The impact of the upcoming wealth shift on digital assets

- What is the current wealth distribution in the U.S.?

- From whom and where will this wealth shift?

- The investment characteristics of Millennials and Generation Z

- The impact of this wealth shift on digital assets

According to Cerulli Associates, a leading research firm specializing in asset management and distribution trends, an estimated $124 trillion in wealth will be transferred in the United States by 2048. This marks the largest wealth transfer in history and is expected to reshape financial markets as younger generations, with different investment preferences and priorities, take control of these assets.

In this article, we focus exclusively on the U.S., as it remains the world's largest capital market and wealthiest nation. Given its global influence, this wealth shift will have a significant impact on investment trends in the years ahead.

What is the current wealth distribution in the U.S?

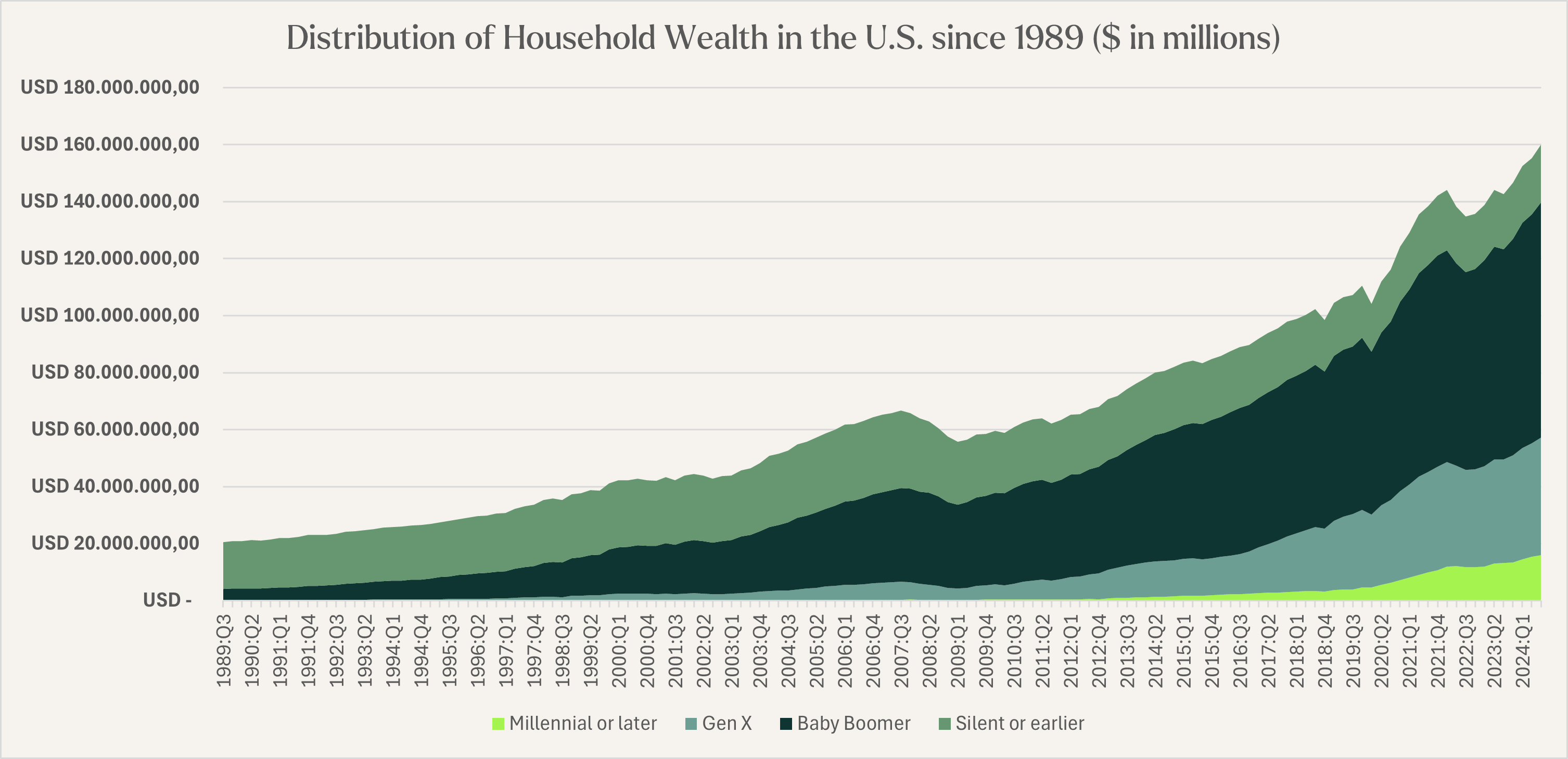

First of all, let’s take a step back and look at how wealth is currently distributed among the different generations. There are currently five generations who have or are building wealth: Silent, Baby boomer, Generation X, Millennials, and Generation Z.

