Newsletter: Recap June

- Bitcoin recovers after a downward trend

- Organizations file for Bitcoin spot ETFs

- Binance leaves the Netherlands

- Institutions start acquiring MicroStrategy

- BCOI and UBS launched regulated securities on Ethereum

- The Hodl Funds

- Hodl - Dutch Blockchain Days

- Hodl Research: Layer 2 Report

Bitcoin recovers after a downward trend

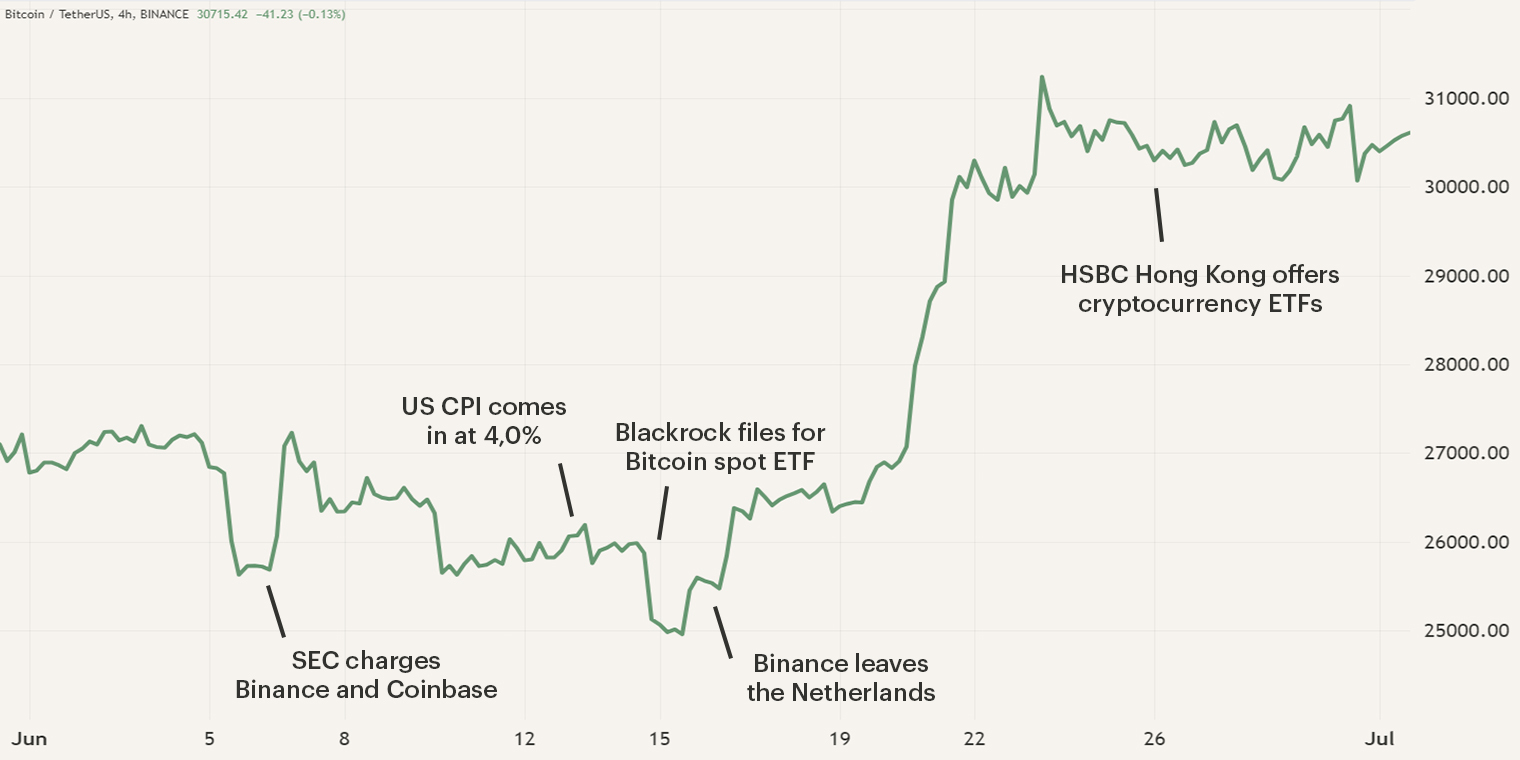

June was a remarkable month as a great deal of positive and negative events occurred. In the first two weeks of June, the market witnessed one of the largest hacks of the year, with wallet provider Atomic experiencing the theft of $100M in client funds. In the following days, the Security and Exchange Commission (SEC) charged leading exchanges, Coinbase and Binance, with operating as unregistered security exchanges, resulting in high levels of volatility. Where Bitcoin traded slightly above $27,000 at the beginning of June, the negative sentiment and regulatory actions pushed the digital asset's price down toward $25,500.

