Newsletter: Recap September

Newsletter: Recap September

Welcome to our newsletter of September 2022. Every month we create an overview of the performance of our Hodl funds, the developments within Hodl and the latest cryptocurrency news.

Tightening Monetary Policy

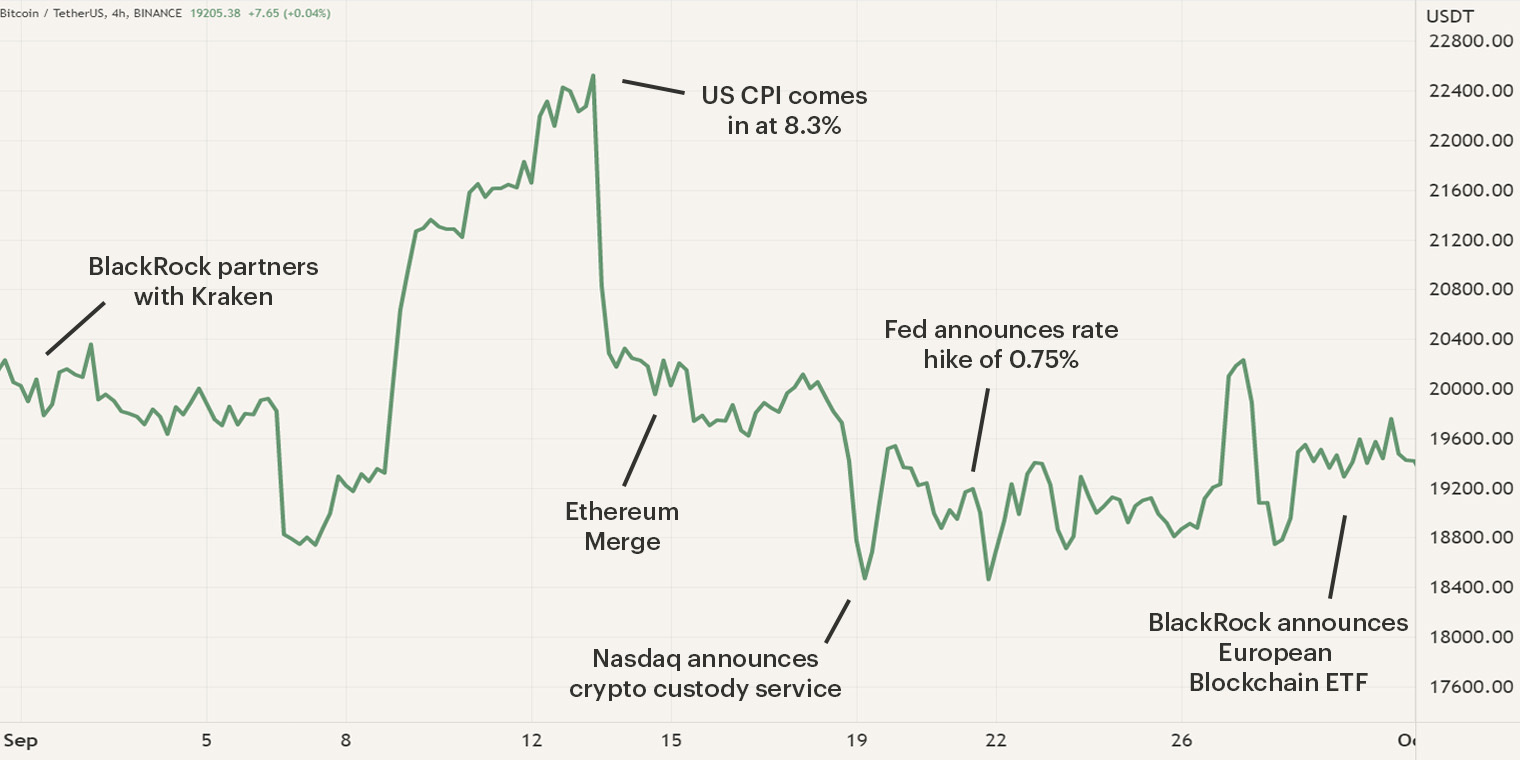

During the first two weeks of September, the cryptocurrency market experienced turmoil as the latest economic data was released and the Ethereum Merge was finalized. On the 8th of September, the Federal Reserve (Fed) announced that it will continue its hawkish stance if inflation fails to cool down. On the 13th of September, the latest Consumer Price Index (CPI) was published, which was 8.3% higher than expected, this caused financial markets to experience a sharp drop as it indicated more rate hikes. After the initial drop in value across the markets, all attention was focused on the upcoming meeting of the Federal Open Market Committee (FOMC). You can read more about the events of the first half of the month in our market update of September.