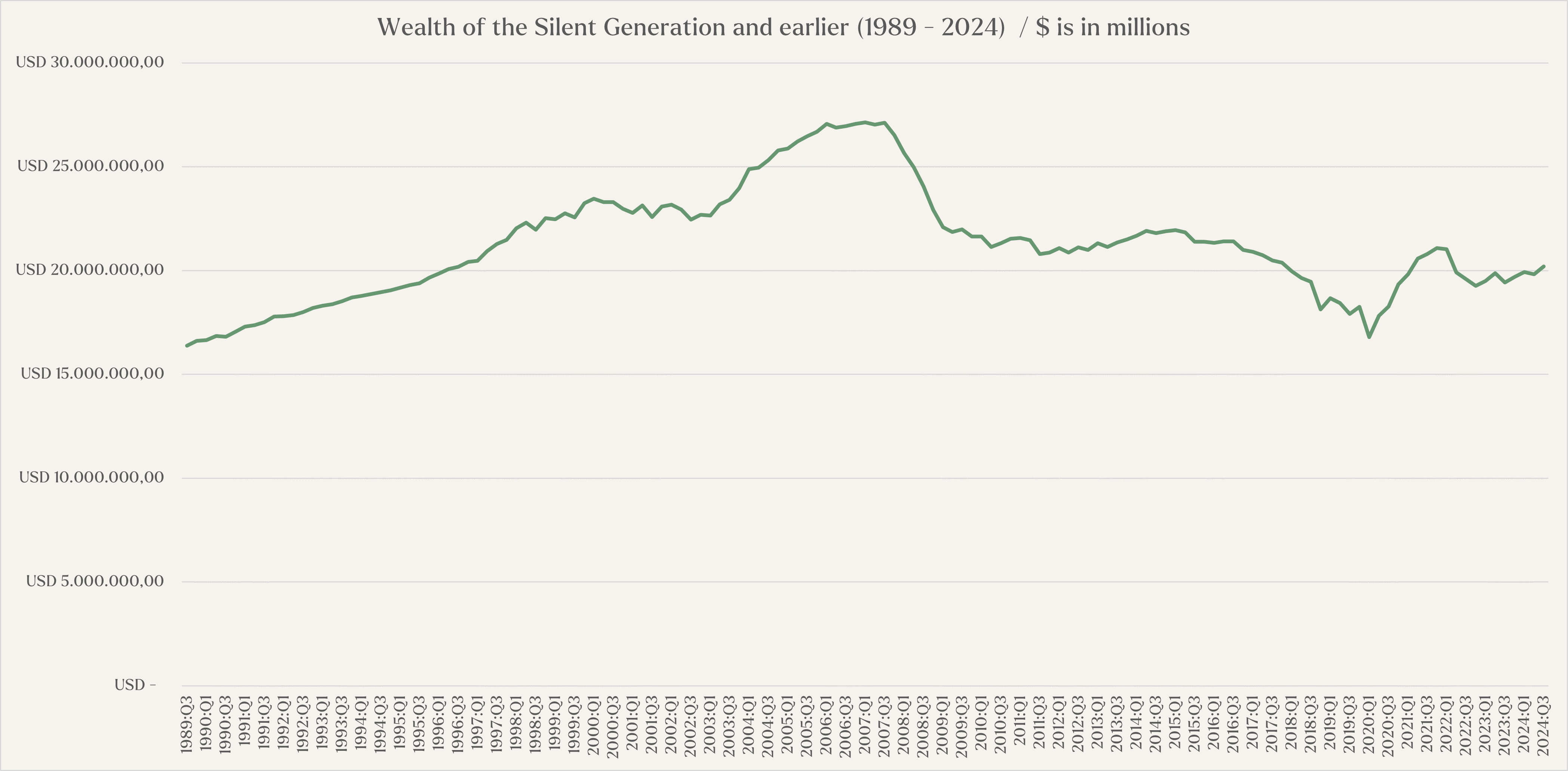

Silent and earlier generations

Born before 1946, this generation represents a small percentage of the population but continues to hold a significant share of wealth—currently estimated at $16.38 trillion. From 1989 to around 2008, their wealth steadily increased, peaking at nearly $28 trillion. However, as shown in the chart below, their total wealth has been in decline since 2008, where it currently stands at $20.20 trillion. This trend is largely driven by the natural transfer of assets to younger generations as wealth is gradually inherited.