The focus then shifted toward the publication of the U.S. CPI figures and interest rates. The overall CPI is displaying a downward trend, however, the Core CPI remains rather high at 0,4%. With inflation slowly cooling down, the Federal Reserve has decided to halt one of its most aggressive campaigns at an interest rate of 5,25%. You can read more about the events during the first half of the month in the Market Update of May.

The news in the second half of July was in favor of the market as we saw an increasing amount of positive news come to light. We saw BlackRock, the world’s largest asset manager, apply for a Bitcoin spot ETF, which was swiftly followed by other organizations applying for the Holy Grail of traditional investment vehicles. Furthermore, we saw Hong Kong become increasingly active as HSBC Hong Kong enabled cryptocurrency exposure for its clients and the introduction of the first regulated security on Ethereum. The consecutive publication of positive news caused positive sentiment to resurface, causing Bitcoin to rally above $30,000.

Organizations file for Bitcoin spot ETFs

On the 15th of June, BlackRock filed an application at the SEC for a Bitcoin spot exchange-traded fund (ETF). An ETF is a type of investment fund that trades on stock exchanges, representing a diversified portfolio of assets such as stocks, bonds, or commodities. In 2021, we saw the introduction of the first Bitcoin ETF, however, this was a futures ETF, which doesn’t have to acquire Bitcoin, it solely consists of investment contracts. A spot ETF is required to buy and store Bitcoin, which will allow traditional investors to acquire Bitcoin through the stock exchange. Additionally, these investors don’t have to worry about the storage and security of their acquired assets.

In 2022, BlackRock entered the digital asset market by allowing certain clients to buy and trade Bitcoin while using Coinbase as their custodian. Applying the ETF is a massive step for the market; again, Coinbase will act as its custodian. However, three other firms such as Van Eck previously filed for a spot ETF, and all three were rejected by the SEC. It remains the question if the SEC will approve the filing of BlackRock but it seems that a shift in interest has occurred because as June progressed, Valkyrie, Invesco, WisdomTree and Bitwise all applied for a Bitcoin spot ETF.

In addition to spot ETFs, on the 20th of June Deutsche Bank reportedly applied for a digital asset custody license. This shift occurred very quickly after the bank's investment arm showed interest in investing in two German cryptocurrency firms. Slowly we see traditional institutions gaining exposure to the digital asset sector even though regulatory actions caused negative sentiment within the market.

On the 30th of June, the SEC published a statement that the recent filings to launch a spot ETF were inadequate and not sufficiently clear. This is unfortunate but the problem isn’t as big as it seems as the asset managers can update their applications and refile.

Binance leaves the Netherlands

On the 16th of June, Binance announced that they are leaving the Dutch market with immediate effect. From the 17th of July, Dutch residents can only withdraw their assets from the platform as purchases, trades and deposits are disabled. Binance is leaving the Dutch market due to a virtual asset service provider (VASP) application. An entity that engages in financial activities involving virtual assets, such as exchanges, needs to be registered as VASP at the watchdog of that jurisdiction. After months of comprehensive registration application, de Nederlandsche Bank (DNB) has decided to reject Binance’s application.

[embed id=26]

Binance has emphasized that they are committed to obtain all the necessary regulatory approvals to offer its products and services to Dutch residents. The exchange stated that they are working intensively to be compliant with forthcoming Markets in Crypto Assets Regulation (MiCAR). This new European Union regulation will significantly reduce the barriers to entry into the Dutch market for Binance. However, this is an ongoing process that will take some time to complete, so we expect that Binance won’t return to the Netherlands during 2023 and with a bit of luck see the reentry in 2024.

We would like to emphasize that the Hodl Funds aren’t affected by Binance leaving the Dutch market and that operations will continue as before. If you want to read more about the departure of Binance, if this may have affected you and what to do if your funds are located on Binance, please read the news article through the button below.

