Our view on the 2024 US presidential election

- The road towards the election

- How will Donald Trump impact the market?

- How will Kamala Harris impact the market?

- Who will win the 2024 presidential election?

The road towards the election

As we entered 2024, one of the major topics for the year was the upcoming US presidential election. As the US remains the biggest financial market and the world’s superpower, the election outcome will shape the world’s market and how it will use its power.

The race started slowly with a few Republican nominees still in the race against ex-president Trump but it became clear that he would become “the'' nominee for the Republicans. Even though he was still facing criminal charges which some thought might jeopardize his campaign.

With Biden announcing his re-election campaign already in 2023, the world prepared itself for the repetition of the 2020 election. The run-up was hectic, with Biden failing heavily in the debate against Trump as he stumbled through sentences and lost his train of thought. Then on the 13th of July, Trump survived an assassination attempt, this event strengthened his chances of winning against Biden, which dropped significantly in the polls.

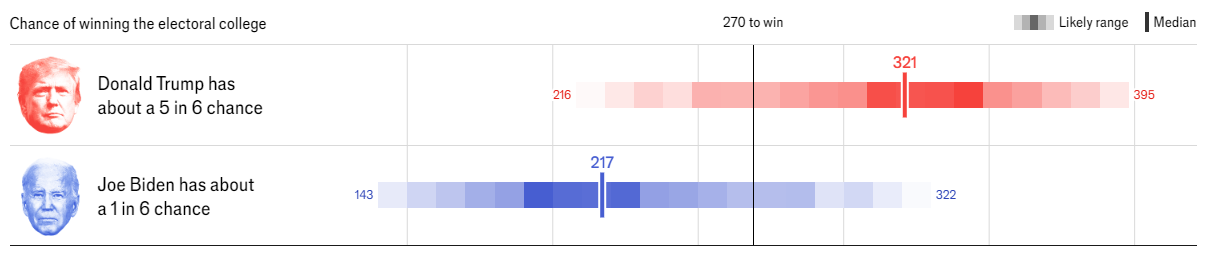

Source: https://www.economist.com/interactive/us-2024-election/prediction-model/president/

On the 19th of July, The Economist prediction polls gave Donald Trump a 5 in 6 chance of winning. This led many to think that the race was already over before it began. However, on the 21st of July, Biden ended his re-election bid, endorsing Vice President Kamala Harris to succeed him. The official democratic candidate will be announced at the Democratic National Convention in Chicago, Illinois between the 19th and 22nd of August. Although Kamala Harris seems the logical option, the Democrats can still provide another candidate. This has given the Democrats a second chance of winning the election although Trump remains the strong favorite. With the election opening up again, we will provide our view on both candidates on how these will impact the digital assets market.

How will Donald Trump impact the market?

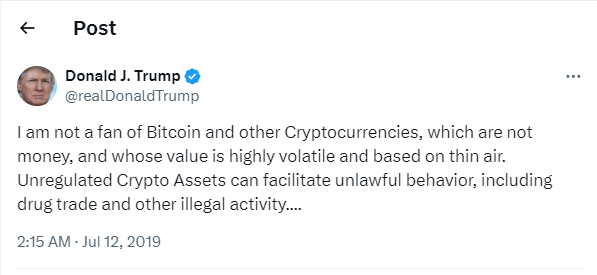

Trump wasn’t initially a supporter of Bitcoin and the broader digital assets market, voicing his negative opinions multiple times, including on his then-Twitter account (see illustration below). However, he appears to have changed his stance, launching various NFT sets and accepting Bitcoin donations. As the election approaches, Trump is doubling down his support for the industry, pledging to help Bitcoin miners and create a pro-digital assets environment in the U.S. Additionally, he spoke at the Bitcoin conference in Nashville on July 27th at which he promised that the US would never sell any of its Bitcoin under his presidency. This pro-digital assets stance is echoed by his running mate, James David Vance, who held up to a quarter-million dollars worth of Bitcoin as of 2022 and has criticized Gary Gensler as the "worst person" to regulate the crypto industry.

Source: https://x.com/realDonaldTrump/status/1149472282584072192

So it isn’t a surprise that the majority of the digital assets market is hoping that Trump returns to the White House. This is also reflected in the number of donations digital asset firms are making towards Trump. For example, Elon Musk has announced that he will donate $45 million monthly to a political group backing Donald Trump, whom he has advised on crypto policy. Furthermore, the digital assets market reacted overwhelmingly positively to Trump’s odds increasing as Bitcoin’s price surged.

If we see Trump getting re-elected, we expect a friendlier legal narrative in the states and hopefully a new chair of the Securities and Exchange Commission (SEC), which is currently Gary Gensler. Since his arrival, Gensler has evolved into the antagonist of the market through his lawsuits against anyone breathing in the market. Through this friendlier approach, we expect stronger market growth and a broader general acceptance of digital assets.

How will Kamala Harris impact the market?

Throughout his first term, it has become evident that President Biden and the Democratic Party are not supporters of digital assets. The Biden administration, through the SEC, has applied significant legal pressure on firms, choosing to rule by force rather than cooperation. Despite the SEC approving the Bitcoin ETF and being on the verge of approving the Ether ETF, we believe these actions are politically driven. We expect that Kamala Harris will not deviate from this stance if she is elected as president, also because she was part of the previous administration. This hunch was amplified as Harris declined to appear and speak at the Bitcoin Conference at which Trump is attending. Furthermore, there is also a chance of acceleration of legal pressure as the SEC would already be in motion, unlike in the first term when they were still gaining momentum.

For these reasons, the Democratic Party hasn’t seen much support from the digital assets market for a potential re-election and the majority also hopes that this won’t happen. Nevertheless, a Kamala Harris election win isn’t armageddon, we still expect the market to grow, only less strongly as legal pressure will mount while a hostile environment grows.

Who will win the 2024 presidential election?

The upcoming months will be an exciting period as this election race unfolds. Although Trump currently has the lead and has ascended to almost a “God” among the Republican Party and his followers, you never know what happens next. Trump was leading the polls against Biden, however, there isn’t much data on him against Harris, although many do expect that he has a lead.

For the Democratic Party, it is paramount that they develop a strategic plan and reverse the damage done in the run-up to the election. Harris remains a favorite, but her position on the ballot isn’t certain yet, as some Democrats doubt her chances of winning against Trump. Time is running out for the Democrats to create a unified party, and select a candidate and running mate, while the Republicans already have everything in position. However, politics is unpredictable, and anything can happen. In 2016, polls heavily favored Hillary Clinton until Trump outperformed expectations and won several key swing states.

For the digital assets market, a second Trump term currently seems the most beneficial. However, we need to see if he keeps his promises and creates a more favorable environment for digital assets if he returns to the White House. Although Trump is the more favorable option, the market will continue to grow in users and adoption, no matter who is in the White House or who is the ruling party.