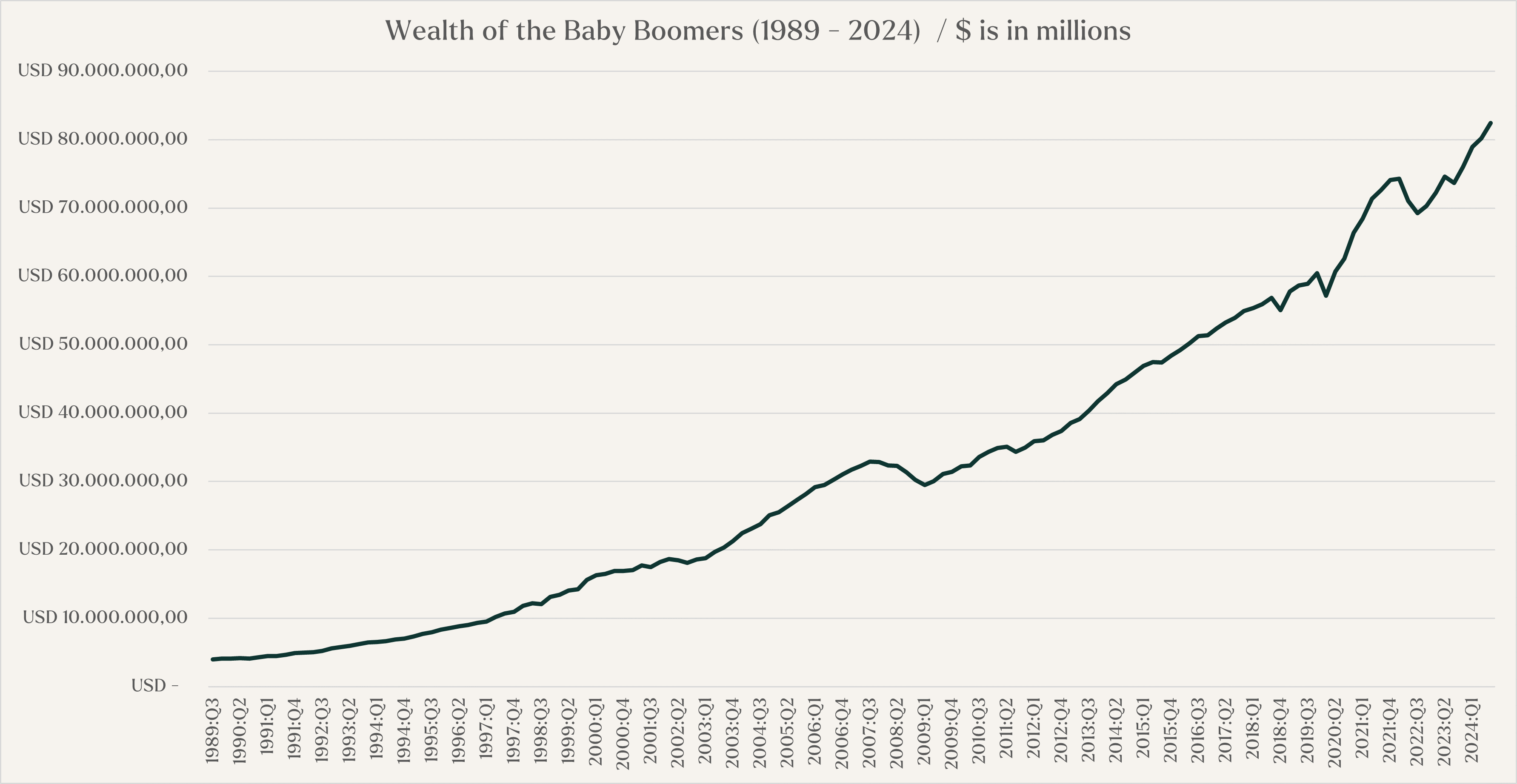

Baby Boomer

Baby Boomers, born between 1946 and 1964, represent a generation that grew up during a period of rapid population growth and post-war economic expansion. Over the decades, they have accumulated an extraordinary amount of wealth. In 1989, Baby Boomers held $4 trillion in assets—a figure that has since surged to $82.48 trillion. Today, they control over half of all wealth in the United States.

As this generation enters the later stages of life, they will be at the center of the largest wealth transfer in history, reshaping financial markets and investment landscapes for years to come.

