Newsletter: Recap July

Newsletter: Recap July

Welcome to our newsletter of July 2022. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl, and the latest cryptocurrency news.

Sentiment turns after first signs of recovery

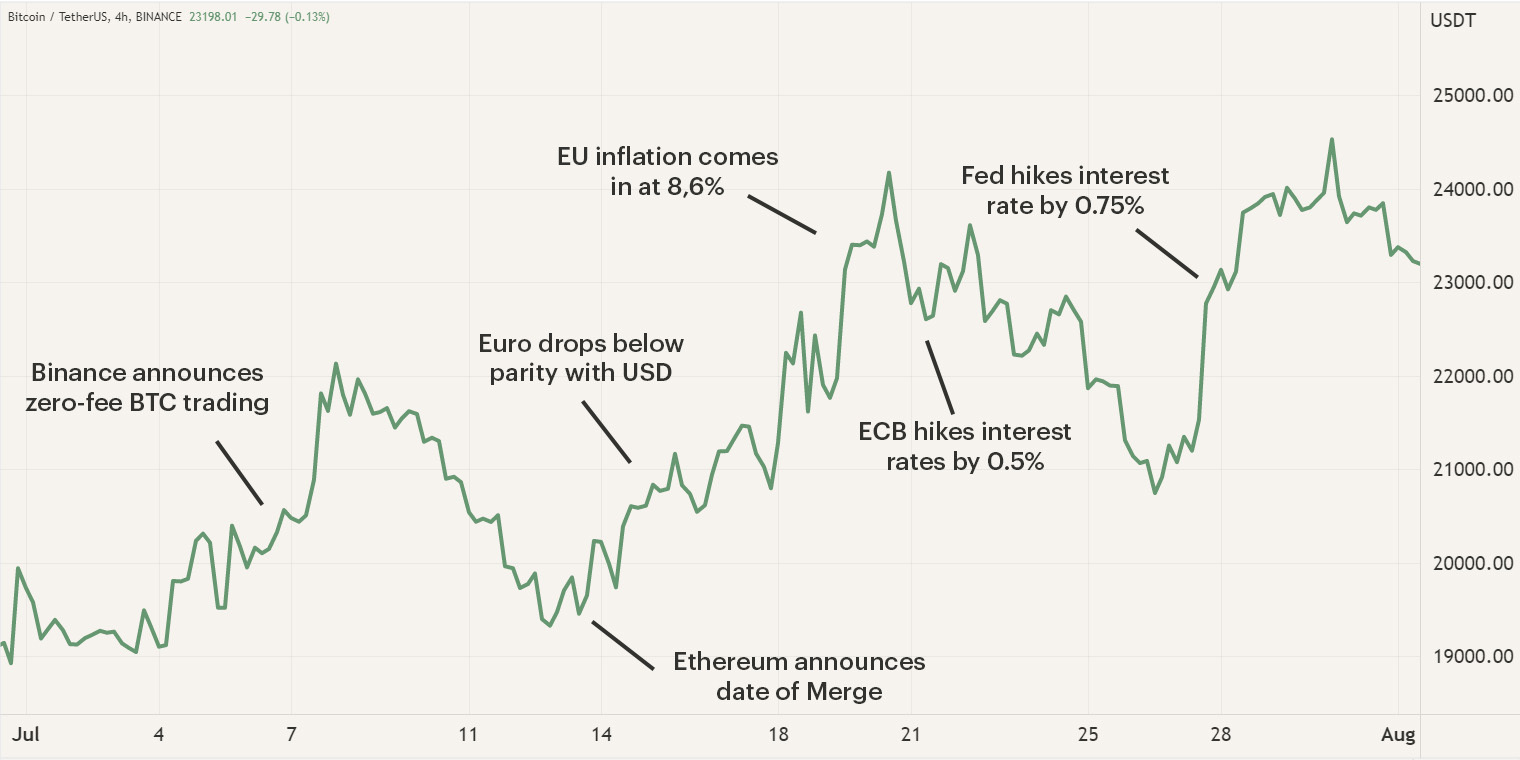

The month of July allowed the sentiment in the market to cautiously move towards a more positive stance. The cryptocurrency market showed initial signs of recovery, leading to short rallies of Bitcoin towards $22K and later $24K. As the entire market followed this trend, signs of a possible upwards trajectory were being displayed. In traditional markets, the dollar became stronger. The rate hikes introduced by the Fed over the past few months have significantly improved the position of the dollar as investors seek an alternative currency where the difference between inflation and interest is bigger. This has caused the euro to reach parity with the dollar. You can read more about the events that caused the parity in our market update of July.

