Market update: August

- The road to Spot Bitcoin ETFs continues

- SEC delays decision on Spot Bitcoin ETFs

- The first Spot Bitcoin ETF live on Euronext

- Institutions start applying for Ether ETFs

- PayPal launches its stablecoin

- Hong Kong enables the trading of digital assets for retail investors

The road to Spot Bitcoin ETFs continues

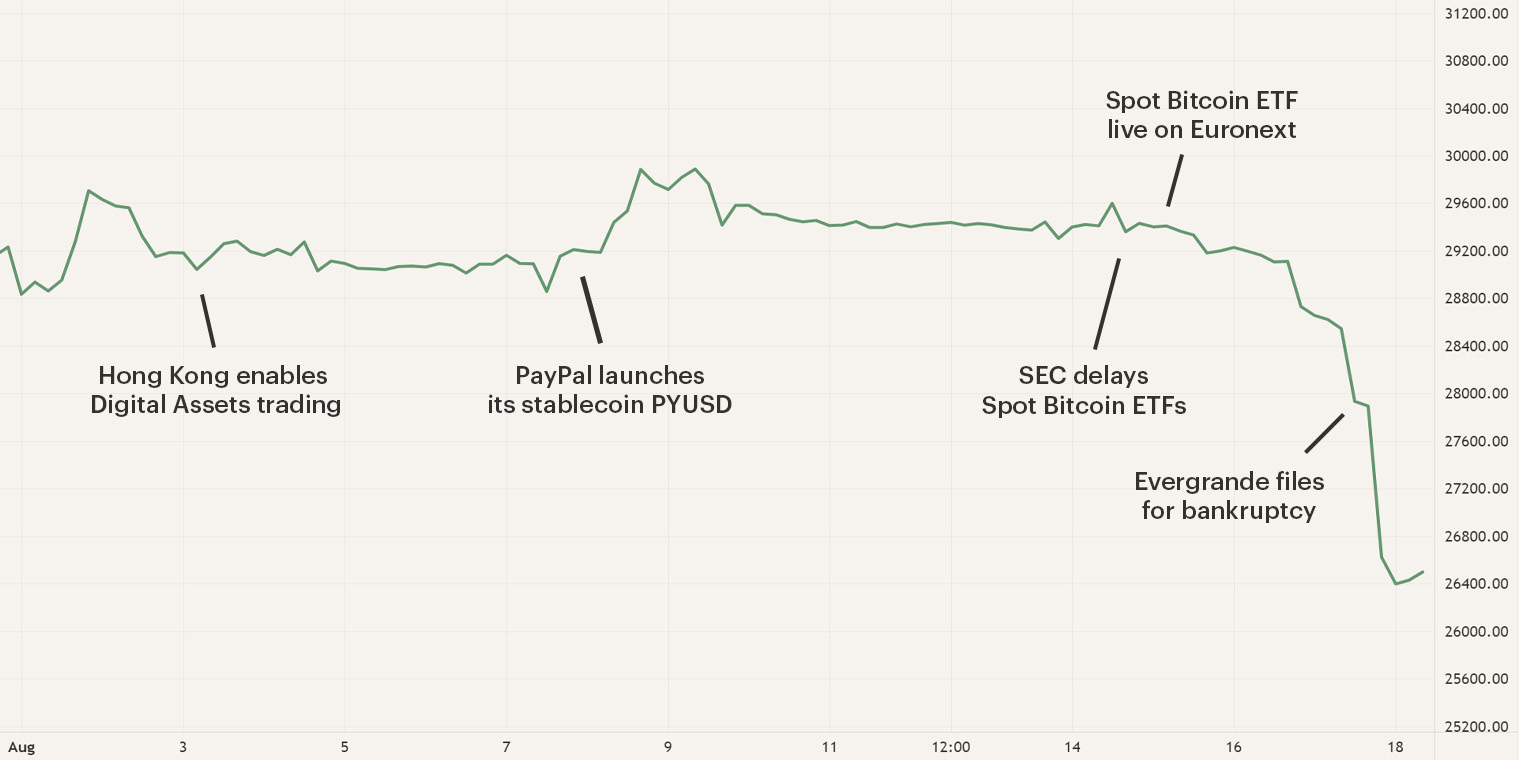

After the various applications for Spot Bitcoin ETFs, this month it was the SEC's turn to make its first ruling. Not unexpectedly, we saw a request for a delay for all applications. This will push the next deadline to early 2024. Remarkably, on the same day as the ruling, the first Spot Bitcoin ETF went live on Euronext in Amsterdam. So with this going live and the upcoming legislation around MiCAR, Europe is taking the lead in adoption.

After we saw prices fall slowly in the third week of August, a rapid decline in the entire market followed on August 17. We saw a similar delcine in the stock market. This came as a result of worsening economic data from China. The consumer spending fell, unemployment rose and the crisis in the real estate market continues. The latter became evident when Chinese real estate giant Evergrande filed for bankruptcy in the U.S. on Aug. 17. A few hours prior to this news there were also reports that SpaceX would have depreciated its Bitcoin reserves by $373 million. This news caused a rapid price drop and a cascade of liquidations that briefly pushed the Bitcoin price toward $25,000. At the time of writing, the price has stabilized around $26,400.