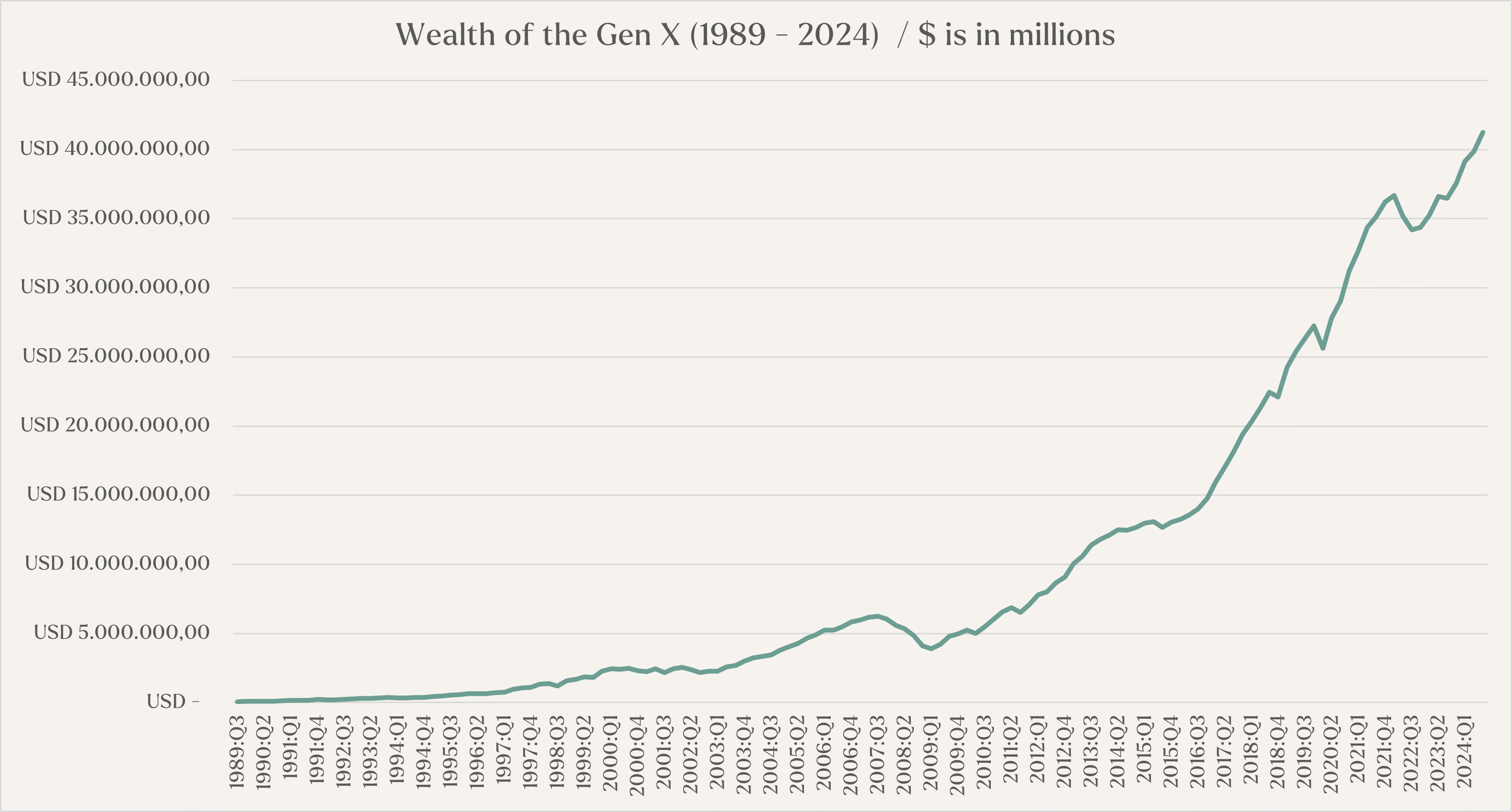

Generation X

Generation X, born between 1965 and 1980, is the second wealthiest generation in the U.S. Starting with just $0.08 trillion in 1989, they have since accumulated an impressive $41.26 trillion in wealth.

As this generation is still in its peak earning years—and with life expectancy continuing to rise—they are poised to build even greater wealth over time. In the short term, they are also set to benefit the most from the ongoing wealth transfer. More on this in the next section.

