What is the Real-World Asset Narrative?

In recent years, the digital assets industry has seen a rise in the significance of topics such as Decentralized Finance (DeFi) and Artificial Intelligence. Within this landscape, strong themes, beliefs, or ideas that influence perceptions and values of cryptocurrencies are referred to as "narratives." These narratives hold sway over investor sentiment, market trends, and the adoption of new technologies. In 2023, a powerful narrative gaining traction is the real-world assets (RWA) narrative. In this blog, we highlight its emergence, growing popularity and projected future impact.

What are Real-World Assets?

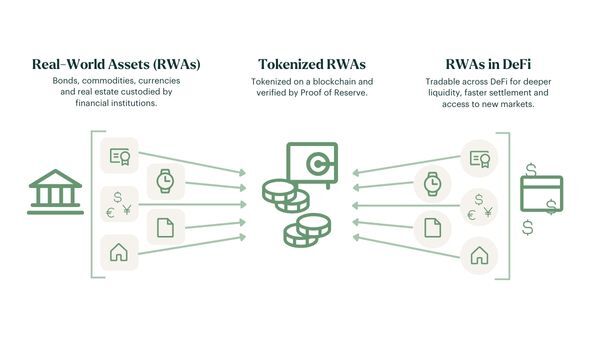

RWA exist physically but are also tokenized on-chain, becoming a source of yield within the broader DeFi landscape. With the physical world hosting a vast array of assets, the RWA sector is rapidly expanding, offering an array of products and services. Pinpointing the exact start of this narrative is quite challenging. Some argue that the inception of the first dollar-pegged stablecoin marked the initial tokenization, introducing an RWA to the blockchain.

Over time, smart contract networks like Ethereum gained popularity, introducing more users to tokenization concepts. Consequently, more users sought to tokenize RWAs, and as is common in technology, they built upon each other's work. This led to the introduction of increasingly complex instruments in the market.

The more straightforward assets for tokenization include real estate, precious metals, commodities, and art. This ease arises from the involvement of a centralized third party that stores these assets and offers their tokenized versions on smart contract platforms.

Consider non-fungible tokens (NFTs), for example, a vendor can tokenize his luxury watches with an NFT, which represents ownership of the asset. Users can acquire the watch through the blockchain and the vendor will put the watch in storage until the user redeems it. Meanwhile, the owner of the NFT can choose to redeem the watch or choose to sell the NFT, the ownership of the watch, to another user, within the digital assets industry.

Tokenizing fungible assets, such as gold, follows a relatively simple process. For example, one token represents one ounce of gold, worth ~$2000, so if users buy $2000 worth of gold they get one token. However, as it’s tokenized they can buy $200 worth of gold receiving 0.1 tokens. The token amount will remain the same, but the price of the underlying asset fluctuates, so if gold increases to $2500, the user will receive $250 for his 0.1 tokens. The big advantage is that these gold tokens can be divided into increments as small as 0.000001 which is difficult for physical gold. As in the previous example, this token can be redeemed for money or traded against other assets in the DeFi ecosystem.

RWA Gaining Popularity

In 2022 and 2023, the RWA sector transformed with a sudden surge in interest rates, consequently elevating bond yields. As the safer yields of U.S. treasury bonds became more appealing amid the expensive cost of borrowing, the digital asset market faced a downturn, witnessing a significant liquidity outflow. This prompted DeFi protocols to explore other opportunities to generate revenue and attract liquidity.

To adapt, DeFi protocols began offering users access to US treasury bonds through their platforms. Typically, these offerings require users to undergo Know-Your-Customer (KYC) verification to access these investment vehicles. Once verified, users can deposit stablecoins to acquire bonds, earning the interest minus a fee for the service and maintaining their exposure and capital in the cryptocurrency market.

The DeFi ecosystem also saw the rise of private credit offerings. Within this framework, companies seeking capital can apply for loans through a DeFi protocol. The protocol establishes a loan agreement, specifying details like the principal amount and interest rate, which is then made available on their platform. Users on the platform can choose to invest in these offered loans by depositing stablecoins. These stablecoins are subsequently loaned to the aforementioned businesses. While certain DeFi protocols don’t mandate KYC procedures for these investments, the majority do require it.