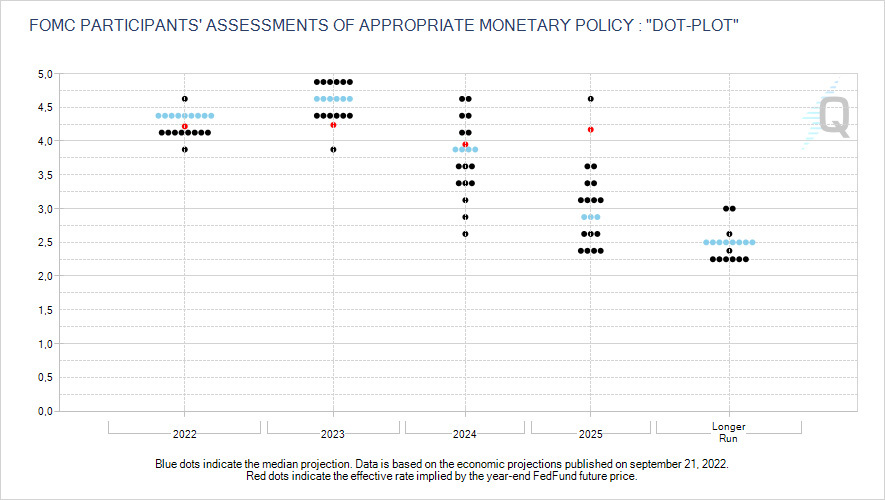

On the 21st of September, the FOMC officially confirmed its additional interest rate hike of an additional 0.75%. During the post-meeting press conference, Jerome Powell, Chairman of the Fed, emphasized that the Fed will continue its course of aggressive measures until inflation is brought back down to 2%. Following this statement, the Fed released their updated “Dot-Plot'', which consists of the expected interest rates at a certain point of time in the future by all individual members of the FOMC.

Where the market initially expected the Fed to ease its hawkishness, the updated Dot-Plot indicated a continuation of rate hikes in 2023. The expected interest rate at the end of 2023 is now 4,6%, whereas the Dot-Plot of last June estimated 3,8%. The new expected interest rates imply that the coming year's rates will increase by 1,25%, with no decrease seen until 2024. As the meeting commenced, the cryptocurrency market experienced volatility as Bitcoin’s price oscillated between $18K and $20K. After bottoming at the resistance of $18K, Bitcoin initiated an upward move by breaking through its resistance of $19K, moving towards $20K.

Institutions continue to enter

As the market proceeds to move sideways, institutional organizations continue to explore opportunities within the cryptocurrency market. In our previous newsletters, we discussed the entering of asset manager BlackRock into the market with their private trust fund and partnerships with exchanges Kraken and Coinbase. This month, the asset manager announced its blockchain ETF in Europe, displaying that the interest in digital assets is becoming more long-term. The ETF consists of 35 companies whose primary business is related to cryptocurrency and blockchain, for example, miners and exchanges but also payment companies.

In addition to BlackRock, Nasdaq is taking its first steps to enter the cryptocurrency services industry with a focus on security. Nasdaq will be joining the industry with a custody product for institutional investors which focuses on bitcoin and ether. Over the past three months, we observed an increase in traditional institutions entering the market, displaying the further potential growth of the industry. We forecast that these entities will be the main driver of crypto adoption as these organizations provide solutions and products to a larger audience such as institutions. Additionally, these services provide exposure to the market in a less difficult manner. Plus, as these leading institutions get a foothold in the market and experience success, more institutions will tend to participate.