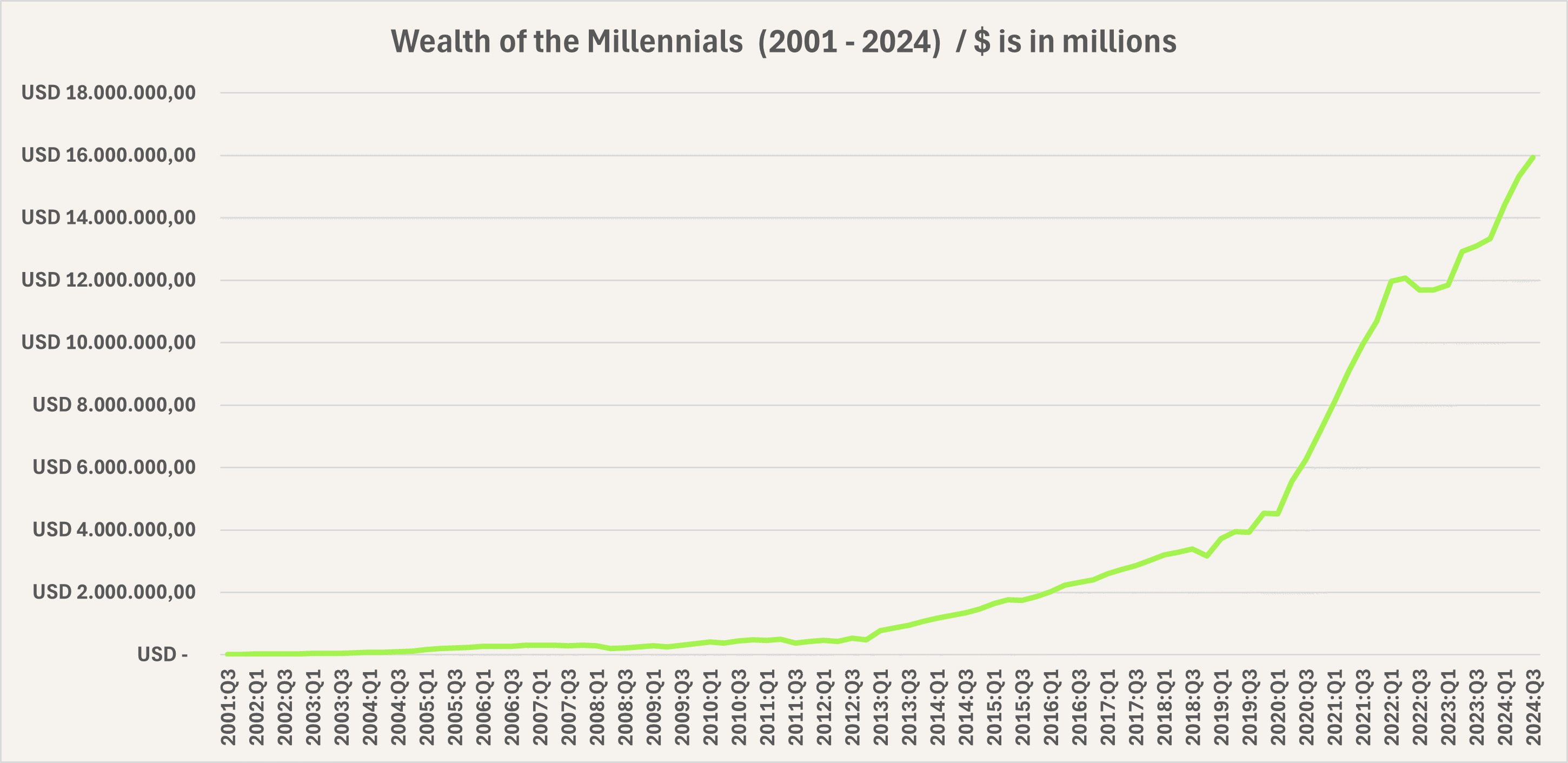

Millennials

According to the Federal Reserve, Millennials—defined as those born in 1981 or later—began accumulating wealth later than previous generations. In 2001, Millennials collectively held just $0.1 trillion in wealth. Although growth was initially slow, reaching $1 trillion by 2013, their total wealth has since surged to an impressive $15.95 trillion in a relatively short time.

Generation Z

It’s important to note that while the Fed categorizes Millennials as those born from 1981 onward, a new generation also falls within this timeframe: Generation Z, typically defined as those born between 1997 and 2012. Though still young, Gen Z is often grouped with Millennials for data purposes. As the great wealth transfer unfolds, this generation stands to benefit significantly—making it a key focus of our analysis.

From whom and where will this wealth shift?

According to the Cerulli report, an estimated $124 trillion in wealth will be transferred by 2048, with $105 trillion expected to pass to heirs and $18 trillion allocated to charitable causes. Baby Boomers and older generations will account for nearly $100 trillion of this transfer, representing 81% of the total.

While Millennials are set to inherit the most wealth over the next 25 years—approximately $46 trillion—Gen X will receive the largest share in the next decade, inheriting $14 trillion compared to Millennials’ $8 trillion. Together, these two generations will be the primary beneficiaries of this historic wealth transfer, collectively inheriting $85 trillion. An estimated $11 trillion in assets is set to be inherited by Generation Z.

The investment characteristics of Millennials and Generation Z

As Millennials and Generation Z will inherit an estimate of $56 trillion, their investment decisions will impact the capital market for years to come. But what are the investment needs and objectives of these generations?

