% of the total digital assets market, Ethereum follows in second with 15%, and the rest of the market accounts for 28%. This means that there are two possibilities:

- The market is experiencing a cycle we haven’t seen before.

- The real bull phase hasn’t started yet.

We believe that we are still in a traditional market cycle and that the true bull market is yet to start. Macroeconomic conditions may have put additional pressure on the market but we believe it can weather this storm.

Our expectations for altcoins

As the traditional market cycle unfolds, we anticipate a period when altcoins will significantly outperform Bitcoin. For this to happen, Bitcoin first must achieve higher highs, so we might see the Bitcoin dominance increase even more. After this, we expect a liquidity shift towards altcoins, allowing them to outperform. However, it’s important to note that this period of outperformance is usually short and intense.

Source: tradingview.com

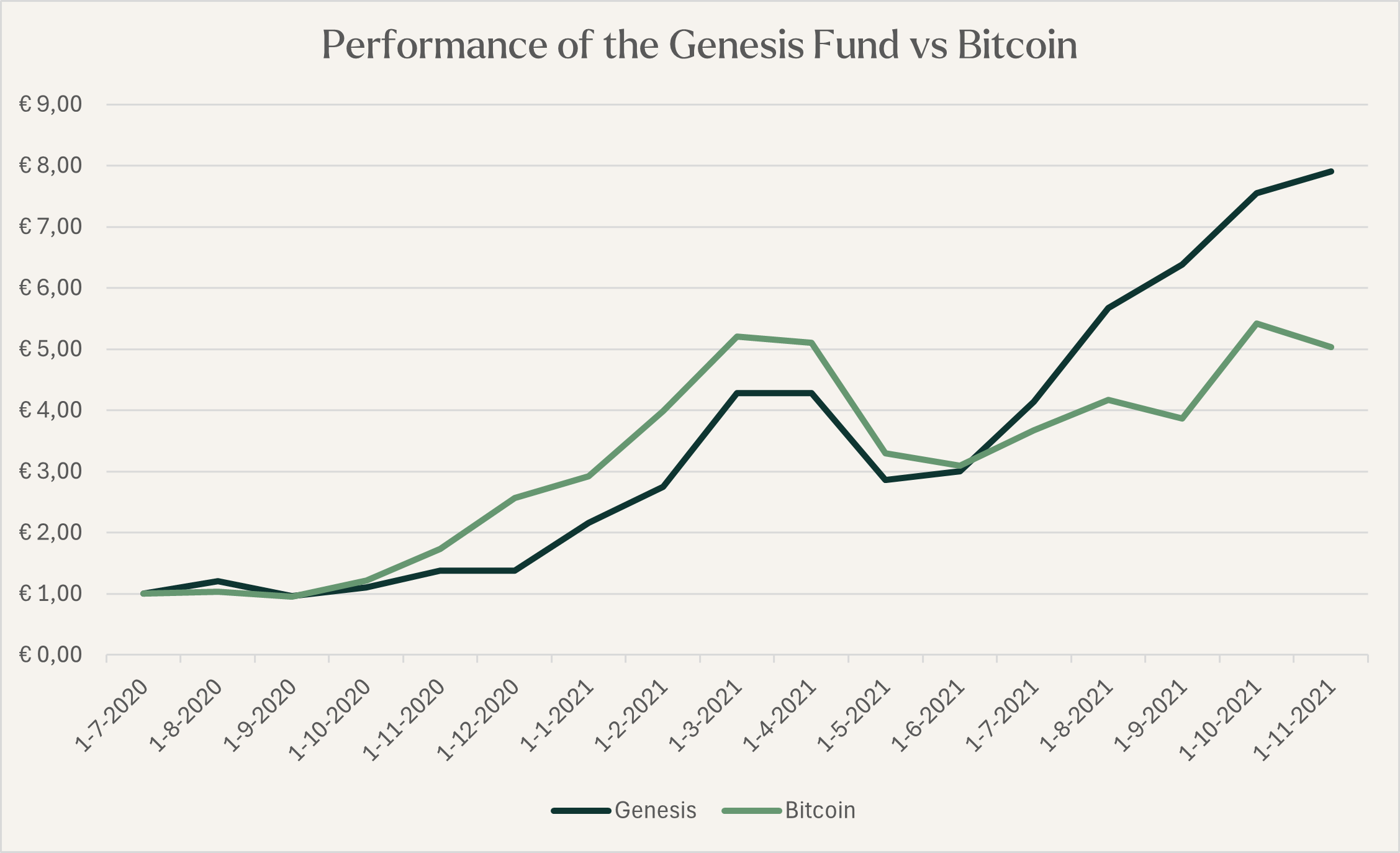

In previous cycles, we've observed that while Bitcoin dominance tends to last for an extended period, it declines rapidly during altcoin season. This is observed in the illustration above, as the market entered 2021, there was a liquidity shift to altcoins, causing Bitcoin’s dominance to drop. This pattern is also reflected in our Genesis Fund’s performance: initially, the funds may lag behind Bitcoin, but they quickly recover and surpass Bitcoin's performance once the altcoin rally begins. As seen in the 2021 cycle, until the 30th of June 2021, Genesis had the same performance as Bitcoin, but in the 5 months that followed, Genesis increased by 163,33% while Bitcoin increased by 62,68%. Furthermore, approximately 93% of this performance was made in only two months, July and August, increasing by 38.00% and 39.96%, respectively.

This underscores the potential of altcoins, though investors must patiently wait for this phase to unfold while Bitcoin generates substantial returns. However, the wait may be worthwhile, as altcoins exhibit greater upward volatility than Bitcoin. This is further illustrated by their projected market capitalization and diverse use cases. While many expect Bitcoin to grow to a $7 trillion market capitalization by 2030 (from its current $1.1 trillion), the altcoin market today is only worth $0.96 trillion, which is divided across thousands of assets. Given the lower market capitalization, altcoins have a higher growth potential and can experience faster gains with smaller capital inflows than Bitcoin.

How will this impact the Hodl investment strategies?

Actively Managed Strategy

The performance of our Actively Managed Strategy has currently lagged behind Bitcoin, primarily due to Bitcoin’s dominance and the underperformance of altcoins. However, as the market cycle progresses and altcoins gain momentum, we anticipate a recovery in the performance of our actively managed funds, with the aim to surpass Bitcoin. Historically, these funds have experienced periods of significant outperformance, and we remain positioned in our selected altcoins, waiting patiently for this phase to unfold.

Algorithmic Trading Strategy

The Algorithmic Trading strategy is also poised to benefit from the rise in altcoin prices, as it is positioned in these assets as well. Additionally, it stands to gain from increased trading volumes on exchanges. While trading volumes have been rising over the past two years, they have yet to return to the levels seen in 2021. As altcoin prices climb, trading volumes typically increase, which enables the trading bots to handle larger volumes. This, in turn, generates more rebates, which can be reinvested into acquiring more assets, further enhancing the fund's growth potential.

Venture Capital Strategy

The altcoin dominance phase will be especially advantageous for our Venture Capital strategy. Since this strategy focuses on investing in early-stage tokens, a strong and expanding altcoin market significantly improves the likelihood of successful token launches and favorable market entries.

Want to learn more about the market’s cycle or our investment strategies? Schedule an open appointment with one of our specialists to learn more about the market and our investment strategies or download our brochure.