Market update: April

Market update: April

Introduction

Welcome to our first market update. In January, we requested feedback from our investors to see how we can improve our services. Many respondents indicated that they would like more frequent updates about the cryptocurrency market. We understand this sentiment very well as the market develops at a rapid pace and prices follow accordingly. Therefore, we will publish an additional market update halfway through the month. In this update, we will walk you through the latest developments in the market and take a look at the most important cryptocurrency news.

Global market slump drags crypto along

The first two weeks of April were dominated by a downward trend in financial markets. Despite the favorable rate hike in March, investors were cautious due to hawkish statements by the FED. Jerome Powell, chairman of the FED, didn’t exclude the possibility of multiple 0.50% rate hikes this year and he also shared plans to shrink the US balance sheet by a rate of up to $95 Billion a month.

Many investors, therefore, de-risked their portfolios leading up to the publication of the inflation numbers on April 12th. A higher-than-expected inflation rate may lead to stricter policies by the FED, whereas a lower inflation rate may lead to milder policies. Which in turn, provides more room for higher-risk investments. The published number, year-on-year inflation of 8.5%, fell in line with the expectation of economists. The market was relieved, however, it wasn’t enough to initiate an upward move. The FED meeting was followed by a neutral sideways movement.

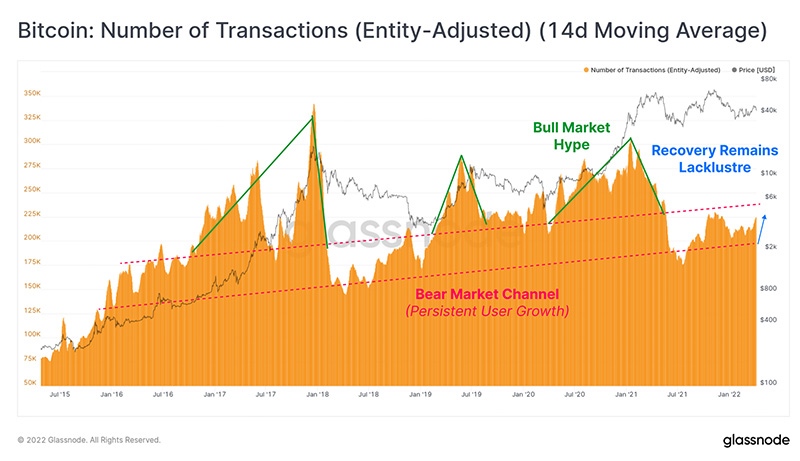

The declining interest of investors is also visible in several on-chain analyses. There is a low inflow of new investors, the amount of daily active users is at the lower bound and the amount of transactions is relatively lackluster. At this moment the market is being guided by long-term holders. They hold on to their positions, whereas short-term investors quite often sell at a loss.

Adoption of cryptocurrency advances

Despite the declining interest of investors, the institutional adoption of cryptocurrency keeps expanding. The biggest announcement of Bitcoin 2022, the biggest Bitcoin conference of the year, was the collaboration of Strike, a digital payment provider on the Bitcoin-Lightning Network, and Shopify: a worldwide supplier of e-commerce software. The incorporation of Strike allows 1.5 million merchants to receive Bitcoin payments in their webshops.

Shortly after the announcement, Strike also shared the partnerships with NCR, the world’s leading provider of payment solutions & POS systems. Another remarkable announcement was the collaboration between Tesla, Block, and Blockstream. Together they plan to build a Bitcoin-mining facility powered by solar energy. Another step towards a greener Bitcoin Network, an argument that currently withholds many investors.

Last month we already mentioned the ambition of multiple nations to lead the blockchain and cryptocurrency market. This month we have seen a continuation of this trend. UK’s Economic Secretary to the Treasury, John Glen, announced a plan to create the “world-leading regime” for regulated trading of cryptocurrencies and the possible acceptance of stablecoins in the British economy.

The rapid development of the cryptocurrency market was also showcased in this year’s Midas List. The list of the world’s best Venture Capitalists, is being led by a VC active in the cryptocurrency industry. This year, Chris Dixon from Andreessen Horowitz (A16z) tops the list due to its early-stage investments in Coinbase, Uniswap and Avalanche.

The investor’s guide to cryptocurrency

The survey carried out earlier this year has given us the valuable insight that many of our investors and email subscribers would like to have some basic cryptocurrency knowledge. That is why we have created a cryptocurrency guide meant for investors. In this guide, we will walk you through the evolution of money, the rise of cryptocurrencies, and the various applications cryptocurrency can have in our society.

Every two weeks we will share a chapter of this guide in a new blog series. Today we will look into the evolution of our money and the rise of a digital revolution as a result of the worldwide Financial Crisis of 2008.

Learn more about crypto investment with our comprehensive guide. Read the first chapter here.

Receive our newsletter to stay on top of the crypto market.