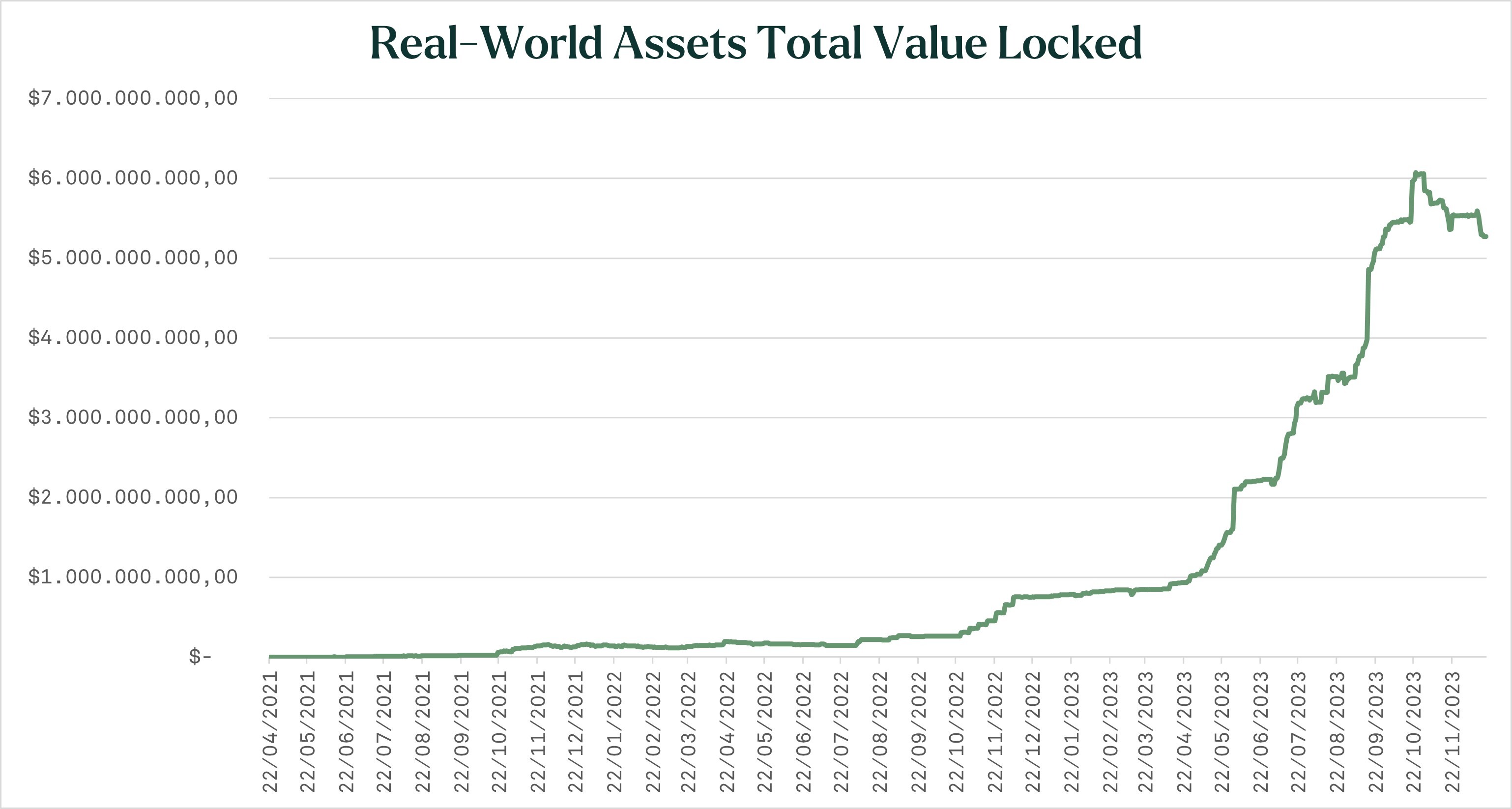

Although requesting a KYC process goes against the decentralized and pseudonymous nature of the industry, it hasn’t held back users from investing in these products. As seen in the illustration above, the popularity of the RWA sector has surged to incredible heights. As 2023 started, the total value locked (TVL) in RWA protocols was below $1B, as the industry moved towards the end of 2023, it holds the $5,5B mark, a significant increase.

The two largest protocols by TVL, Maker RWA and stUSDT, collectively account for slightly over $5 billion within the industry. As a result, the RWA sector is considerably imbalanced. However, the industry is witnessing the emergence of several smaller RWA protocols like Maple Finance and BackedFi, experiencing an upward trajectory. With the sector's ongoing expansion in value and user base, there's potential for the imbalance to correct itself over time.

The Future of RWA

As mentioned earlier, the RWA sector has seen remarkable growth, attracting an increasing number of users toward diverse investment opportunities. We strongly believe that RWA will evolve into a crucial pillar within the digital assets industry, unlocking new possibilities for businesses beyond its boundaries.

A key factor in this anticipated growth is RWA's provision of a sustainable yield source within DeFi. Unlike previous strategies solely reliant on digital assets like staking, liquidity provision, and arbitrage, RWA enables users to earn stable yields independent of the market. This ensures that users can still generate returns even during a market downturn or reduced trading activity. Additionally, it enhances market liquidity by drawing in new users and creating fresh investment prospects.

Moreover, the RWA sector extends access to liquidity for businesses in emerging or undercapitalized markets. One of the inherent advantages of digital assets is their inclusive nature, enabling virtually anyone to participate in the market. For businesses previously excluded from financial markets or situated in emerging economies, DeFi protocols offer a route to liquidity—provided the business is deemed investment-worthy.

A significant driver lies in the RWA sector serving as a bridge between traditional and digital realms. Users can leverage the stable yield of traditional assets while benefiting from the unique attributes of the digital assets industry, such as rapid transaction finality and transparent operations. We believe that RWA and blockchain can create an interoperable and efficient financial network, ushering in a new era of DeFi and capital markets.

Sign up for our newsletter to stay on top of the crypto market.