In the second half of the month, we saw this move accelerate when Ethereum announced an expected date of the Merge, a critical new update of the network. The Merge has been long anticipated by investors as it has been postponed a few times. Ethereum led the upward move but soon the entire cryptocurrency market followed. As the FOMC meeting closed in we saw volatility increase. When the outcome of the meeting matched the expectations, the market continued its upward trajectory.

Ethereum Foundation announced expected date of The Merge

Halfway through July, Tim Beiko, a core developer of Ethereum, announced that the expected date of the Ethereum Merge is going to be the 19th of September. Currently, Ethereum operates on the consensus mechanism called Proof-of-Work (PoW), which requires increasing computing power to validate the network.

To improve the energy efficiency of Ethereum, developers created the Beacon Chain, a Proof-of-Stake (PoS) version of Ethereum. PoS is more energy efficient as the protocol chooses validators that may verify the next block instead of requiring computing power, lowering the energy consumption by 99.95%. This is significant progress for the whole crypto ecosystem as Ethereum is the second largest cryptocurrency and thousands of protocols are built on the network. The announcement of the Merge date caused Ethereum's price to rally by 60% in a timespan of two weeks.

On the 21th of July, Vitalik Buterin, founder of Ethereum, shared his insights about the future of Ethereum and the upcoming phases after the Merge. The Merge is one of the five key phases on which Ethereum is working; it consists of the Merge, Surge,Verge, Purge and Splurge. These phases will aid in the scalability and congestion of the network with an eventual goal of processing 100,000 transactions per second.

Fed follows suit with an additional 0.75% rate hike

Where we saw the ECB increase its interest rate by 0.5% on July 21, we saw the Federal Reserve (Fed) follow suit at their FOMC on 27 July. The Fed announced an interest rate hike of 0,75%, increasing the benchmark rate to 2,25 - 2,5%. In anticipation of the announcement, the market experienced volatility as there was speculation that the Fed was to react more hawkish with a possible increase of 1%. As the Fed announced the actual interest rate, it provided some relief as the market already priced in the 0.75% hike. Bitcoin continued its upwards trajectory to $24K in the days after.

The Fed has now increased the interest rate for four consecutive meetings, the next Fed meeting will be in September. The Fed pointed out its next move will be determined by the latest data. We will therefore have to see how inflation responds to the current monetary policy and the economic conditions.

The Hodl funds

The relief of the market also led to a positive performance of the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of €3.32, €3.28 and €0.39.

Check your personal results here.

Team expansion

In addition to the new colleagues introduced in the market update, we want to introduce another two new members of the Hodl team. Xavier Goby has started as Back-end Developer and Celin Birol has converted her successful internship into a role as Content Marketeer.

Xavier: "I have long been intrigued by the world of financial investments and especially by the FinTech sector. Although I am an Aerospace Engineer by academics, I have previously interned at Shell's Power Trading division as an AI & Data Scientist. I find this new opportunity to further professionally develop myself at HODL amazing and I’m truly thrilled to start."

Celin: "After my pleasant and educational internship in which I researched the possibilities to improve the marketing-sales processes, I was certain that I wanted to continue working in the fast-paced environment of Hodl. I’m excited to officially join the Hodl team and continue my journey as a content marketer."

Cashcow nominated: Best Dutch Crypto fund

We are proud to announce that Hodl has been nominated for the Cashcow awards 2022 in the category of Best Dutch Crypto fund. The Cashcow awards are an initiative of Cash magazine, cashcow.nl and investor club Bull Up. Every year, the committee awards organizations which are the best in their field, and after an eventful year we are pleased to be nominated.

To proceed to the next round, we would highly appreciate it if you take the time to cast your vote for Hodl. You can find Hodl’s nomination at the 9th question. If you don’t have a preference for the other questions, you can simply skip those by voting N.V.T. (Non-applicable). Cast your vote through link below!

European Blockchain Convention

Last month, the European Blockchain Convention (EBC) took place in Barcelona. The EBC is one of the most influential European conferences in blockchain and crypto, a perfect opportunity to introduce Hodl to a larger audience and share our observations of the market. Our CEO Maurice Mureau was one of the speakers and shared his views on the current macroeconomic state and how cryptocurrency is finding its way into traditional investment portfolios. To learn more about the role of cryptocurrency in a modern investment portfolio and the perspectives of institutional investors, you can now watch the recording below.

Sign up for our newsletter to stay on top of the crypto market.