On 16 September, the White House released its first extensive crypto framework, created by the combined effort of nine federal agencies. The aim of the framework is to provide institutions and individuals a more clear-cut overview of the regulatory landscape regarding cryptocurrency. The result of this collaboration is a fact sheet, summarizing nine separate reports consisting of seven chapters, which discuss a variety of topics including a U.S. CBDC.

EBC chooses Amazon to collaborate on CBDC Euro

On 16 September, the European Central Bank (ECB) announced that it will collaborate with five fintech, payments and e-commerce firms to develop front-end prototypes for a digital euro app. The five chosen firms consist of Amazon, Nexi, Caixabank, Worldline and European Payments Initiative. Each of the five firms will focus on a specific use-case of the digital currency, with Amazon focusing on e-commerce payments. These companies were selected due to their capabilities in regard to front-end development.

During the past two years, the interest in a Central Bank Digital Currency (CBDC) among the various central banks has grown and testing has become more genuine. The ECB hasn’t shared its stance officially about a possible implementation of a CBDC in Europe, however, earlier this year an executive board member of the ECB said that a digital euro can possibly be launched as early as 2026. Opinions relating to a CBDC are divided as the implementation can improve international payments but might also negatively impact financial privacy. A CBDC can for example grant a Central Bank access to all personal transactional data.

The Hodl Funds

The volatility of the month September has led to a relatively neutral performance of the Hodl funds. The Hodl.nl Genesis Fund, the Hodl.nl Consensus Fund and the Hodl.nl Oracle Fund ended respectively at a Net Asset Value (NAV) of €3.07, €3.09 and €0.35.

Update of the Hodl Client Portal

To best serve our participants, we offer a Client Portal where investment results can be tracked. Earlier this year, Hodl underwent a rebranding that improved our look, feel and usability. A few months ago, we implemented this into our website and now it is time for our client portal to match this new branding and level of service. By doing so, we hope to improve the service towards our participants. In addition to the investment results, you can now also find an overview of our latest newsletters and easily download all our latest research and reports.

Are you not yet a participant of one of the Hodl funds? Now it is possible for you to take a look at our new portal! By creating an account in our portal you will get a first impression of our services and get easy access to all our latest reports, brochures and whitepapers. Want to take a look? Create an account via the link below.

Changes in the Hodl board

Due to our rapid growth and future plans, Hodl has been working hard on its internal organization and processes in recent months. With a strong focus on our growth, we have decided to restructure the board. Peter van Dam has indicated a desire to take a less active role within the organization to focus on his other ventures. The board has therefore asked Axel Macro, the current Chief Legal Officer (CLO), to join the board, an invitation he has accepted with satisfaction.

Axel has been closely involved with Hodl for several years and is particularly concerned with our Legal & Compliance matters. Before joining the organization, Axel gained a reputation as an excellent lawyer with 35 years of experience and has extensive legal expertise. In addition, he has been active in the investment world for decades and has demonstrated his entrepreneurship through the successful establishment of several companies. He has also been CLO of a stock traded company for several years. With Axel joining the board, Peter officially takes a step back. He remains involved as a shareholder of Hodl but is no longer involved in the day-to-day operations. We would also like to take this opportunity to express our thanks for Peter's commitment over the past years. Should you have any questions regarding this change, please feel free to contact us.

Unique access to MetaRembrandt

In November 2021, team members of Hodl established Hodl Finance, an incubator that aids in developing upcoming blockchain projects. One of these unique projects is the collaboration with the Rembrandt Foundation, which is launching an NFT collection of the world-renowned masterpiece “The Night Watch”. The MetaRembrandt project aims to preserve Rembrandt's heritage by transforming the painting into 8,000 unique digital pieces. Owning one of the pieces will grant the owner access to Rembrandt’s complete collection in the MetaRembrandt Museum of which they will also become a founding member.

Because of our close involvement with Hodl Finance and the MetaRembrandt team, we can offer our participants a unique opportunity to get whitelisted for the official first phase mint of the The Night Watch NFTs! In the upcoming days, our participants will receive an email with more information on how they can apply. Not yet a participant of the Hodl Funds? Subscribe to the MetaRembrandt newsletter to stay up-to-date and increase your chance to get your hands on one (or more) of the unique 8,000 pieces.

Sign up for our newsletter to stay on top of the cryptocurrency market.