Millennials

- It’s no surprise that millennials are leveraging technology and social media to actively invest in the assets of their choice.

- Social and environmental responsibility often play a crucial role in their investment decisions.

- Compared to older generations, millennials are allocating a larger portion of their portfolios to digital assets.

Generation Z

- Gen Z is entering the investment world early, with an average starting age of 19.

- Digital assets are a key component of their portfolios, with 55% of U.S. Gen Z investors holding these assets.

- Their investment strategies are highly tech-driven, relying on mobile apps and robo-advisors for portfolio management.

The impact of this wealth shift on digital assets

We anticipate that digital assets will be a major beneficiary of the upcoming generational wealth transfer, particularly from Millennials and Generation Z. Having grown up in an increasingly digital and tech-driven world, these generations are naturally more inclined toward digital innovation. Moreover, digital assets already hold a significant place in their investment portfolios. If this trend continues, we could see a substantial influx of capital into the market.

Currently, the total market capitalization of digital assets stands at approximately $3.3 trillion—a fraction of the size of traditional financial markets. If just 1% of the estimated $56 trillion in generational wealth transfer flows into digital assets, that would amount to $560 billion, creating a significant impact.

While Baby Boomers and Gen X shaped the financial markets of the past, we believe Millennials and Gen Z will define the future. Given their affinity for digital assets, it seems inevitable that this sector will play a crucial role in the next era of capital markets.