Institutions start acquiring MicroStrategy

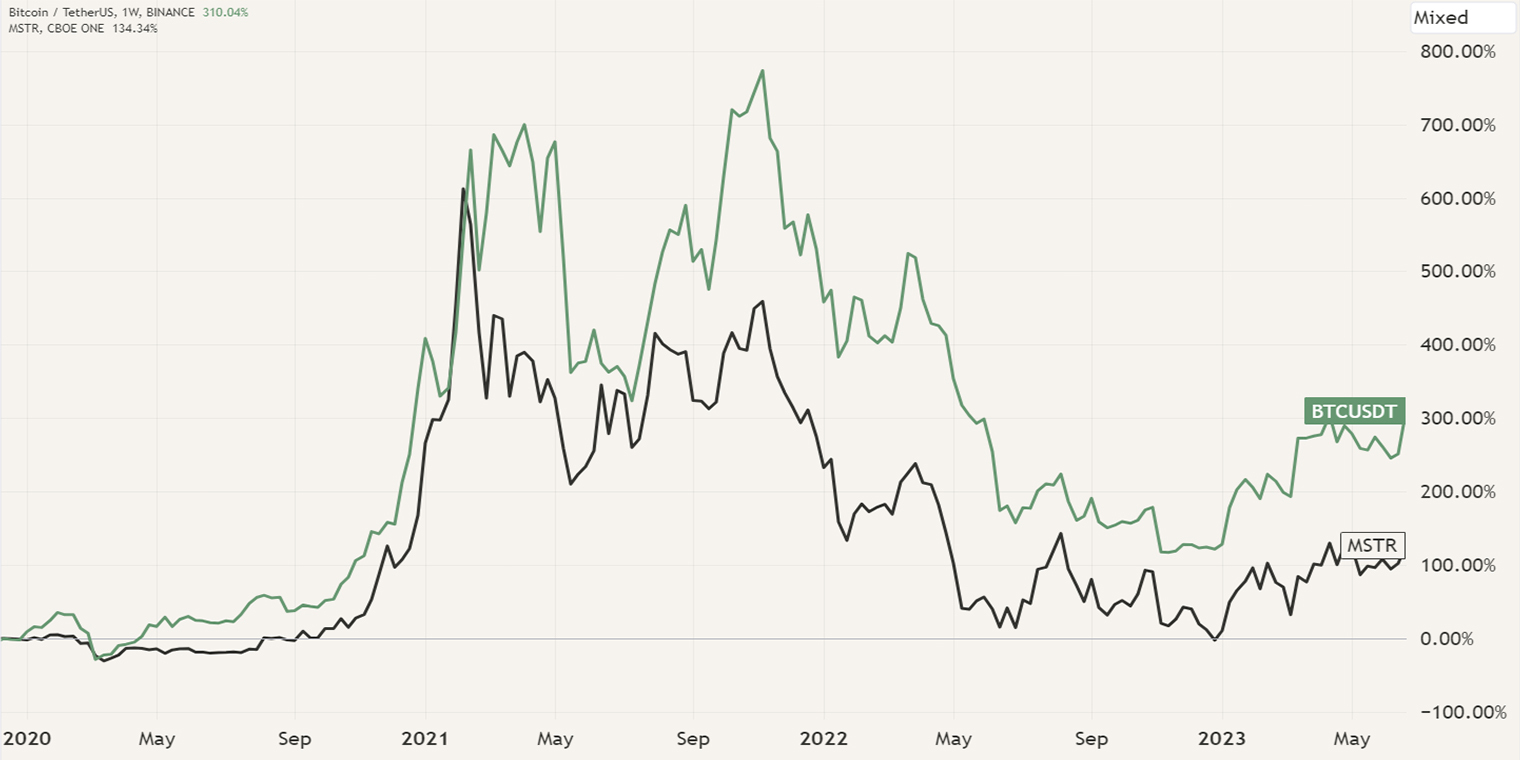

One of the biggest holders of Bitcoin is the company MicroStrategy which provides intelligence, mobile software and cloud-based services. On the 29th of June, the organization stated they acquired over 12,000 BTC for $347M, bringing their total holding to 152,333 BTC worth over $4,6 billion. 50,000 of these holdings were acquired over the past two years, lowering their average entry.

During the first quarter of 2023, the firm experienced an increase in its stock purchases as BlackRock and Fidelity added MicroStrategy to their balance sheet. Many expect that these organizations purchase MicroStrategy as it somewhat acts as a Bitcoin ETF. Due to the significant Bitcoin holding of the firm, the stock price displays a strong correlation with Bitcoin. Many market participants suspect that traditional investors and organizations use MicroStrategy as a way to gain exposure to the crypto market.