Furthermore, in early August we saw Hong Kong further open its doors to the crypto market with the legalization of trading cryptocurrencies. We also saw PayPal launch its own stablecoin (PYUSD) and several financial institutions apply for Ether ETFs. The month of August so far has been very much about the continued embrace of cryptocurrencies.

SEC delays decision on Spot Bitcoin ETFs

This month, the SEC approached the first deadlines for the Spot Bitcoin ETF applications. The first ETF application was from Ark Invest. Two days before the deadline, the SEC announced that it was pushing the deadline for all applications forward by several weeks, possibly even months. Currently, there is also a lawsuit pending that Grayscale filed against the SEC. The lawsuit was filed by Grayscale, accusing the SEC of being negligent in approving their application to convert the Grayscale BTC Trust into a Spot Bitcoin ETF. Several Bloomberg analysts, based on their sources, have expressed that they expect a ruling on the case this week. However, there is a chance that this decision will also be pushed forward, though the court may impose a date when the SEC must rule on the application.

The first Spot Bitcoin ETF live on Euronext

Where the SEC moved to delay, the first Spot Bitcoin ETF became tradable in Amsterdam. The Jacobi Bitcoin ETF from Jacobi Asset Management became tradable on Euronext Amsterdam on August 15. This makes it the first Spot Bitcoin ETF to enter the European market. Although this application was also considerably delayed since its initial release in 2021, this is a big step in further adoption. Together with the upcoming MiCAR legislation, this clearly shows that Europe is ahead of the United States. The ETF is tradable under the ticker BCOIN and is co-created by Fidelity Digital Assets, Flow Traders, Jane Street and DRW.

Institutions start applying for Ether ETFs

After the rapid string of Bitcoin ETF applications in June, a slew of different Ether ETF applications followed this month. After BlackRock's initial Bitcoin ETF application, interest from institutional parties seems to be on the rise. Now several asset managers are also looking to issue an ETF for Ethereum. For now, these are only Future ETFs and not yet a Spot ETF where the assets really need to be held as collateral. Meanwhile, Volatility Shares, Bitwise, Roundhill, VanEck, Proshares, Direxion, Valkyrie and Grayscale have all filed applications with the SEC.

For now, the ambiguity surrounding regulation in the U.S. remains a hot topic. Although more and more parties are speaking out positively about Bitcoin, this does not necessarily apply to other cryptocurrencies. Nevertheless, the SEC has given an initial indication that it may approve the ETF applications. This would also be in line with the approval of previous futures-based ETFs for Bitcoin.

PayPal launches its stablecoin

On the seventh of August, payment provider PayPal launched their dollar-pegged stablecoin on the Ethereum network, becoming the first major technology firm to embrace digital assets for payments and transfers. The stablecoin is issued in collaboration with Paxos, a firm that builds regulated blockchain and digital assets solutions, the firm also issued the stablecoin BUSD, which has halted the issuance due to regulatory scrutiny.

PayPal’s stablecoin will be issued with the ticker PYUSD and will have the same features as other stablecoins as it’s fully backed by U.S. dollar deposits, short-term U.S. treasuries and similar cash equivalents, and can be redeemed 1:1 for U.S. dollars. Stablecoins such as USDC and USDT follow a similar backing method. As the stablecoin rolls out, eligible U.S. PayPal customers who purchase PayPal USD will be able to transfer, send, fund purchases and convert the stablecoin within the PayPal platform

However, there is also some controversy due to the centralized functions that PYUSD's Smart Contract has. For example, PayPal can freeze the balance of PYUSD on another wallet and even erase the entire balance. In addition, the asset is linked to your PayPal login and requires the user to go through a verification process. This makes stablecoin more centralized than many others, but nonetheless, this remains a big step forward toward a better user experience. The arrival of PayPal may therefore be a starting shot for other companies to enter the market.

Hong Kong enables the trading of digital assets for retail investors

On the third of August, HashKey exchange and OSL Digital Securities announced that they have acquired Hong Kong’s first cryptocurrency exchange licenses, which will allow exchanges to retail customers. Both exchanges were first only allowed to offer their services to professional investors, which may have helped the new approvals as the first checks were already made, but will now access a greater number of potential investors. OSL Digital Securities announced in its statement that individuals can immediately register on its platform and access their products. The exchange will start with the offering of Bitcoin and Ethereum and is soon expected to increase its offerings.

This move follows HSBC Hong Kong's announcement of July in which it stated that it would allow its users to trade Bitcoin and Ethereum ETFs on the Hong Kong Stock Exchange. So far, however, these are still future-based ETFs. Besides Europe, Hong Kong also seems determined to become a leading player in the digital assets market.

Sign up for our newsletter to stay on top of the crypto market.