Currently, it seems that interest in the digital asset market is slowly returning to the traditional markets. The application of Bitcoin spot ETFs has caused traditional institutions to position themselves more openly toward the market. Additionally, if the various Bitcoin spot ETF applications are denied, MicroStrategy is the first close thing to gaining cryptocurrency exposure through traditional channels.

BCOI and UBS launched regulated securities on Ethereum

On the 9th of June, the BCOI, the wholly-owned investment bank of the Bank of China, issued a total of $28M in digital structured notes on Ethereum. This has made the BCOI the first Chinese financial institution to issue a tokenized security in Hong Kong. The digital notes were created in collaboration with Swiss Bank UBS, which had issued $50M worth of tokenized fixed-rate notes in December 2022, however, this was on a permissioned blockchain.

The newly issued security is the first of its kind in the Asia Pacific as it constitutes under both Hong Kong and Swiss law and operates on Ethereum. This action marks a successful introduction of regulated securities onto a public blockchain. The introduction of regulated securities on Ethereum is a momentous milestone as financial instruments are being decentralized. We expect that by introducing these products, Hong Kong aims to attract more digital assets firms.

On the 26th of June, this vision was strengthened as the Hong Kong and Shanghai Banking Corporation (HSBC) reportedly introduced its first cryptocurrency services in Hong Kong. HSBC Hong Kong has enabled its customers to buy Bitcoin and Ethereum-based ETFs, allowing 1,7M clients to enter the digital assets market. According to local journalists, the bank will offer three ETFs which are listed on Hong Kong Exchanges, these are CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF and Samsung Bitcoin Futures Active ETF. This displays the determination of Hong Kong's willingness to adopt digital assets and to provide exposure to traditional investors. However, it’s important to note, all three ETFs are future-based, so no digital assets are acquired during the investment period.

The Hodl Funds

From this month, a new administrator will be calculating the Net Asset Value (NAV) of the Hodl Funds. Due to the complexity of the first NAV, the final NAV of June is taking longer than expected. For now, we would like to share the interim NAV while we continue to calculate the final NAV. We apologize for any inconvenience caused and assure you that future NAVs will be available sooner.

The volatile month of June has led to an increase and decrease in the Hodl funds as the holdings differentiate. The Hodl Gib Fund, the Hodl Algo Fund, the Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended at an interim Net Asset Value (NAV) of €965.00, €1,052.82, €2.97, €2.88, and € 0.36. True Asset Fund II ended the month with a NAV of €15,004.64. Clients of True Asset Fund can view their personal performance in the IQ-EQ portal. The final NAV will be published in the client portal on the 14th of July.

Hodl - Dutch Blockchain Days

On the 14th of June, Hodl attended and sponsored the Dutch Blockchain Days, the leading event in cryptocurrency and Web 3 in the Netherlands. During the event, Anton Skakur, our Head of Ventures, spoke on a panel about the Ventures division of Hodl and what his outlook is for the future. The event catered to a variety of speakers from digital asset firms to traditional institutions such as Deloitte and JP Morgan.

We are looking forward to participating in future events as the Dutch cryptocurrency ecosystem continues to grow and evolve. Over the past three years, we have seen not only an influx of firms entering the market but also a surge of interest. As the market still showcases a very big growth potential, it is interesting to connect and collaborate with local players in the market.

Hodl Research: Layer 2 Report

We are proud to announce that Hodl Research published the first industry report that delves deeper into the scaling solutions on Bitcoin and Ethereum. Over the past three years, both networks have welcomed millions of new users and this has caused the transactional activity to increase. Both underlying blockchains can process a limited amount of transactions and this increase has caused the networks to congest. Due to this congestion, users experience high transaction costs and long transaction times. To solve this issue, developers are looking for methods to increase the transactional throughput of the networks.

One of these methods comes in the form of Layer 2 solutions, these technologies can execute transactions off the main network while verifying these transactions on the main network. This lowers the stress on Bitcoin and Ethereum while leveraging their security and decentralization. To read more about the technologies, ecosystems, developments and our outlook regarding these Layer 2 solutions, access the report through the button below.

Sign up for our newsletter to stay on top of the cryptocurrency market.